June 15, 2021 – Small business spending in the first quarter of 2021 dipped 9.5 points quarter-over-quarter (QoQ), according to the Visa Small Business Spending Index. Despite the two stimulus bills passed during the first quarter that included small business relief and fewer restrictions thanks to vaccine deployment, weaker than expected sales for small businesses has caused many firms to pull back on spending until a higher level of demand returns.

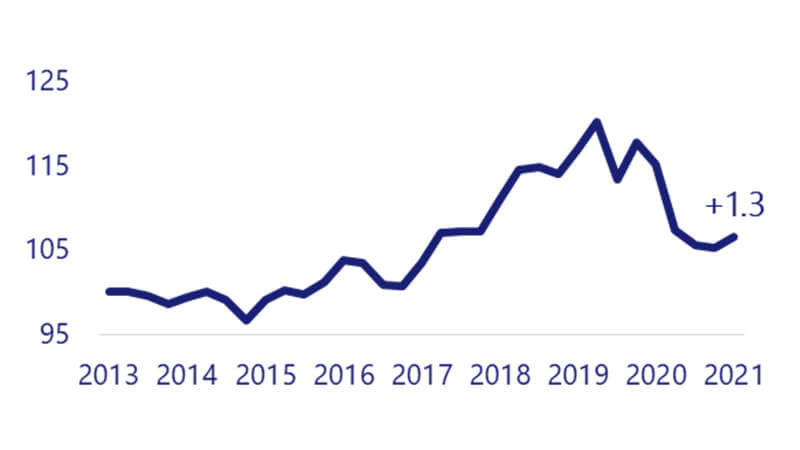

Outstanding balances on Visa small business credit cards rose slightly in the first quarter, causing the Visa Small Business Borrowing Index to increase 1.3 points QoQ. While small business borrowing remains far below pre-pandemic levels (down 11.3 points from Q4-2019), recent survey data from the Federal Reserve indicated that by the end of the first quarter there were nearly 20 percent fewer lenders saying they had tightened credit standards for small businesses compared to Q4-2020¹. Furthermore, the Q2-2021 survey indicates that more lenders are loosening credit standards for small businesses than tightening them, suggesting that small business borrowing should continue to recover throughout 2021.

Both delinquencies and charge-offs fell in the first quarter. Small business delinquencies are now at an eight-year low, which is a testament to the strong support the government has provided to small businesses during this pandemic.