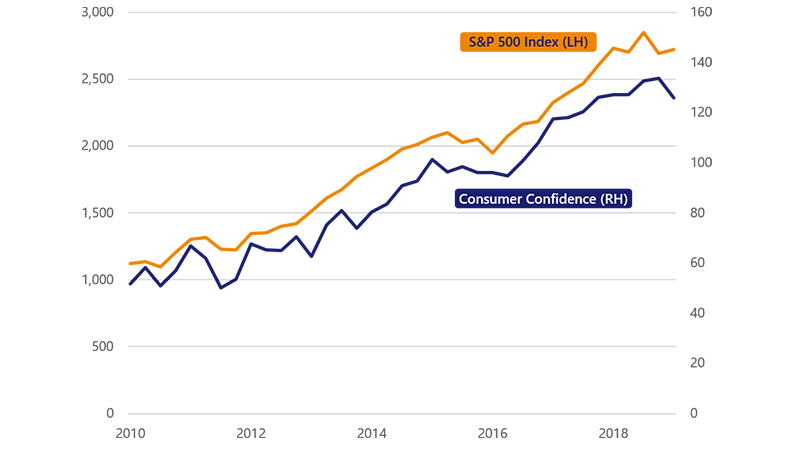

May 10, 2019 – At the end of last year, cracks in global economic growth began to emerge. In response, central banks and governments around the world took a more cautious stance and in some cases have turned to providing additional stimulus measures. For example, the U.S. Federal Reserve suggested that in the current economic environment, no further interest rate hikes would be needed this year and the European Central Bank indicated that it will likely keep interest rates low for a while longer.

There are some signs that the change in tone of global policymakers has helped to stabilize global growth, albeit at a more modest pace. That said, risks to the global outlook remain, with three issues in particular that could potentially slow global growth further: Brexit, declining global home prices and trade tensions—the latest U.S.-China showdown is only intensifying the situation. U.S. economic data will likely begin to turn a bit more positive in the second quarter. Outside the U.S., the global economy is slowing, but still growing, with plenty of pockets of risk. Even with such ever present risks, the stability in global economic data in recent weeks has helped to sustain confidence in the view that global economic activity should muddle along for now.