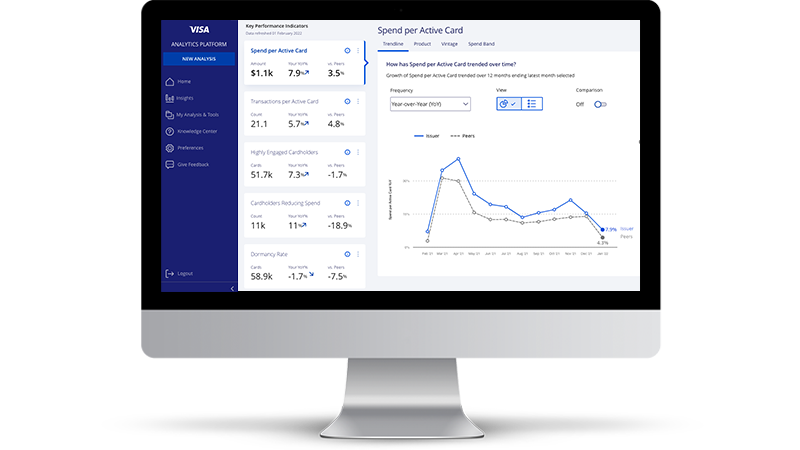

Visa Analytics Platform is a web-based, self-service analytics solution that puts payments data and insights at your fingertips. Our powerful peer benchmarking,¹ easy-to-understand dashboards, and customizable reports empower users across your organization to gain actionable payments intelligence — helping you make faster, more informed business decisions.

Gain competitive edge with payments data and analytics

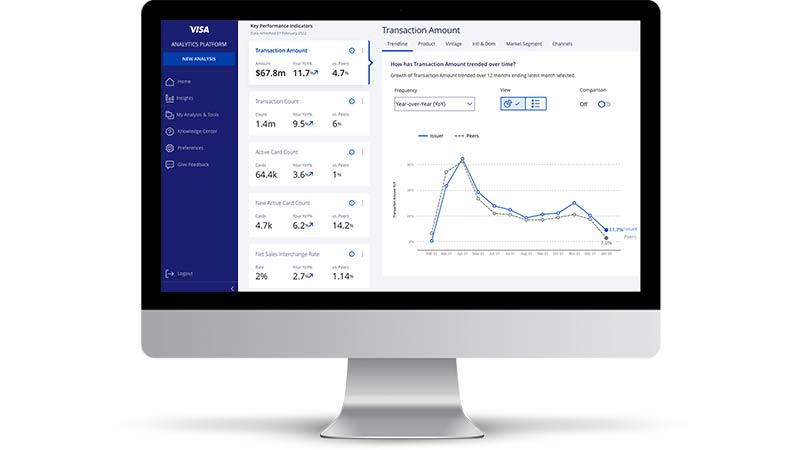

Fast access to payments insights

Visa Analytics Platform provides detailed payments data to help meet your needs — enabling you to get granular, faster, and get actionable insights with less effort.

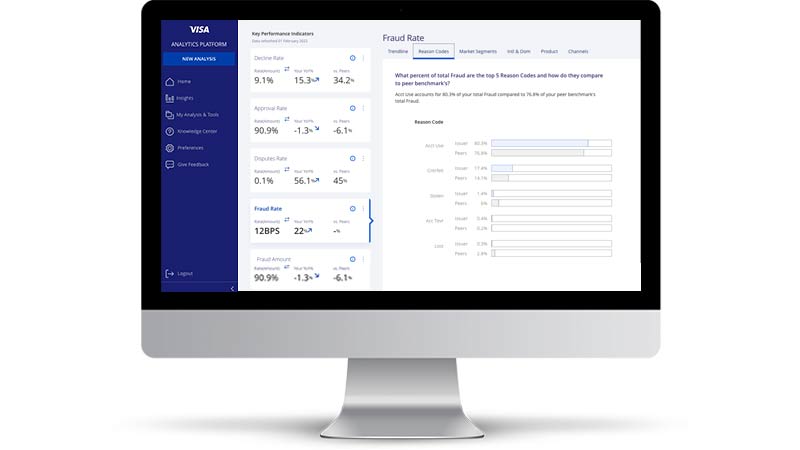

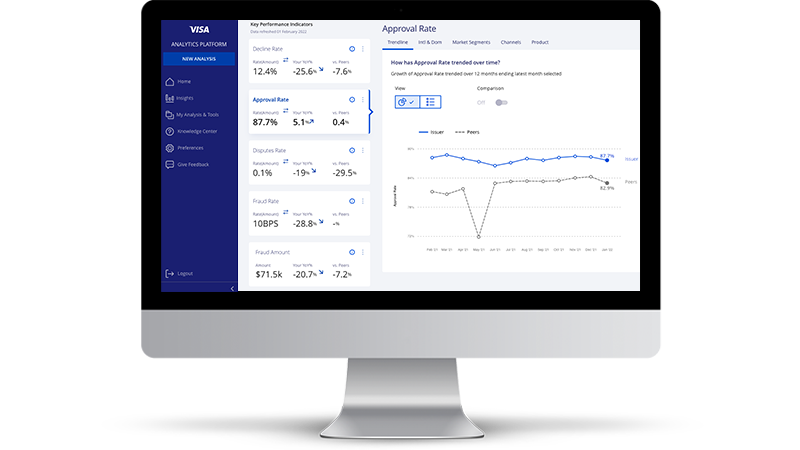

Powerful peer benchmarking¹

Visa Analytics Platform provides powerful business intelligence through detailed, anonymized peer benchmarks¹ – empowering you to quickly find opportunities to help improve performance and become top-of-wallet.

Easy-to-use

Easy-to-understand dashboards with pre-built visualizations make key performance insights accessible to users — even for non-analytics experts. This helps you to make data-driven decisions more quickly, while reducing operational burden on your analytics department.

Enhance analytics for every level of user

Executives

Assess business performance at a glance. New dashboards make it easy for you to gain key portfolio and peer insights — helping you identify potential growth opportunities faster and guide your business with more confidence.

Managers

Accelerate your ability to deliver actionable insights and reports with intuitive workflows and pre-built visualizations — empowering your team to make data-driven decisions.

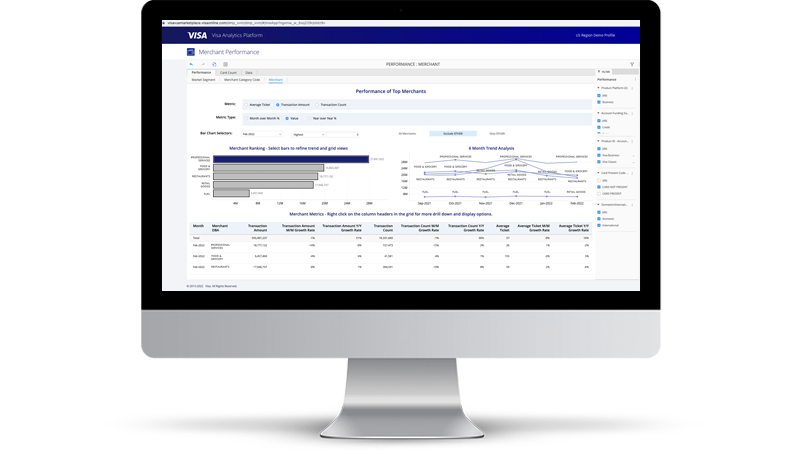

Data Analysts

Get access to customizable reports with rich payments data to dive deeper and help answer detailed follow-up questions with less effort.

Transform your business with data-driven decisions

Better understand cardholder behavior

Analyze your cardholder engagement to increase card usage and loyalty.

- Drive early card activation and retention

- Track spending patterns across market segments, merchants, and geography

- Analyze spend behavior across digital and physical channels

*The data on this page is used for illustration only and does not reflect actual Visa data.

Financial institutions across the globe use Visa Analytics Platform

-

Luminor Bank improves authorizations with Visa Analytics Platform

"Visa Analytics Platform provides significant support for data-driven decisions, optimizing our time and resources to increase efficiency.” – Grigori Ilkevitš, Head of Daily Banking Products, Luminor Bank

Explore more about Visa Analytics Platform

Transform to a data-driven business

Faster access to insights and benchmarking data can help you improve decision making.

See what’s possible with Visa Analytics Platform

Powerful payments intelligence has already helped other financial institutions reimagine what’s possible.

- ¹ All benchmarks are based on competitive peer set.

- The data on this page is used for illustration only and does not reflect actual Visa data.