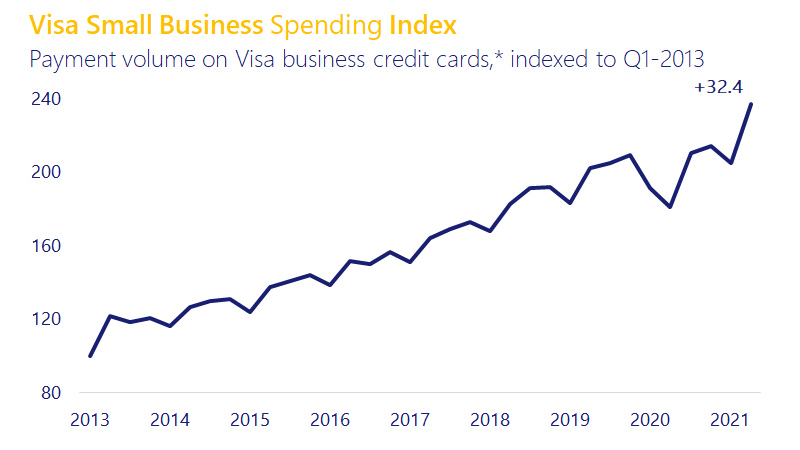

September 15, 2021 - Small business spending in the second quarter of 2021 surged 32.4 points quarter-over-quarter (QoQ) and 56 points year-over-year (YoY), according to the Visa Small Business Spending Index. Consumer demand also surged in Q2 due to a large-scale rollback of COVID-19-related restrictions, which contributed to small businesses being more comfortable and able to spend. However, part of the rise in spending was due to the elevated inflation rate for inputs that small businesses needed.

Outstanding balances on Visa small business credit cards rose for the second consecutive quarter, leading the Visa Small Business Borrowing Index to rise 2.5 points QoQ and 1.6 points YoY. Small business borrowing remains far below pre-pandemic levels (down 8.8 points from Q4-2019), mostly due to the large amount of small business relief and government stimulus disincentivizing borrowing from traditional sources. These programs will end in early 2022, which could spur more demand for borrowing from traditional sources if small businesses are able to weather the new Delta variant challenges.

Both delinquencies and charge-offs fell drastically in the second quarter. Small business delinquencies and charge-offs are both at an eight-year low. Strong sales and relief efforts have helped a large share of small businesses deleverage and remain current on their card payments. The dissipation of stimulus and relief effects could push these indicators back up next year.

“The broad-based reopening has led small businesses to feel very empowered to spend. Additionally, the spending has been prudent as small business card delinquencies and charge-offs are at the lowest point since we began tracking them. However, borrowing is proving slow to recover due, in part, to government relief programs filling that role.”

Wayne Best

Chief Economist, Visa Inc.