Digital remittances can make a difference in migrant lives

New Visa Economic Empowerment Institute (VEEI) study finds digital remittances are making remittances faster and cheaper for migrant workers and offers recommendations for continuing this progress

Remittances, or the transfer of money by a foreign worker to their home country, are a lifeline for millions of migrant workers and their families, as well as a boost to the GDP of many countries around the world. According to World Bank data, as many as 28 countries receive up to 20 percent of their GDP via remittance flows. But, the cost of sending and receiving money abroad has created barriers and many MTOs (money transfer organizations) are innovating to offer better solutions.

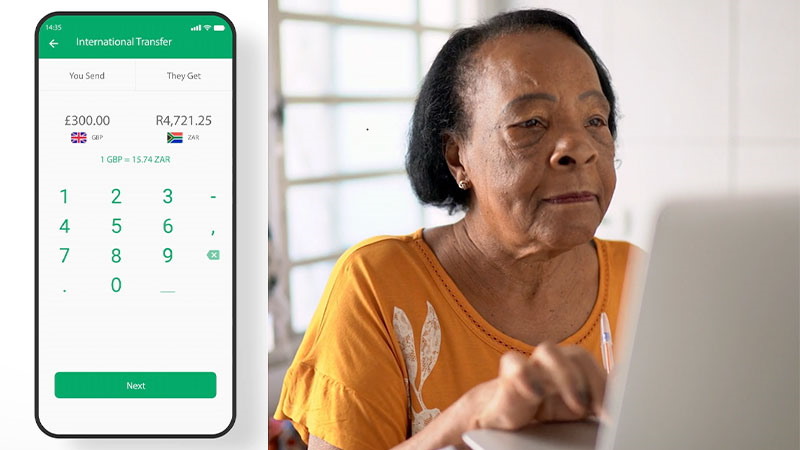

Enter digital remittances, which have brought the advantages of e-commerce to remittances. These digitally initiated remittances have proven indispensable throughout the pandemic, because physically visiting an office and using cash isn’t always possible. In addition to being faster and more transparent than traditional remittances, digital remittances are more affordable and secure. A new study from the Visa Economic Empowerment Institute (VEEI) offers recommendations for how policy makers can drive progress even further for their communities and their economy. We recently spoke with the VEEI and Visa Direct teams about the findings.

Why are remittances so vital for workers today?

Ruben Salazar Genovez, Global Head of Visa Direct: Every time an individual leaves their country of origin, they are likely leaving because they are seeking a better life. They want better jobs. They want to live in areas that are safe. But when they leave, they often leave dependent family members behind. Remittances pay for medical bills, utilities, and basic needs and, can help reduce poverty.

Presently, there are 200 million migrant workers that use remittances to send financial support back to their countries of origin1. In 2019, remittance flows reached $706 billion USD2 awhich reflects only a portion of their total income. and, that doesn’t account for the total income of these workers. Remittances play an important role in the global economy.

What opportunities do we have to bring more equity across borders?

Barbara Kotschwar, VEEI Executive Director: The United Nations has recognized remittances as a matter of global importance. There is a UN Sustainable Development Goal (SDG #10) of bringing remittance costs to three percent by 2030. We at VEEI really wanted to take a look at the trends in remittance cost, take a look at what the driving factors were, and see what can be done to bring those costs down even further.

Timothy Summers, VP of Digital Product: Enabling migrant workers to digitally send remittances is definitely moving costs in the right direction. The real opportunity, though, is enabling digital receipt of those remittances. Right now, the vast majority of digital remittances are still picked up in cash on the other end. And from talking to MTOs, we think that that's adding up to 3% in costs. When we have true digital receipt at the receiving end, then the costs can come down further.

Ruben: The trends we are seeing in remittances flows are important in understanding the role digital inclusion can play for receivers of remittances. Someone may have a bank account, but that doesn't guarantee that they are participating in a digital economy, and that's one of the largest challenges that we're going to face in the next couple of years.

Improving remittances begin with improving digital infrastructure

Digital remittances, in fact, offer greater physical security and peace of mind too. How does gender equality factor in here?

Barbara: We see remittance digitization as a matter of gender equalization because carrying cash can be a serious impediment for women to do business. Being able to receive remittances digitally can be a big factor in helping women, in particular, manage their businesses in a safe manner.

Ruben: That's absolutely right. The act of receiving these funds may involve traveling from remote locations, going to an ATM or going to an agent and walking around with a significant amount of money. There is some sense of physical security in having funds directly deposited into your debit card.

We have also observed in G20 countries that having access to a debit card or having access to a banking account sometimes is dependent on having legal documentation or a national ID. This may limit the channels individuals may use to access remittances, so instead of going through formal remittance channels, they end up in other more costly distribution networks because they do not have the proper credentials.

What can policy makers do to overcome these barriers? What are some examples of countries supporting the expansion of digital remittances?

Barbara: It’s really important to have basic digital infrastructure — electricity, internet connectivity, broadband. We also advocate for policy makers to keep an open digital ecosystem. We like to say that an open trade policy is really a small-business-enhancing policy.

It is more important for the public and private sector to work in partnership to really activate digital enablement in receiving countries. Not only will that make it easier and less expensive to receive remittances, but you can also enable access to using digital payments in businesses. That would be a boon to private sector development around the world as well.

Chad Harper, Global Payments Fellow, VEEI: We need to keep consumers and businesses in mind when trying to drive digital enablement. Ultimately, someone won't be willing to receive that remittance on their debit card if they then can't go out and use it in the community. It’s a two-sided equation. Countries that have done a good job on digital enablement have focused on both sides of that equation. They've made it easy for consumers to use, and merchants to accept, electronic payments.

VEEI believes that there are multiple viable infrastructures for global money movement, and the private sector is working to make remittances faster, more inclusive, much more transparent, and cheaper. Policy makers should focus on helping enable this progress two ways: streamline the regulatory environment associated with cross-border payments and simplify the process for bringing new products to consumers and communities. We want remittances to work in every possible country pairing you can think of globally.

Ruben: MoneyGram is a great example of how we are partnering to simplify remittances for migrant workers in Central America and the Caribbean. MoneyGram is offering a remittance service in Jamaica, Nicaragua and El Salvador where consumers can deposit directly to their accounts by using Visa debit or reloadable Visa prepaid card credentials (using Visa Direct). The receiver can then obtain the funds in less than 30 minutes directly to their account via a Visa debit or reloadable Visa prepaid card.

This shows that when we partner with the purpose of supporting migrant communities, the public and private sector can work quickly and eliminate significant barriers. We couldn't have done it without government support and the government couldn't execute without our support. It was definitely a win-win. And the winner here is the consumer, who is able to immediately receive the funds in a matter of minutes, not days, from banks and their government.

Learn more about the VEEI findings.

1 United Nations News. (2019, June). Remittances matter: 8 facts you don’t know about the money migrants send back home. https://news.un.org/en/story/2019/06/1040581

2 World Bank (2019) World Development Indicators [Data file].