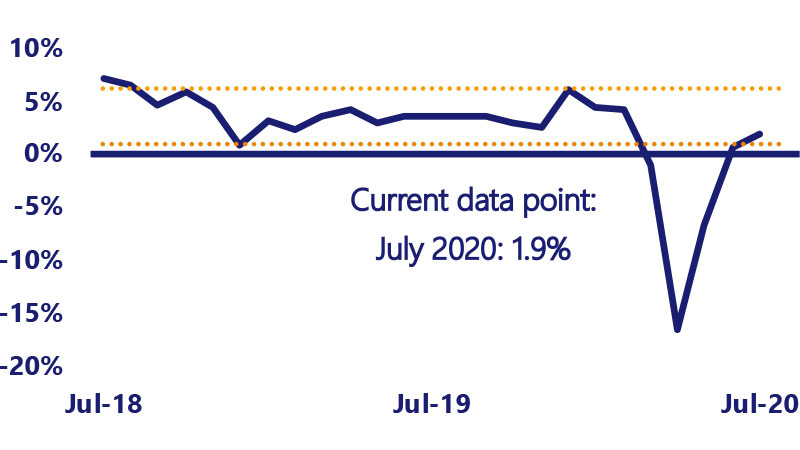

August 28, 2020 – Retail sales (excluding auto sales) rose 1.9 percent from June’s level of sales and now stands 1.9 percent above last July’s levels. The closely-watched control group (which feeds into the calculation of GDP growth) rose a more modest 1.4 percent month-over-month (MoM), following a 6 percent rise in June. Personal disposable income growth remained robust in June, rising 8.9 percent year-over-year (YoY), as enhanced unemployment insurance benefits continued to more than offset the 2.4 percent year over year (YoY) decline in wage and salary growth. Government transfer payments, which capture unemployment benefits, social security payments and other income assistance, remained at 59 percent over last year’s level, highlighting the impact of the federal stimulus.

Overall consumer confidence fell 5.7 points from June to July. Confidence in current business and labor market conditions rose 7.5 points, which was the third straight month of increases. However, future expectations fell 14.6 points since June. Confidence fell across all age ranges, and among all household income levels of $50K and above.

In July, the pace of the labor market recovery slowed significantly, with roughly 1.7 million new jobs added. The economy is still down by roughly 12.9 million jobs since February. The unemployment rate fell 0.9 percentage points to 10.2 percent in July. However, the Bureau of Labor Statistics still believes this number is understated due to changes in unemployment insurance requirements.

"A surge in COVID cases in July across a large number of states led to a slowdown in the pace of reopening. The result was a more modest pace of consumer spending," according to Michael Brown, Principal U.S. Economist, Visa Inc. “Services spending on the part of consumers continues to lag the recovery in goods spending.

“Job gains moderated in July as economic activity slowed due to a spike in COVID cases,” said Travis Clark, Associate U.S. Economist, Visa Inc. “This spike also led to a pullback in consumer confidence for the month as consumers became more pessimistic about future economic conditions.”