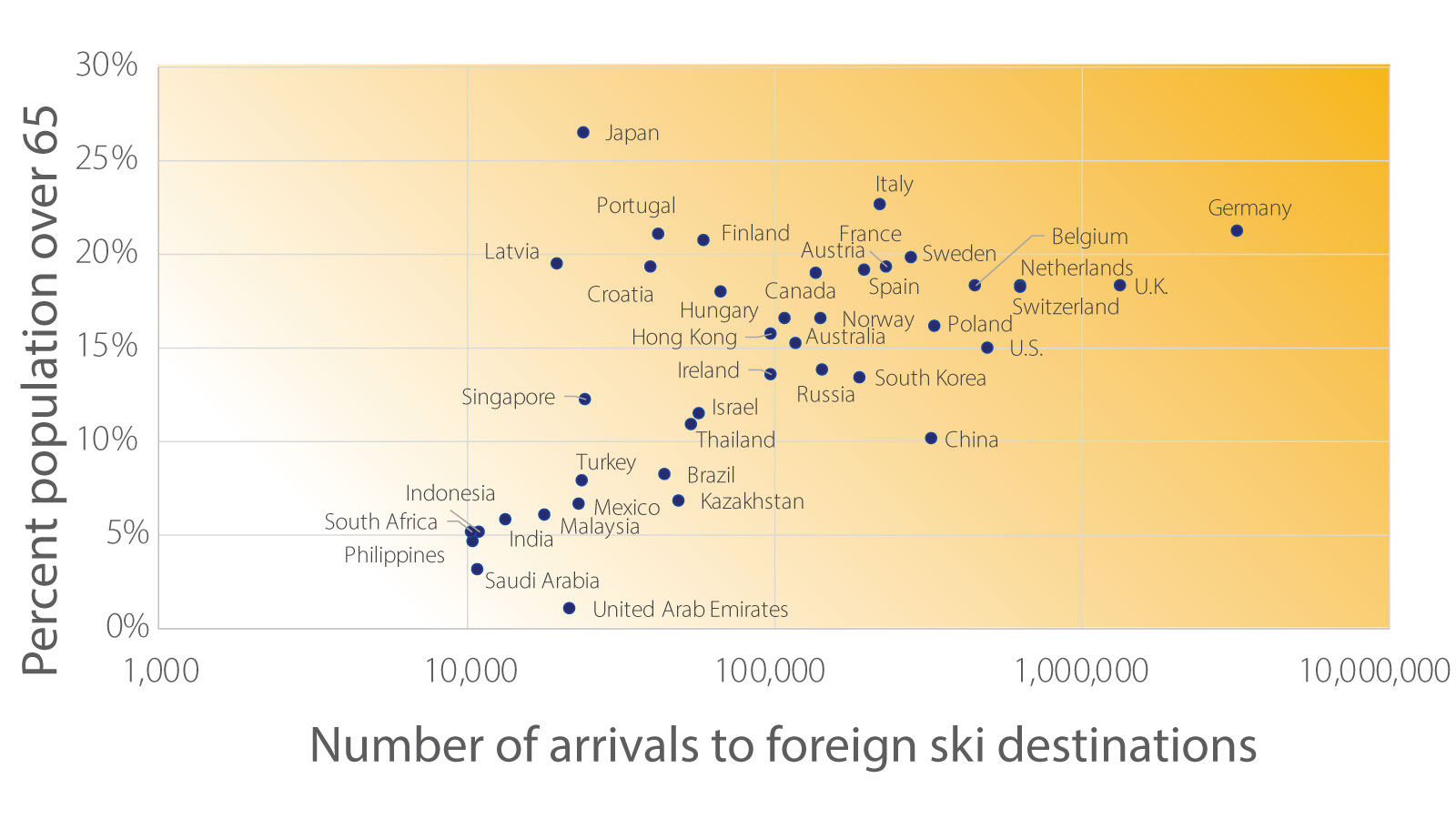

February 6, 2018 – Age is not necessarily a constraint on most travel, but for skiing (which requires more mobility) it can be. Ski destinations are more exposed to aging trends in part due to the preponderance of European travelers in the cross-border ski market. According to United Nations population statistics, a higher percentage of the population (at or close to 20 percent) in most Western European countries is over the age of 65, compared to just 10 percent or less in many emerging markets.

The slippery slope of population aging in ski tourism

Cross-border tourists visiting destinations near ski facilities (first quarter average, 2015-2017)

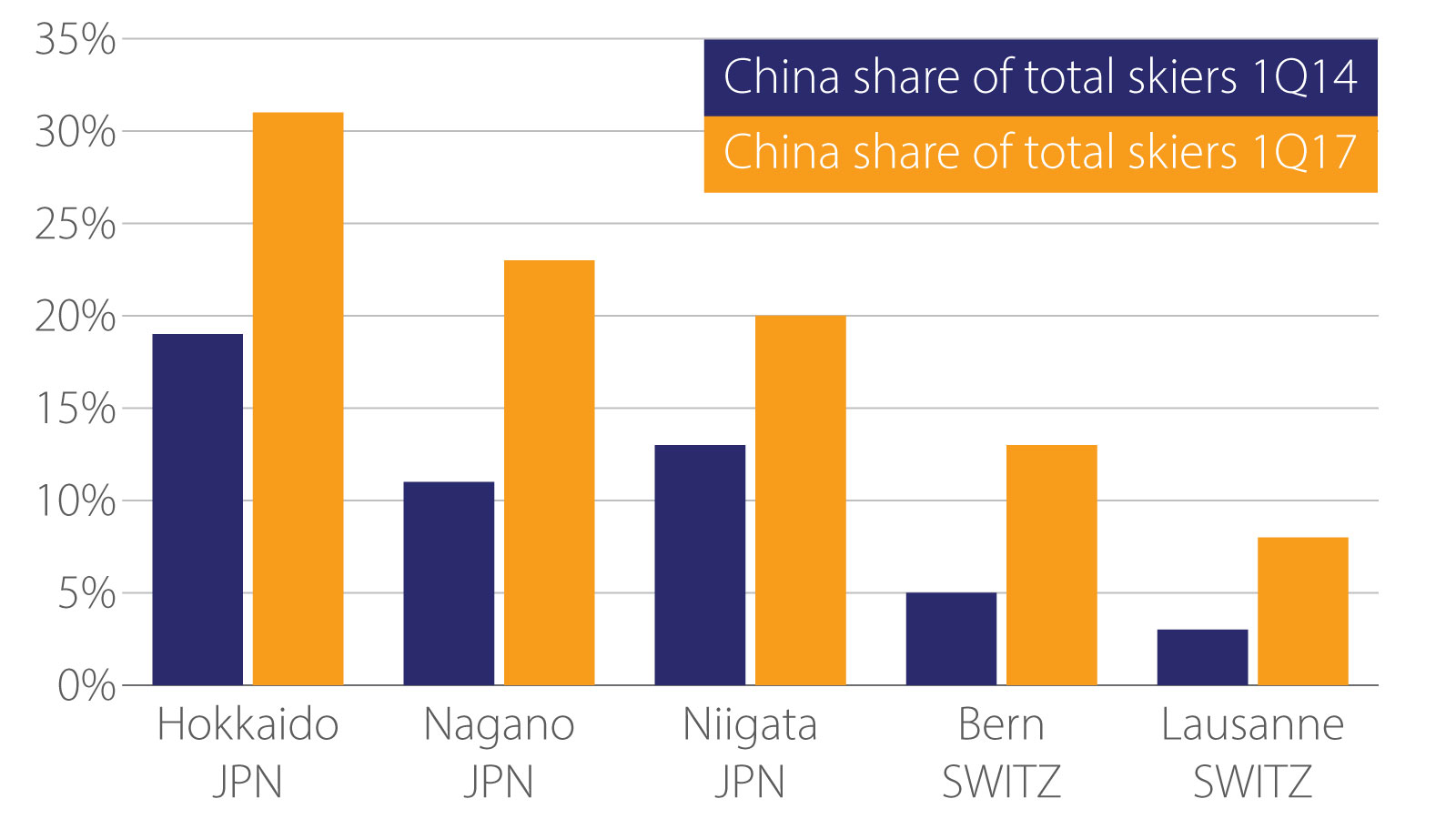

While the already established markets in Europe may be maturing, opportunities for further growth could come from the expanding global middle class. As their incomes rise, cross-border travel should also increase. China’s share of tourist arrivals, for example, doubled in key ski cities over a three-year period. The data shows the share of Chinese tourists also doubling in relatively more ‘luxurious’ ski resorts and glamourous ski destinations such as Switzerland (Bern and Lausanne), which suggests that luxury travel is no longer as price sensitive for the Chinese ski tourist.

China’s share of total skiers at the top five ski destinations visited by Chinese tourists has almost doubled in just three years (1Q2014 vs 1Q2017)

Will demand for ski travel increase in emerging markets?

Currently, a global average of 6 percent of winter travel is to ski destinations, according to Visa’s analysis of VISIT data. The propensity to travel to a ski destination is very low in emerging markets when compared to Europe and especially countries such as Germany, the Czech Republic and Switzerland, where as many as one in six trips taken during the winter months is to a ski destination. The convenience of their close proximity to popular ski destinations benefits many European countries, but is necessarily the case for most emerging markets. Asian ski tourists are skiing predominantly in Asia—with two-thirds choosing Japan in the 1Q2017 ski season. The economies of Southeast Asia bear watching. Though the developing Southeast Asian economies have lower per-capita income and currently represent less than 1 percent of tourist arrivals worldwide, they have much younger populations and are experiencing rapid income growth, according to Visa Business and Economic Insights analysis of data from VISIT and Oxford Economics.

What would happen if countries that are currently below average in their winter travel to ski destinations were to increase their visits to match half the global average? Based on Visa Business and Economic analysis, this convergence could lead to foreign visits to ski destinations rising by up to 20 percent. Some of these new visitors will come from advanced economies such as the United States, and as many as 1.2 million new ski travelers could come from the emerging markets. Potential further upside exists, as these projections represent a shift in existing travel patterns. Ideally the increase in ski visits would also be the result of greater demand for winter travel.

One potential hurdle to attracting more emerging market visitors to ski destinations is the perception that ski vacations cost more than others. To investigate this, Visa calculated the current weighted average cost for more than 750 winter travel destinations. Total costs include lodging, local transportation, dining, entertainment and shopping, but exclude the cost of getting to the destination. While ski destinations are more expensive, the arrivals-weighted average amount spent on Visa-branded cards by visitors to ski destinations is around $1,200, compared to $1,100 for other sites. The differences are not too far apart. Additionally, emerging market travelers are already taking over16 million winter trips to destinations that are on par to this average cost, according to Visa’s analysis of VISIT data.

Download complete analysis in PDF

Additional highlights of this report: