Scalable processing you can trust every time

Proven payment processing is crucial to providing a best-in-class cardholder experience, because when your customers tap, swipe, or click, they expect it to just work. And with Visa DPS, it does.

Our trusted platform delivers the reliability, simplicity and scalability you need to keep transactions running smoothly for every cardholder, every time.

Powerful processing. Proven performance.

Take your payments further

We're constantly innovating to deliver smarter, more impactful payment experiences that are helping you scale with ease, operate with confidence and perform at your peak.

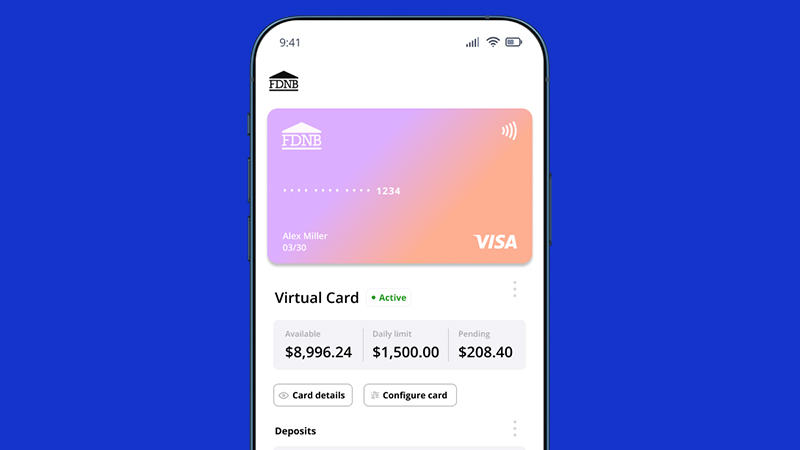

Issue cards at scale

Instantly issue digital cards, unlock immediate provision to wallets, and access best-in-class card printing services.

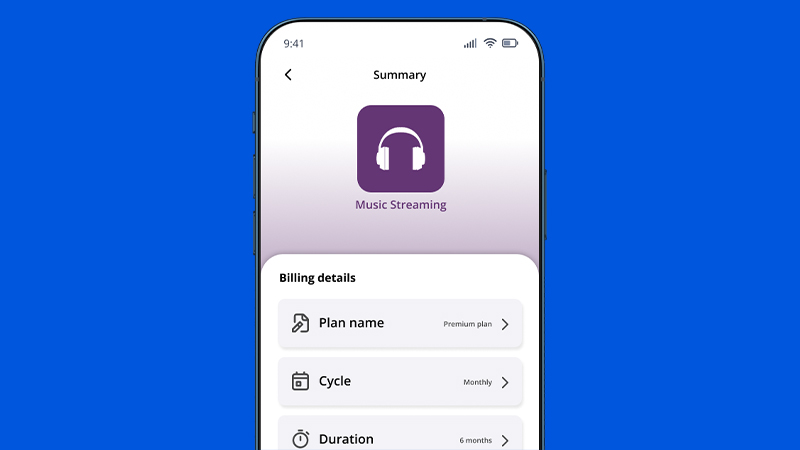

Drive digital transformation

Accelerate your digital roadmap with modular capabilities and adaptable deployment options that suit your needs.

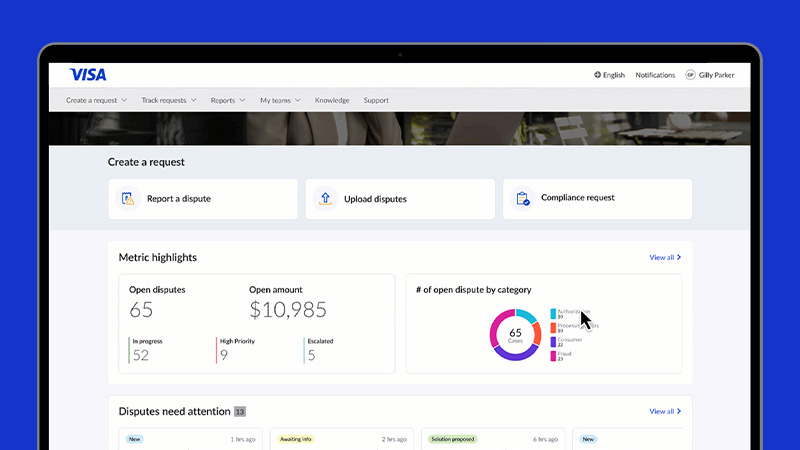

Unlock modular services

From automated disputes to near real-time insights and rapid card fulfillment, our APIs integrate easily, boost performance, and ease operational load.

One platform, your way

At the heart of Visa DPS is a single, proven processing platform, trusted by some of the world’s largest issuers to deliver enterprise-grade resilience and next-gen flexibility.

Built with modern APIs

Visa DPS APIs make it easy to connect, launch, and scale fast. With modern architecture and plug and play services, you get secure, flexible processing built for what’s next. Visa clients can access APIs directly in the Visa Developer Center.

Be an innovator: Real stories

Check out CTO and co-founder of Current, Trevor Marshall, as he discusses building with DPS Forward.

- O&I Reporting, FY24

- Visa Global Billing Platform (VGBP), DPS authorization transactions, FY24

- Visa Data Manager (VDM), DPS financial transactions, FY24

- Visa Data Manager (VDM), DPS debit authorization transactions, FY24

- Based on all transactions disputed via the Allocation and Collaboration flows within VROL as of February 2023

- Visa Data Manager (VDM) and Global Business Intelligence (GBI), VisaNet U.S. debit cleared & settled transactions of MRTclients and all Visa issuers, Feb'24 - Jan.'25.

Note: The comparative rate (%) of difference between i) the percentage of MRT clients' debit cleared & settled transaction dollar volume that is fraudulent and ii) the percentage of all Visa issuers' U.S. debit cleared & settled transaction dollar volume that is fraudulent (i.e. [MRT clients' debit fraud rate]/[All Visa issuers' U.S. debit fraud rate] - 1) - Global Business Intelligence (GBI), DPS and VisaNet U.S. debit authorization transactions, FY24