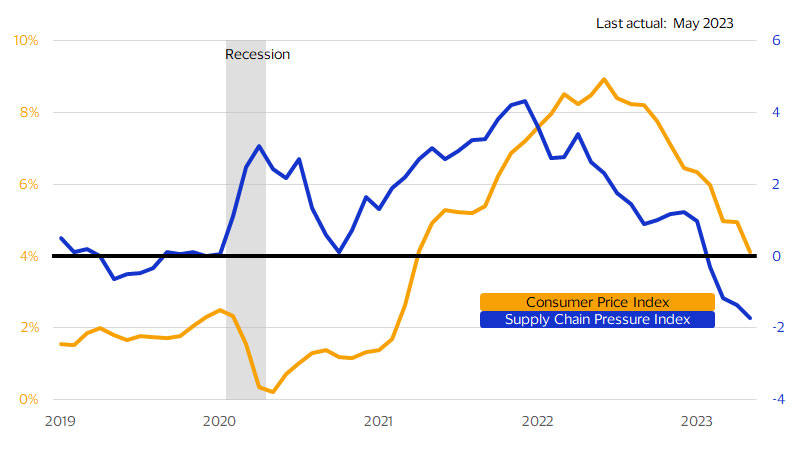

Lower inflation is taking pressure off consumer budgets

Consumer Price Index (CPI) and Global Supply Chain Pressure Index (GSCPI)

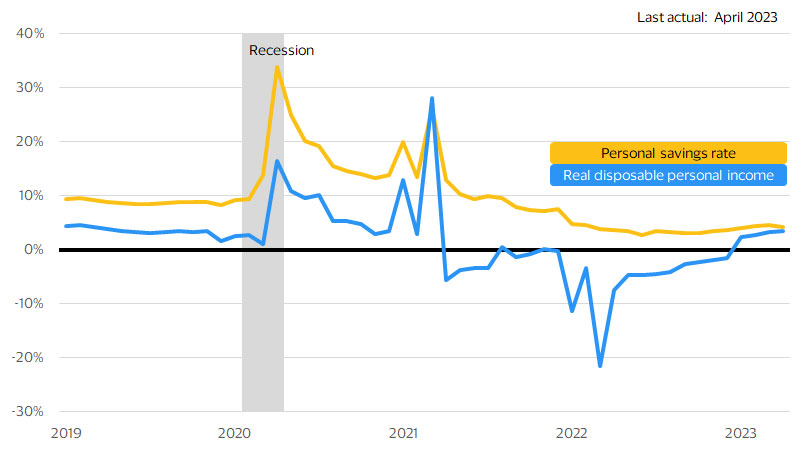

Incomes are finally outpacing inflation

Real disposable personal income (RDPI) and personal savings rate

(RDPI = YoY percent, savings rate = share of personal income)

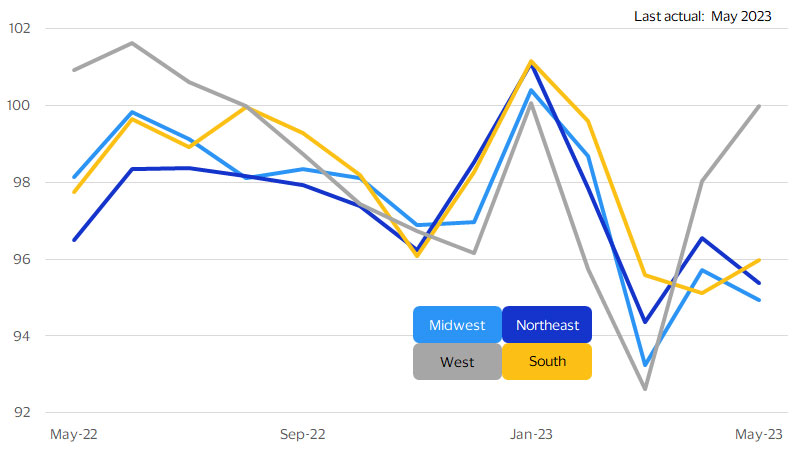

Inflation and spending differ by region

Spending Momentum Index by region

(Seasonally adjusted; ≥100 = expansion, <100 = contraction)

Footnotes

- ¹ Visa Business and Economic Insights and U.S. Department of Labor

- ² Visa Business and Economic Insights and Federal Reserve Bank of New York

- ³ Visa Business and Economic Insights and U.S. Department of Commerce

- ⁴ Visa Business and Economic Insights and U.S. Department of Labor

- ⁵ Visa Business and Economic Insights and U.S. Department of Labor

- ⁶ Visa Business and Economic Insights and U.S. Department of Energy

- ⁷ Visa Business and Economic Insights and U.S. Department of Commerce

- ⁸ Visa Business and Economic Insights and U.S. Department of Commerce

- ⁹ Visa Business and Economic Insights and U.S. Department of Commerce

- ¹⁰ Visa Business and Economic Insights and U.S. Department of Labor

- ¹¹ Visa Business and Economic Insights and U.S. Department of Energy

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statement we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The Visa U.S. SMI is based on a sample of aggregated, depersonalized VisaNet and third-party data; it is not reflective of Visa operational and/or financial performance. SMI is provided “as is” without warranties of any kind, express or implied, including, without limitation, as to the accuracy of the data or the implied warranties of merchantability, fitness for a particular purpose, and/or non-infringement. The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

SMI Methodology

The Visa U.S. Spending Momentum Index (SMI) measures the breadth of year-over-year change in household spending within an economy, including the share of households with increased spending compared with those where spending was stable or declined. The index is generated using proprietary techniques that extract economic signals from business-related noise inherent in VisaNet transaction data, such as portfolio flips, routing changes, or evolving acceptance across geographies or merchant segments. Regional and national aggregates are population-weighted averages. The resulting sample data is then aggregated using a diffusion index framework in which index values are scored from 0 to 200. Values above 100 indicate broad-based net acceleration in economic momentum. Values below 100 indicate contraction on an annual basis.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.