Forecast for real GDP growth

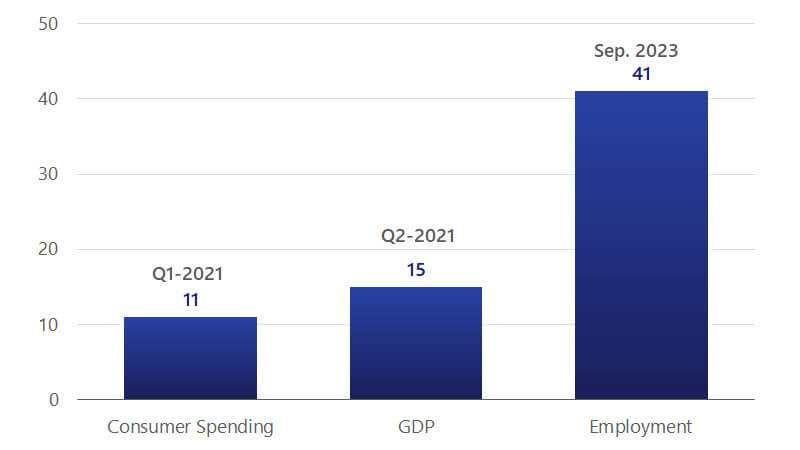

Our forecast for real GDP growth this year is 5.6 percent year-over-year (YoY) following a 3.5 percent contraction in economic growth last year. Nominal consumer spending is expected to rise 10.3 percent this year both due to higher inflation pressures and stronger real spending. The multiple rounds of stimulus are expected to help lift government spending this year as well. In total, we now see a full recovery in aggregate macroeconomic health measures such as total consumer spending and GDP growth occurring this year.

One aspect of the U.S. economy that is expected to take longer to recover is the labor market. As of the April employment report, the U.S. economy had 8.2 million fewer jobs than before the recession began last March.³ More importantly, the job losses were very uneven across industries, income, and demographic groups.

While every major industry category lost jobs during the recession, the hardest hit industry by far was the leisure and hospitality sector. As of April, the industry still had 2.8 million fewer jobs than it did in January 2020. Given the disproportional impact on leisure and hospitality, which has an average hourly wage 42 percent below the U.S. average, there is also clear evidence that those impacted by layoffs were lower-income individuals.

Among the demographic groups most impacted by the pandemic were those with only a high school diploma, women, and Black/African Americans.⁴ When comparing labor market health across demographic groups, one approach economists use is to look at the employment-to-population ratio. This calculation captures each demographic’s employment as a share of the total working age population for each group. By this measure, all three of the demographic groups have employment-to-population ratios below that of the U.S. as a whole.

While the U.S. economy overall will recover this year, the unevenness of the labor market recovery will leave scars on the groups hardest hit for several more quarters.We expect monetary and fiscal policy to remain accommodative well into the expansion phase of this economic cycle. Even with such continued support, risks remain to the outlook. The most significant risk is the uncertainty around the effectiveness of thevaccine against new variants of COVID-19. Should case counts rise to a point that further restrictions are needed, there could be a material negative impact to the outlook for economic growth. The eventual removal of some of the fiscal support could also pose a risk to the recovery. As the mortgage forbearance programs end and student loan payments resume before some of the hard-hit demographics are back to work, there could be a pickup in credit defaults later this year. The risks however are not all skewed to the downside. Should hiring activity and consumer spending rebound faster than we expect, growth could easily exceed our current forecast for this year and lead to a much more even rebound in job growth.