June 25, 2020 – As COVID-19 takes the U.S. economy into uncharted territory, many credit card issuers and other lenders are wondering how consumers’ debt behavior might change during the current crisis; however, lenders may not get all of the answers they are looking for right away. As a large portion of consumers’ income is interrupted, many are seeking relief on their loans through forbearance or deferrals, meaning that any changes to the debt repayment “hierarchy" will be delayed until consumers start to get back on their feet. While there are many unknowns and virtually everything about this crisis is unprecedented, historical patterns and current trends can provide some clues.

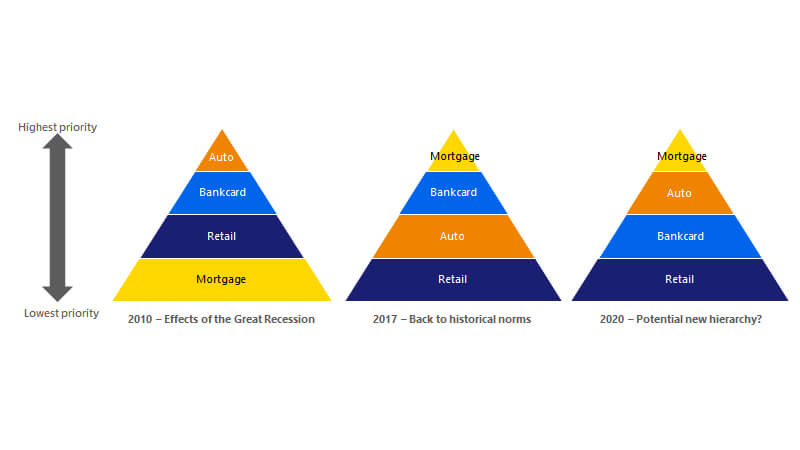

Historically, there was a repayment pattern to the three major forms of consumer debt, with consumers opting to pay back their mortgages first, followed by auto and credit card debt, according to an analysis of loan data from Moody’s Analytics. This hierarchy changed during the Great Recession as auto and credit moved ahead of mortgage repayments. Retail credit cards also rose in the hierarchy as many subprime and even near prime consumers lost access to bankcard lines of credit. The hierarchy shifted back to historical norms as credit supply and demand regained their balance during the post-recessionary period. Conditions are very different in this new recession, especially given the passage of the most significant government relief and recovery legislation in the history of the country, which could very well shake things up again in the hierarchy.

More in this insight:

- The ability to revolve on their loan payments may play a role in which bills consumers pay, or pay first.

- What is mandated under the CARES Act and how long can consumers defer payments?

- As deferral expiration dates approach, issuers will be weighing customer needs, hardship and loyalty vs their bottom lines.