How brands differentiate in times of uncertainty: building trust

May 2023 – At the beginning of 2022, consumers were ready to be active again, see friends, dine out, attend movie theaters, and travel. By the fall, the freewheeling vibe had been interrupted by high inflation and economic and geopolitical events. Unlike during the pandemic period, when people were largely fixated on either the economy or their health, the post-pandemic period has brought back many more issues of concern for consumers—adding things like climate change, personal safety, technology issues and many more into the mix again. This environment of increased uncertainty can impact consumer spending behavior.

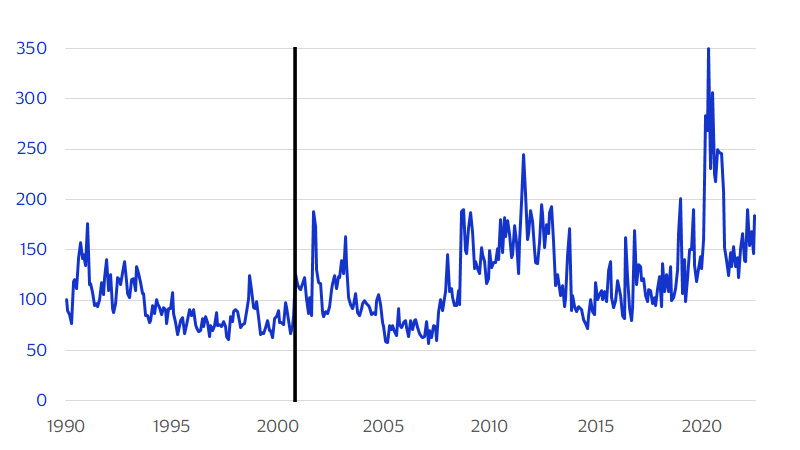

Many consumers may now see uncertainty as “the next normal”. This is reflected in the Uncertainty Index – a normalized index of the volume of news articles discussing economic policy uncertainty. The volatility increases over time and in particular when comparing recent years to the 1990s.

Uncertainty Index – increased volatility since the turn of the century (Normalized index of the volume of news articles discussing economic policy uncertainty)

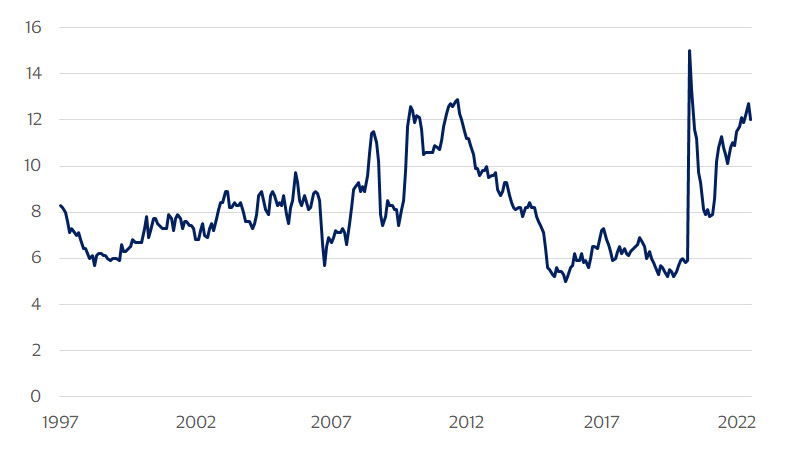

Misery Index showed increased volatility during the pandemic (Unemployment plus inflation rate)

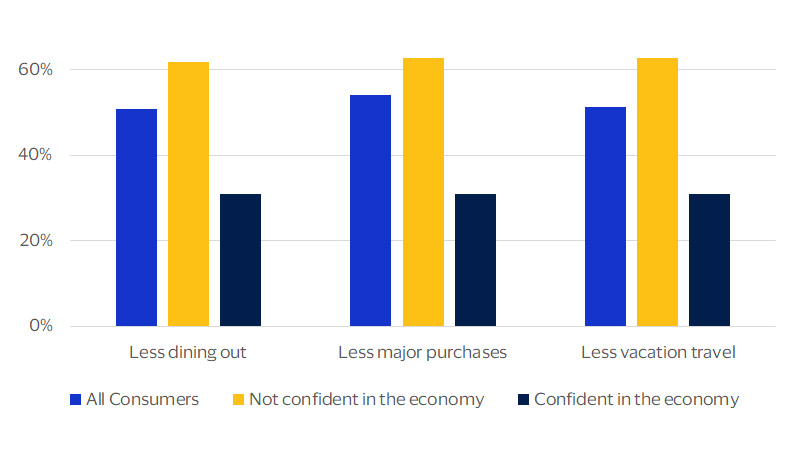

Confidence in the economy impacts consumer spending. (Survey: As a result of changes in the economy, are you doing more or less of the following?)

Trusted relationships help consumers manage uncertainty

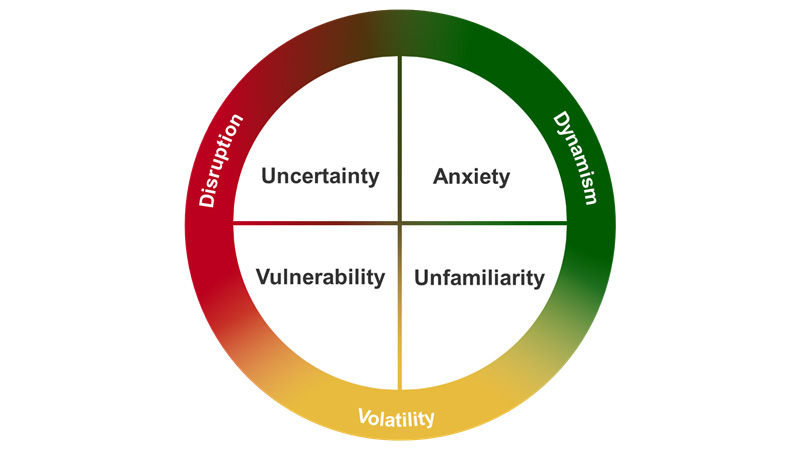

Establishing longer-lasting, more profitable relationships becomes an even more important success factor in times of uncertainty. A trusted relationship with the company is no longer solely based on the goods or services it provides. Increasingly, consumers see businesses social leaders and “highly effective agents of positive change”—up 29 points globally from last year. Eighty-one percent say businesses should be personally visible to demonstrate work their company has done for society’s benefit and are expected to inform and shape conversations on policy.¹ We can use this information to build trust among customers. By recognizing the risk consumers feel and taking measures to allay that risk, brands can embrace this environment and the opportunity it offers to strengthen their relationships with customers. Some examples of customer stressors and antidotes are:

- Unfamiliarity – Inflation is discomforting because it’s unfamiliar to consumers. As an antidote, brands need to provide reassurance, safe harbor, something to count on.

- Anxiety – A stressor such as health or the environment. Antidote – brands need to promote or provide well-being or health in their messaging (healthy adds value).

- Uncertainty – Loss of assurance or perceived value, for example, which can be addressed by offering flexible business relationships that take the risk out of shopping and buying.

- Vulnerability – is most closely linked to financial insecurity – loss of income, or the declining value of savings or investments. Antidote – businesses need to promote and deliver value in the face of pricing pressures.

The environment creates feelings of dismay

The current environment feels chaotic to consumers, and brands that help them to organize the chaos are the ones that will likely thrive. Here are some examples that resonate with consumers in addressing their needs and establishing trust.

- Friction-free shopping - brands can add a human touch such as a free return policy or tap to pay, which gives a sense of value and safety to consumers when they shop.

- Attainable luxury – brands can provide products or services that consumers perceived as luxurious before—something more consumers seek in the wake of the pandemic. Example would be an affordable vacation that seemed out of reach before.

- Conscious careers, not only in business-to-customer but also business-to-employee relationships. When brands go through CEO changes, they need to understand the effect it can have on customers and employees. One way to address this would be career management—providing employees with tools and training to be more efficient and successful in their career development.

- Communal wellness, as all generations want to be part of something larger—a community or society. Businesses that embrace this—by investing in affordable housing or community infrastructure, such as parks, for example—also engender a higher level of trust among consumers.

Consumers have faced a growing onslaught of uncertainty that has become their “new” normal. Brands can capitalize on this by staying attuned and flexible to consumers’ needs. Discontinuity will continue to be a feature of the marketplace as the uncertain environment is likely to remain for some time to come.

Footnotes

¹ Visa Business and Economic Insights; Edelman Trust Barometer 2022

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Art of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statement we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the Securities and Exchange Commission (SEC). Expect as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.