November 11, 2021 – Over the course of the last month, a treasure trove of economic data and policy announcements have resulted in quite a few changes to our outlook. Incoming data has largely exceeded our expectations, with 531,000 jobs added in October after an upward revision to September’s employment growth.¹ In addition, third quarter gross domestic product (GDP) growth held up better than we had forecast. On the policy front this month, the Federal Reserve announced that it will begin slowing its pace of asset purchases. The stronger job gains and higher inflation readings over the last month feed into our revised view that the Fed will begin increasing short-term interest rates beginning in Q4 of next year, one quarter earlier than we were forecasting last month.

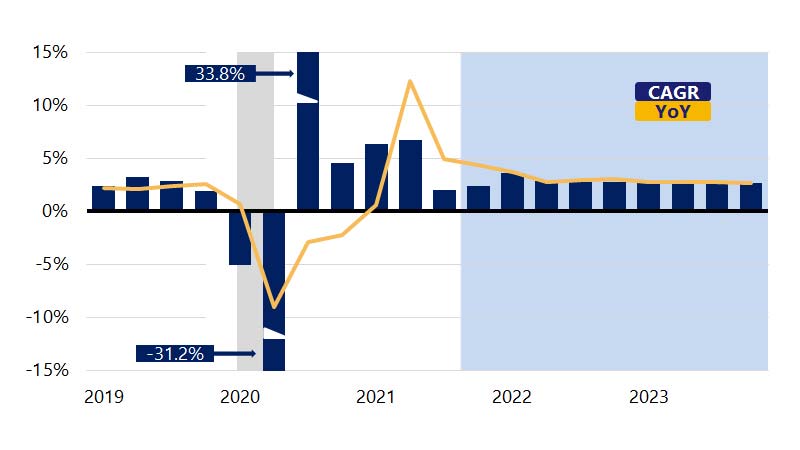

We now expect the economy to expand at a 2.4 percent annualized pace in Q4 and accelerate further to 3.6 percent in Q1 of next year. After downshifting to just 1.6 percent in Q3, real consumer spending is expected to accelerate to 4.0 percent in Q4 as services spending continues to recover (Fig. 2). On an annual basis, robust consumer spending and business investment will support an increase in GDP growth to 5.3 percent year-over-year (YoY) this year. Next year, we expect the economy to expand at a 3.1 percent pace (YoY) with more modest consumer spending and business investment. As supply chain issues begin to subside, inventory rebuilding will likely help drive 2022 growth above the long-run average of the last expansion. Growth in calendar year 2023 is expected to return close to the long-run average rate at 2.7 percent.