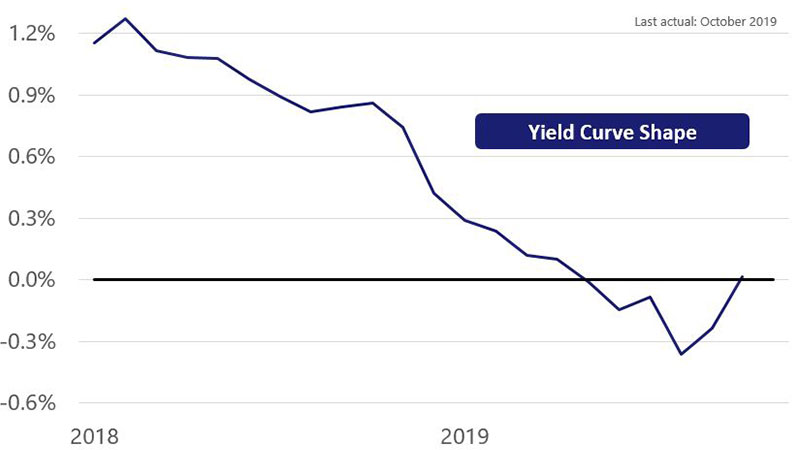

Nov. 13, 2019 — Following a string of disappointing economic data last month, there are signs that economic growth should stabilize in the fourth quarter after decelerating from the second to the third quarter of this year. The pace of job growth slowed to just 128,000 in October, but was weighed down due to a strike in the automobile sector. Forward-looking components of the employment report showed that wage growth and workers’ hours were still holding up, suggesting firming consumer economic conditions to start the fourth quarter. In addition, the yield curve is beginning to steepen once again, which should translate into a bit more momentum in consumer lending.

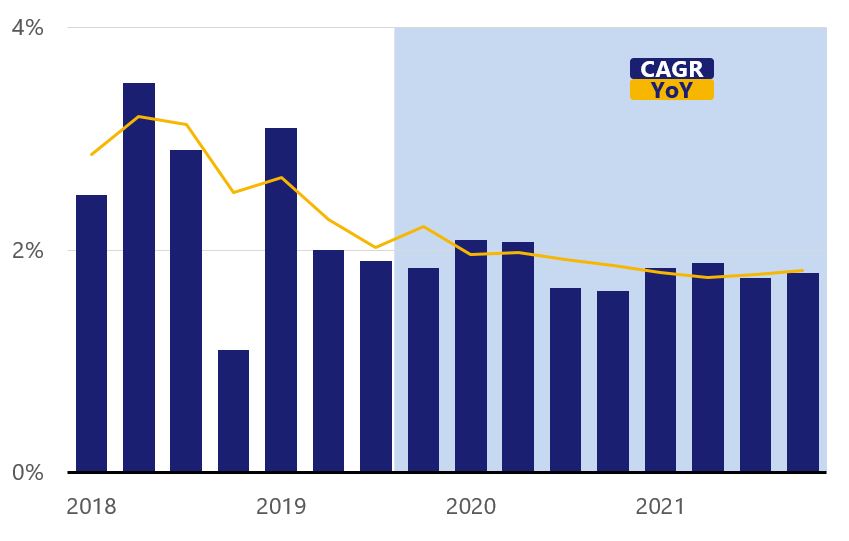

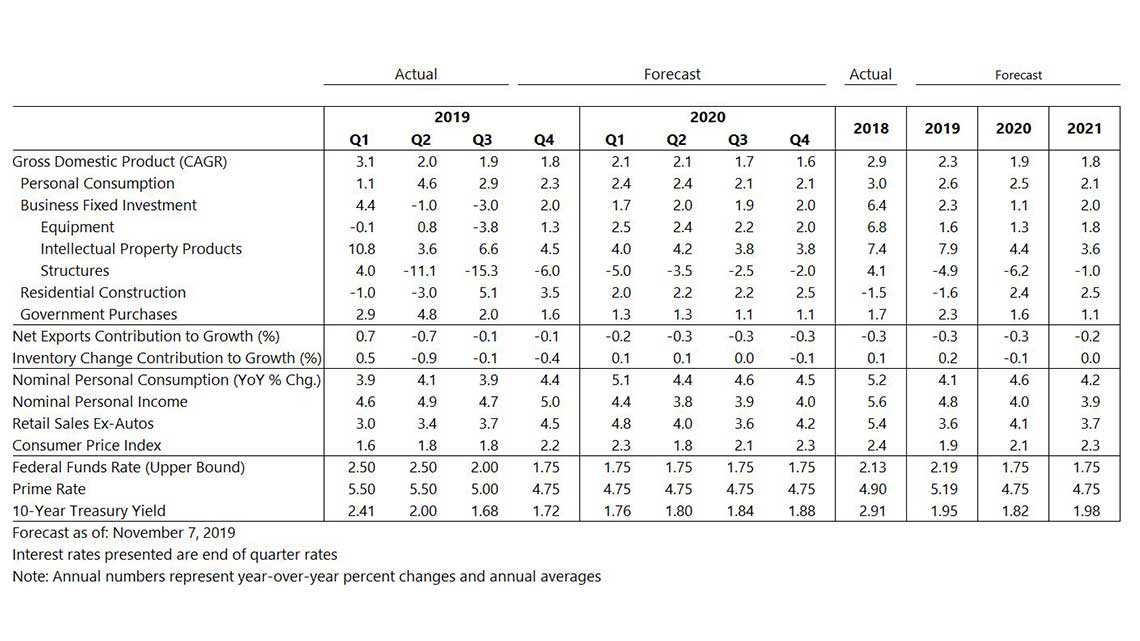

We now know that third quarter gross domestic product (GDP) growth expanded at a 1.9 percent pace, consistent with our forecast of 1.8 percent. Consumer spending and a rebound in the housing sector offset the contraction in business investment. We expect solid consumer spending to drive fourth quarter GDP growth, rising 1.8 percent once again. The forecast is not without risks. As we enter the busy holiday shopping season, the chance of a government shutdown looms large, which could put some downside pressure on Q4 growth.