We are supporting all sides of the ecosystem and enabling them to offer installments in a seamless way before, during and after the purchasing experience.

— Arvind Ronta, Global Head of Installments

Give customers more flexibility to pay for things they want now, or over time. Visa’s BNPL solutions (Buy Now, Pay Later) help businesses and financial institutions account for payment options that customers expect.

Our portfolio of BNPL solutions can help you reach your growth goals and connect more with your customers.

We deliver BNPL solutions that give your customers the flexibility to get the things they want now and pay for it over time.

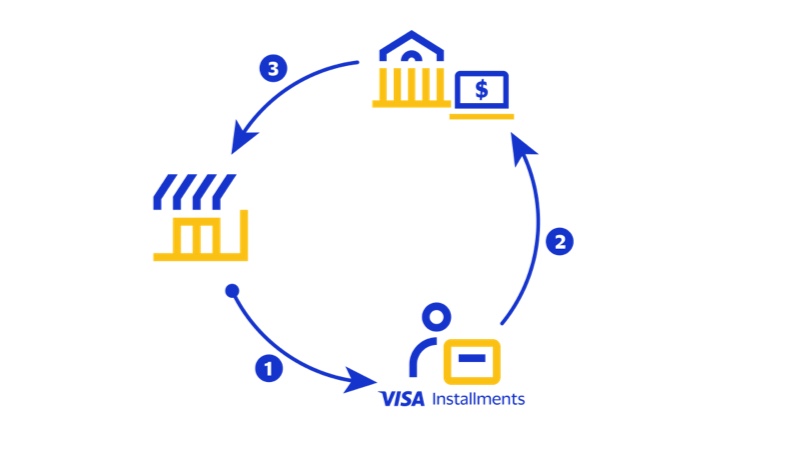

We help drive efficiencies with a set of full service offerings across purchases, repayments and settlement flows.

We are supporting all sides of the ecosystem and enabling them to offer installments in a seamless way before, during and after the purchasing experience.

— Arvind Ronta, Global Head of Installments

Learn how we can help you deliver BNPL solutions to your customers.

Learn how BNPL payment options can help you with your business goals and priorities.