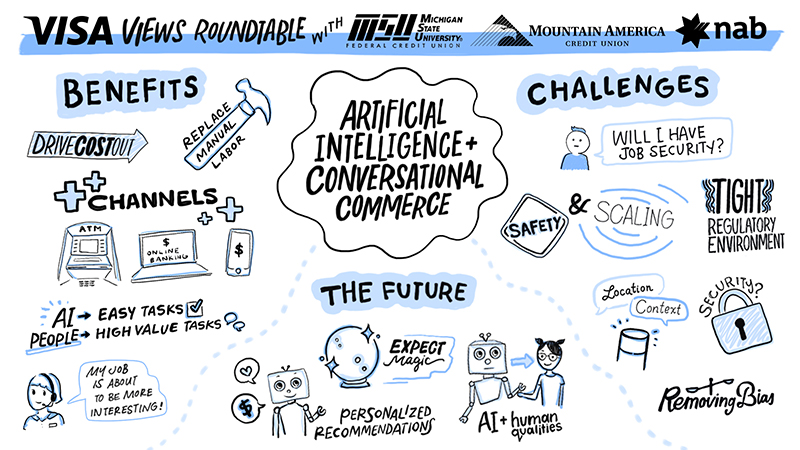

Visa Views: The role of AI and voice in changing how we pay

Panel of financial industry experts talks about progress, privacy and the need for an interface that feels human

Artificial intelligence (AI) and voice-enabled technologies have the potential to transform the financial services industry and help customers in extraordinary new ways. Enterprises are already doing more with these technologies than customers realize, as Visa’s head of Innovation, Mark Jamison, found when he sat down with three clients from around the world who are using next-generation technologies in their businesses:

- Nathan Anderson, EVP/COO, Mountain America Credit Union

- April Clobes, CEO & President, Michigan State University Federal Credit Union

- Jaimee Salmon, Head of Emerging Channels, National Australia Bank Limited

Jamison: Here in Silicon Valley you can’t walk 10 feet without hearing someone talk about AI. The term is moving so fast that it means different things to different people. What is your current perspective on AI?

Anderson: We view AI as an opportunity to drive cost out of the ecosystem and to replace processes that are manually driven. We heard many predictions in our industry: ATMs and mobile would significantly change banking, new developments would take away the need for branches and people – the reality is that each one of these has created new ways for people to transact and interact. AI will allow us to provide better services to people, adding insight and education to allow us to automate a number of back office procedures. This makes us more efficient while providing better service.

Clobes: Our goal is for chatbots to take on some of the daily tasks for employees, to free them up for the higher-value interactions with our members where in-depth expertise is needed. Those interactions aren’t going away, but the easy, self-serve tasks are definitely increasing.

Salmon: There’s a perception that AI and the automation of simple tasks will lead to jobs becoming ‘harder’. However, when we speak to our people in our contact centers they use the phrase, “my job is going to get more interesting.” Our employees understand that AI is about supporting and complementing what they’re doing, not about removing them. Customers feel similarly; they see automation of simple and repetitive tasks as advantageous for them.

Jamison: Michigan State Federal Credit Union is serving a university-aged audience that expects the latest and greatest technology. April, how do you keep up on the latest trends to be more agile and faster to adopt the newest technology?

Clobes: I charge my team to read Fast Company and Wired, and to look for tech trends across all categories. We look at experiences outside our industry, like Disney’s Magic band [plastic bracelets that connect guests with data and experiences using RFID]. It’s a digitally-savvy country driven by customer demand. We want to know: what would our members say about these experiences and how could we deliver similar ones for them?

Jamison: Nathan this question is for you. Mountain America Credit Union is a tech-savvy, forward-leaning institution. Why is it that you are among the very first to pilot virtual assistance?

Anderson: Years ago we tried to do this ourselves, but anything we created became outdated—we realized we are not a software development company. Our strength is understanding our systems well enough that we can partner with the right people, have knowledgeable staff to make the integrations work and find the right partners to move forward with.

Jamison: Australia is one of the most sophisticated banking markets in the world, Jaimee. How does that influence what you do?

Salmon: We live in a digitally-savvy country driven by customer demand for great experiences. The adoption rate of smart speakers for example, is several times faster in Australia than that of the U.S. We have a competitive market, headlined by four major banks, as well as a wave of fintech innovation and challenger banks entering, which drives further competition. At the same time, we have a very tight regulatory environment. We need to balance all these needs to be a safe, trusted, and innovative company.

Even though we are a significant bank with a large transformation agenda, my team operates with a start-up mindset. I think it’s great to be working with newer technologies where it’s experimental test and learn, followed by investing and scaling in the parts that have proven to really matter.

Jamison: Everyone in this conversation is coming at this with a different approach. It made me think about how humans are quirky and they want speed bumps and affirmation in this new form of interface. How is AI meeting the human expectations for it as it evolves?

Salmon: We are constantly researching the expectations and needs of our customers. This leads to some paradoxes; people understand that AI and automation makes things fast, but bots answering customers inhumanely fast can be an unnerving experience. I remember in one round of customer testing when I observed a customer physically recoil off the keyboard when the Virtual Assistant responded too fast. People know it’s a robot, but at the same time they want some anthropomorphic element to be comfortable conversing about important topics like their banking. We built in a “loading, listening” feature to slightly delay our Virtual Assistant’s response because it created a much more natural experience for customers.

Clobes: We spent a significant amount of time creating a personality for our chatbot. Because what surprised me was that people would want to know about the AI person. Knowing that it had a human personality was important, so we created a lot of answers to the question “who are you” to the chatbot.

Jamison: Let’s switch gears and talk about voice. One of the interesting things about voice devices is the difference in, or even lack of, interface. How do you help your customers to know you have it, and know how to try it?

Salmon: With voice, educating customers to help them understand the possibilities is extremely important, and within that, marketing definitely helps. We saw immediate peaks after we ran campaigns over Facebook and Instagram. That helped guide us on what new features to add and where there were gaps in the experience. At NAB, we’re looking to design a multi-modal experience; we think you still need a screen to complement voice experiences in their nascent stage. We believe that a fully voice-driven UI requires a significant amount of base functionality to be enabled, and there will be a number of years where due to feature gaps or customer comfort levels, you will still need visual UI as an optional counterpart. You can see this in the market too: Alexa and Google Home devices now have multimodal interfaces where you can just drive with voice, but you will also see it presenting options, or transcribing your conversation, on a screen.

Jamison: With AI being so new, there is a lot to consider when it comes to privacy. At the senior levels of your organization, are you having discussions around how quickly you want to advance these technologies?

Salmon: It’s difficult to create hard and fast processes and governance around these technologies in a traditional sense – there’s very little precedent out there for enterprise-scale application of conversational AI. We guide our approach on a more principled basis; on what is the purpose of what we are creating, why and how does it serve our customers in what it’s doing. The safety and security of our customers’ information and money is paramount and always our number one priority. One of the things NAB has done is assign data stewards in each business who are the guardians of data. They act to identify issues with data and resolve them. We are also creating an ethical practice model for the use of data that goes beyond simple rules about access control and specific use cases. It’s important to ensure you remain customer-led in your strategy and development, versus simply building something because you can, or because the technology exists.

Jamison: What thought or sentiment would you close with that sums up how you are feeling about this category?

Salmon: It can go in a lot of directions once you start adding individualisation as a contextual input, and understanding what is an ethical use of one’s data. You need modern data governance and ethics frameworks around this to ensure your customer’s safety, security and privacy. With this kind of technology, there’s an opportunity to create really compelling experiences, and really horrific experiences.

Clobes: Our long-term plan is to do our best to simulate the digital channels to offer the same experience as you would have in the branch, offering additional value and services via digital. But we want to make sure we use it appropriately so that it’s not a sales tool every time they log in, because then they will become disappointed in the experience.

Anderson: That’s spot-on what we are looking for, the ability to have a recommendation that truly provides the value that we feel our employees offer when a member comes in for one thing and they walk out with education and solutions for other aspects of their life.