August 6, 2021 – After plunging more than 60 percent at the onset of the pandemic, demand for travel related consumer spending is back.¹ While the COVID-19 global pandemic had a dramatic negative affect on overall consumer spending, the travel sector was especially hard hit by the downturn. In 2019, travel contributed 2.9 percent to overall GDP growth, according to the U.S. Bureau of Economic Analysis, equating to $621 billion in value add from the industry.² As vaccination efforts ramped up earlier this year and communities reopened, travel demand accelerated. With the summer travel season in full swing, we look at consumers’ motivation for traveling again and provide an update on the travel industry’s recovery to-date.

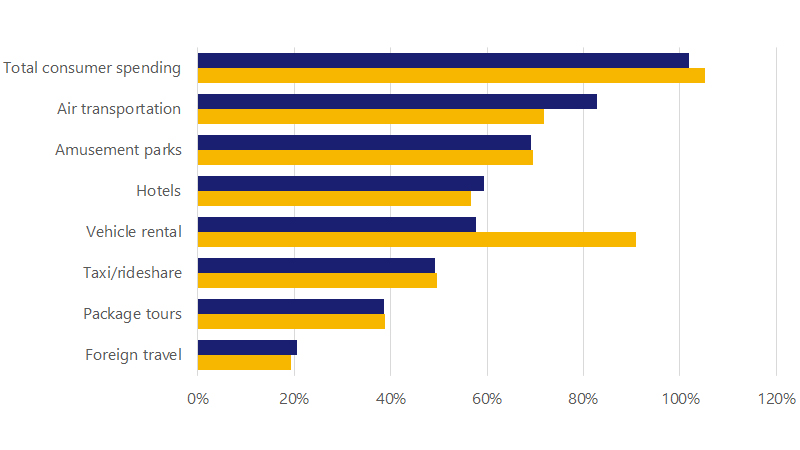

Consumers’ willingness to travel domestically has surged, along with spending on travel. In fact, through May of this year, travel-related spending has recovered roughly 84 percent of its pre-pandemic level.³ However, various aspects of travel are bouncing back faster than others, with auto rentals and air travel leading the way. The pronounced rebound in travel is creating some challenges for the industry, with labor and capacity shortages leading to higher prices. A complete travel industry recovery is still going to take some time. For travel spending to fully recover, the next wave of pent-up demand will need to be unleashed from global travel. At least there is some light emerging at the end of the tunnel for the hard-hit travel industry.