Why do consumers leave so much FSA and HSA money on the table?

Misconceptions about pre-tax healthcare accounts keep many from enrolling

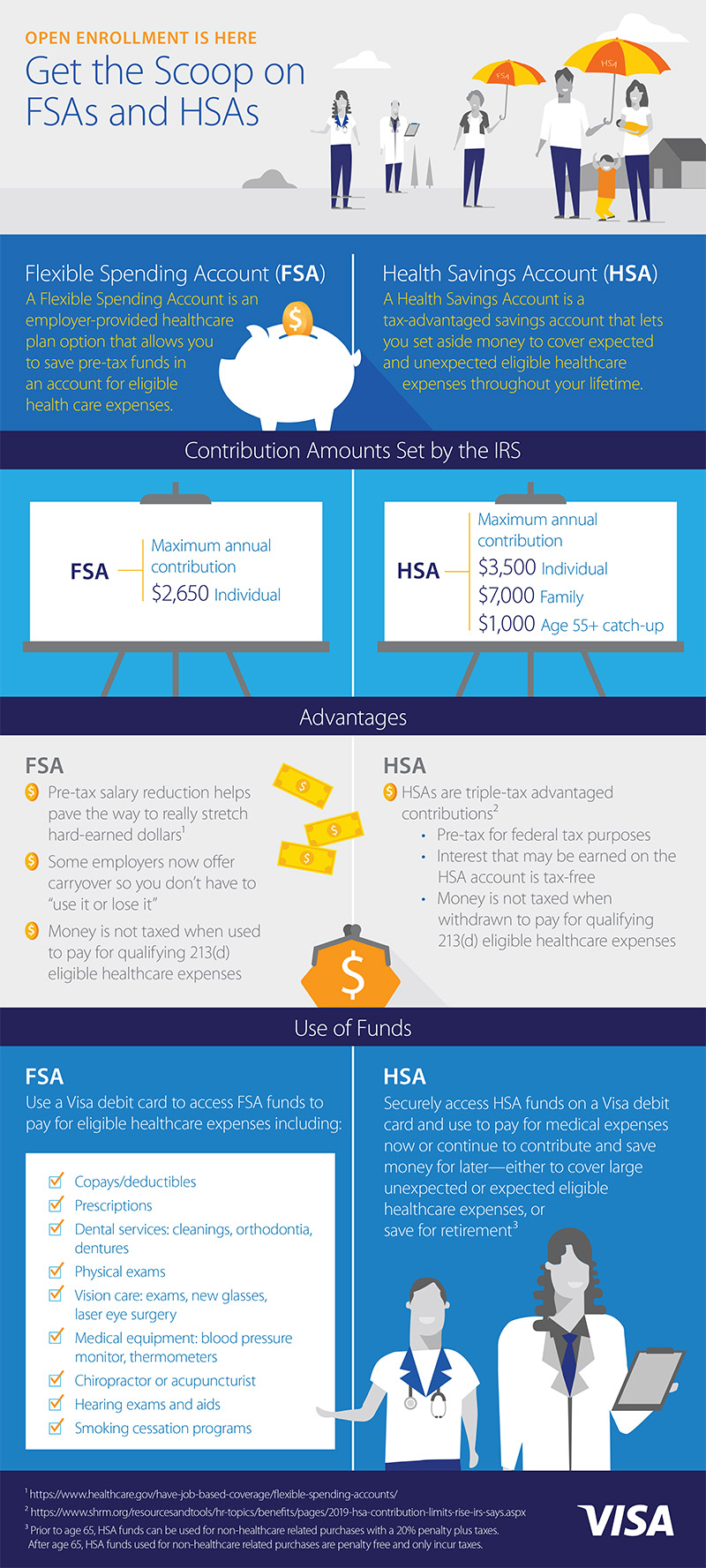

It’s enrollment season for Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), but consumer confusion about these pre-tax healthcare accounts makes many eligible people hesitate to sign up, prompting them to miss out on hundreds of dollars in savings. What do they need to know to take advantage of available plans?

Tax benefits make the plans worth the effort to understand them

Both FSAs and HSAs are tax-advantaged accounts. When people contribute to an FSA or employer-linked HSA, pre-tax cash is deducted from their paychecks. That means the money that goes into the accounts isn't taxed. People who contribute to an HSA outside of their employers can deduct contributions from their taxes at the end of the year. Money that is withdrawn from the account to pay for eligible healthcare expenses isn’t taxed either.

Both types of accounts are designed to ease the pain of spending when healthcare plans don't cover certain expenses

Those can include everything from occasional medical expenses such as laboratory fees and x-rays to everyday items such as bandages and contact lenses. They can even include unexpected expenses such as visits to a chiropractor or acupuncturist and certain home improvement costs intended to accommodate a disability. (This IRS website offers more details about which expenses qualify.)

HSAs are designed to work specifically with a qualifying high-deductible healthcare plan

That’s one of the key differences between HSAs and FSAs.

People can enroll in an account at the same time they enroll in health insurance

When employees choose new healthcare plans or confirm their existing plans at the end of each year, they can also enroll in a healthcare spending account and decide how much to set aside. People in qualifying high-deductible plans can also enroll in an HSA independently of their employers at any time through a bank.

Healthcare spending account deposits are often automatic, and some employers chip in too

With all FSAs and employer-linked HSAs, paycheck deductions can be made automatically, pre-tax. Many employers also contribute funds to HSAs.

It's not always "use it or lose it"

FSAs were introduced before HSAs, and the main criticism of them was that funds unspent at the end of the year were lost. For many people, the spending deadline was enough to turn them off of FSAs entirely. But these days, a bit of the pressure is reduced. Some companies offer employees a short "carry over" period after the year's end. In fact, 67 percent of FSA users with a carry-over option took advantage of it in 2017, rolling over an average of $241 from 2017 to 2018.

Any money left in HSAs at the end of the year always rolls over into the following year and can continue to be rolled over indefinitely.

FSA and HSA debit cards let people skip the paperwork and go cash-free

Healthcare cards such as FSA and HSA cards work just like debit cards. A Visa Healthcare card, for example, can be used to charge eligible healthcare expenses, pulling funds directly from the FSA or HSA account. Last year, 77 percent of FSA users and 68 percent of HSA users surveyed chose this approach.

Misconceptions and a lack of information don’t have to prevent people from taking advantage of healthcare spending plans available to them during enrollment season, including plans that offer a Visa Healthcare card. Find easy-to-follow videos on FSAs and HSAs.

Research cited in this post is from the 2018 Flexible Spending Account and Health Savings Account Consumer Research study commissioned by Visa and conducted by Kelton Global. Nationwide online research conducted in May 2018; FSA survey among 1,250 consumers and HSA survey among 1,047 consumers.