October 30, 2020 - Tourism, by far, has borne the brunt of the economic impact of COVID-19. Based on current trends, cross-border tourism receipts are set to fall from $1.3 trillion in 2019 to $430 billion in 2020, a level last seen in 2002. If the expected $900 billion loss in cross-border spending occurred in a single country, it would be as if households in Russia, Spain, Mexico, South Korea or Australia stopped spending for a year. Tourism's recovery from these historic losses depends on cities, especially those within the top decile of urban areas by population. Such cities (with at least 2.5 million residents) include San Francisco, Tokyo, Buenos Aires, Dubai, and Paris. They attract more visitors and are home to more globe trekkers than their less populous counterparts. Bringing large cities back up to speed is critical for the industry to move forward and regain the ground lost this year.

Tourism's road to recovery runs through cities

Large cities are key to re-starting travel and tourism

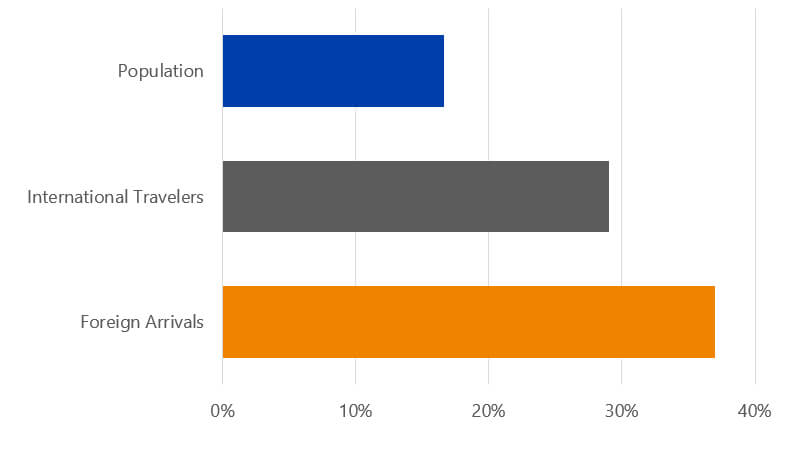

Although only 17 percent of the world's population currently lives in cities with at least 2.5 million residents, these cities are central to global tourism. The speed of their recovery will shape travel and tourism's total recovery. Residents in these large cities account for a disproportionate share of cross-border travelers: 30 percent of the total in 2019. This estimate leverages anonymized and aggregated transaction data to calculate the share of cardholders who travelled cross border, and covers 29 countries of origin and the 372 cities within them. Large cities also play a key role as destinations, representing 37 percent of visits over the past year. They play an even greater role in the Asia Pacific, accounting for 58 percent of all stay-over visits, according to proprietary estimates of city-level travel from the Visa International Travel (VISIT) database.

Large cities* attract more visitors and are home to more travelers than smaller ones (Share of total, 2019)

More highlights:

- Large cities play an outsized role in driving global tourism

- Recovery of travel to and from large North American cities remains subdued

- COVID-19 Economic Impact Index

- Regional recovery updates

- Second wave of infections could shift more business closures from temporary to permanent

Steep recovery lies ahead for travel from large cities

After the lock-downs, large cities did not lead tourism demand as much as before, according to an analysis of travel-related purchases on cards issued in the U.S. and Canada. Some cross-border tourism demand is starting to return to large cities, as measured by the share of cards used in a foreign country. However, compared to pre-pandemic, the current demand remains less than a quarter of what it was and the premium once enjoyed by large cities is narrower. The faster rebound in the share of consumers who have made travel-related purchases (airlines, hotels or car rentals) compared to their cross-border travel, suggests that border restrictions may be partially responsible for holding back the recovery. Half of all countries still have complete or partial bans on cross-border travel, according to Oxford University. However, restrictions alone cannot explain the fact that large cities now lag other urban areas in travel purchases. Other factors also in play include less favorable income and job trends.

Small business closures detract from allure of destinations to visitors

Closures of small and medium-sized enterprises could also hamper the recovery of travel and tourism, especially among the top 10 most-visited North American cities, which accounted for 40 percent of all international arrivals to the region in 2019. Among these top 10, only three (Las Vegas, Toronto and Honolulu) have resident populations below 2.5 million people, underscoring the importance of large cities. Currently, New York and Vancouver are doing the best among the 10, and are the only cities on the list with fewer business closures than the region. Due to a second lock-down that was imposed to curtail the spread of COVID-19, Honolulu lags its peers with more than a quarter of its small businesses closed in September. The closure of businesses, especially in prime tourism locations, makes it harder for these destinations to attract visitors.

Reordering underway of top cities for global tourism

Over the summer, uneven reopenings followed a generally synchronized lockdown during the spring. This has led to a reordering of the most visited cities in the world. As Europe was one of the few regions open for international travel this past summer, European destinations dominated the world’s top 100 most-visited places in the third quarter of 2020, with its share of arrivals rising from 69 percent last year to 97 percent this year. Only four of the top 10 destinations from the third quarter of 2019 made the list this year. While some of these gains may prove fleeting as subsequent waves of infections lead to renewed closures, some may prove to be more enduring.

Reopening of borders and small businesses go hand-in-hand

Where borders have been reopened, both arrivals and small businesses have recovered. Cities that reopened to global travel and accelerated more in international arrivals growth between the second and third quarters of this year, also increased in their share of small businesses that reopened over that same period (chart below). The more visitors a city welcomed over this period, the greater the reopening of its small businesses. To sustain these gains over time, though, will require keeping the disease in check.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook,” “forecast,” “projected,” “could,” “expects,” “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

Studies, survey results, research, recommendations, opportunity assessments, claims, etc. (the 'Statements') should be considered directional only. The Statements should not be relied upon for marketing, legal, regulatory or other advice. The Statements should be independently evaluated in light of your specific business needs and any applicable laws and regulations. Visa is not responsible for your use of the Statements, including errors of any kind, or any assumptions or conclusions you might draw from their use.