June 20, 2018 - By most measures, the U.S. economy is on solid footing and many key economic indicators are at or near post-recession highs. The labor market is tight, consumer confidence is way up and U.S. household net worth is at record levels. However, just as the economy is beginning to kick into a higher gear, fiscal stimulus—in the form of tax cuts—is supercharging the expansion, putting the economy at risk of overheating. This could create a boom and bust pattern, increasing the chance of a recession within the next two years.

Troubled waters ahead for the U.S. economy? Too soon to tell

Benefits of tax cuts have already kicked in

The Tax Cuts and Jobs Act is expected to lower taxes for 80 percent1 of taxpayers this year, and the benefits have already kicked in. New federal tax withholding tables that take into account the new tax law went into effect in February, causing most paychecks to increase by about 1-3 percent.2

The impact on consumer spending will vary. Taxpayers with incomes in the top 20 percent are expected to receive 65 percent of the tax savings.3 However, these consumers are likely to save much of the extra money compared to lower income groups, who are more likely to spend their entire paycheck.

An April 2018 Visa consumer survey showed that only 70 percent of people were aware of the tax reform changes. Among those, less than 40 percent noticed an increase in their take-home pay.

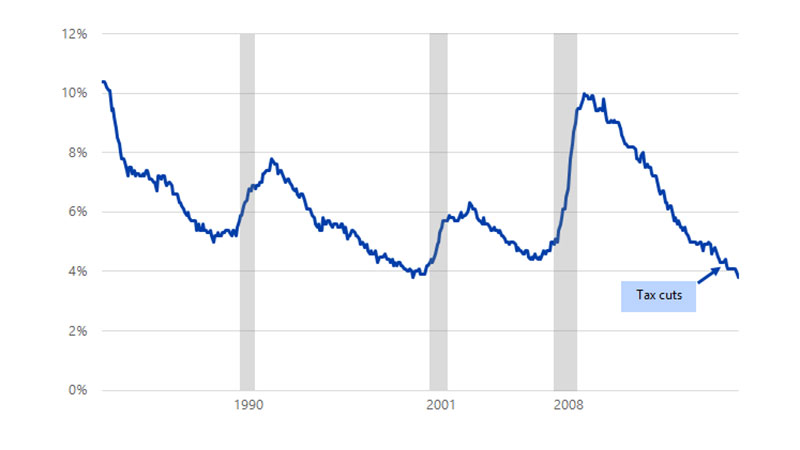

Nevertheless, the addition of more money in people’s wallets should support the already positive conditions for consumer spending this year. Unemployment is at its lowest level since 20004 and wages are finally starting to increase. Household net worth has reached $100 trillion,5 fueled by rising home prices and high (albeit volatile) equity prices. This is encouraging consumers to spend, and 2018 is likely to be a good year for the U.S. economy. Gross domestic product (GDP) adjusted for inflation is forecast to increase 2.8 percent in 2018, up from 2.3 percent in 2017.6

The outlook for 2019 and 2020 is less certain

While not everyone received an income tax reduction under the new law, nearly everyone saw a decline in federal tax withholdings, which may leave millions of taxpayers with an unexpected tax bill in early 2019. The new withholding tables are broad brushstrokes that do not take into consideration each individual taxpayer’s situation.

The government is encouraging people to fill out the new W-4 form, but many people likely will not. As a result:

- Under the new tax plan, an estimated 5 percent of taxpayers will pay higher taxes,7 with some facing additional implications if their federal taxes withheld in 2018 were too low

- Another group will see a tax cut under the new plan, but may still end up paying taxes in 2019 if their 2018 withholdings were also insufficient

Taxpayers who have high incomes, large mortgages, no children and live in high-tax states may be affected the most.This could have repercussions on the economy, causing some consumers to pull back on their spending in 2019 due to uncertainty surrounding their financial situation.

Although the tax cuts are good for taxpayer's wallets, current fiscal and monetary policy developments are likely to dampen the impact of tax cuts on the economy. Currently, they are out of sync. Tax cuts are propelling growth and fueling demand that is likely to lead to faster consumer price inflation. The Fed is raising rates (albeit slowly) in order to reign in growth and keep inflation centered around its 2 percent target. The Fed has already raised the rate once in 2018 and is expected to raise rates three more times this year and three times in 2019.8

Unemployment Rate

Source: Visa Business and Economic Insights analysis of data from the Bureau of Labor Statistics

A recession is unlikely before 2020

In addition, the yield curve,9 which is generally considered to be a measure of investor sentiment on the direction of the economy, is starting to flatten and is currently the lowest it has been since the great recession. If investors become nervous about the current expansion, they will rush to lock in rates for long-term treasuries, causing yields to plummet. Lack of demand for short-term treasuries would cause prices to rise to a higher level than long-term rates, drying up inflation. This would cause the yield curve to invert—a scenario that has predated every recession.

Although job growth and consumer spending are keeping the U.S. economy on firm footing, other factors such as policy uncertainty, market volatility and the possibility of a trade war are creating an uncertain environment. A recession is unlikely before 2020, but it may be a bumpy ride until then. Time to buckle up?

Wayne Best, Senior Vice President/Chief Economist

Wayne Best leads Visa's Business and Economic Insight team. As chief economist, he keeps close watch on emerging opportunities in the trillion-dollar payments industry. An active participant in the World Economic Forum's Future of Consumption community, he identifies economic trends shaping the future. Best's presentations and reports explain the impact of these trends to company and client executives, as well as government leaders around the globe. Before joining Visa in 1990, Best worked as a consultant performing cost benefit analyses for the power industry. In addition to an MBA, Best holds a degree in nuclear engineering and has participated in the Stanford University and Kellogg School of Management executive programs.

Sources

1 Urban-Brookings Tax Policy Center, "The effect of the TCJA individual income tax provisions across income groups and across the states," March 28, 2018.

2 Visa Business and Economic Insights analysis of 2017 and 2018 W-4.

3 Urban-Brookings Tax Policy Center, "The effect of the TCJA individual income tax provisions across income groups and across the states," March 28, 2018.

4 Visa Business and Economic Insights analysis of data from the Bureau of Labor Statistics, Current Population Survey, Household Survey, May 2018.

5 Board of Governors of the Federal Reserve System, "Balance sheet of households and nonprofit organizations, 1952 - 2018."

6 IHS Markit, GDP forecast, May 2018.

7 Visa Business and Economic Insights analysis of 2017 and 2018 W-4; Tax Policy Center, "The effect of the TCJA individual income tax provisions across income groups and across the states," March 28, 2018.

8 IHS Markit, GDP forecast, May 2018.

9 Federal Reserve Board, "Predicting Recession Probabilities Using the Slope of the Yield Curve," by Peter Johansson and Andrew Meldrum, March 01, 2018.

Forward-looking statements and disclaimer

This newsletter contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as "outlook," "forecast," "projected," "could," "expects," "will" and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa's business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict.

DisclaimersCase studies, statistics, research and recommendations are provided "AS IS" and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. You should consult with your legal counsel to determine what laws and regulations may apply to your circumstances. The actual costs, savings and benefits of any recommendations or programs may vary based upon your specific business needs and program requirements. By their nature, recommendations are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Visa is not responsible for your use of the information contained herein (including errors, omissions, inaccuracy or non-timeliness of any kind) or any assumptions or conclusions you might draw from its use. Visa makes no warranty, express or implied, and explicitly disclaims the warranties of merchantability and fitness for a particular purpose, any warranty of non-infringement of any third party's intellectual property rights. To the extent permitted by applicable law, Visa shall not be liable to a client or any third party for any damages under any theory of law, including, without limitation, any special, consequential, incidental or punitive damages, nor any damages for loss of business profits, business interruption, loss of business information, or other monetary loss, even if advised of the possibility of such damages. All brand names and logos are the property of their respective owners, are used for identification purposes only.