NFTs, stablecoins and the refugee crisis

Could crypto play a meaningful role in the lives of the forcibly displaced?

Applications for the 2022 Inclusive Fintech 50, sponsored by Visa, MetLife Foundation, JOA, Accion, and IFC, are open until July 25th. This year’s theme is “Making Digitalization Count.” Apply on the Inclusive Fintech 50 site.

There were 27.1 million people forcibly displaced from their home countries as of the end of 2021 and another 53.2 million internally displaced people according to the United Nations High Commissioner for Refugees (UNHCR). With hot conflict re-emerging in parts of the world, these numbers are likely to increase.

For many refugees, challenges map to a kind of hierarchy — from fleeing physical danger, to seeking sanctuary, to securing the value they have earned over a lifetime. For too many, when it comes to life savings, the choice is between leaving everything behind or carrying everything in cash.

The thing about cash, though, is that it’s a bearer asset. Whoever holds it, owns it. And it doesn’t take much, particularly in the chaos of armed conflict, to lose it — to theft or otherwise.

Storing value with stablecoins

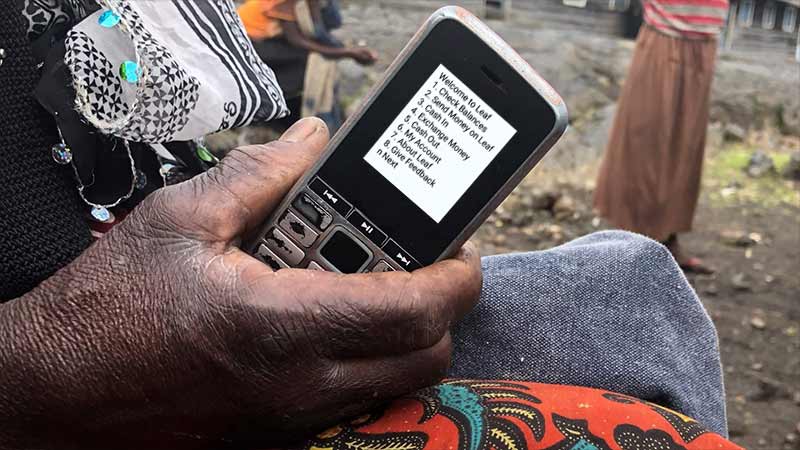

Leaf Global Fintech, one of the 2021 winners of the Visa-sponsored Inclusive Fintech 50, set out to build a solution that helps refugees fleeing conflict zones carry their value with them without physically holding cash. Their tools of choice? Blockchain technology and the phones people already own — in most cases, not even smartphones, but the kinds of feature phones that can place calls and send text messages but are otherwise limited in functionality.

“When someone is separated from their money, their way of life, their family, and their community and are placed even somewhere like the United States, everything is different. They don’t have the ability to bring their generational wealth or often even their cash in hand. That can set someone up for such a poor start,” said Leaf Co-Founder and CTO Tori Samples, who spent 15 years in and around resettled refugee communities before launching Leaf.

The Leaf founders recognized that, in most cases, people fleeing conflict zones have a difficult time getting a bank account and that it’s both inconvenient and dangerous to carry cash.

“We designed a digital mobile wallet that works on both smartphones and non-smartphones,” said Co-Founder and CEO Nat Robinson, who spent seven years starting and running a microfinance company in Kenya before launching Leaf. “This helps our customers store their cash when they’re leaving one country and then withdraw it, making payments along the way, in other countries.”

Beginning in Rwanda, Uganda, and Kenya, with plans to expand to other countries, Leaf leverages the Stellar blockchain to create custom tokens pegged to national currencies — local stablecoins outside of places where well-traded stablecoins for USD and EUR exist. For instance, in Rwanda, Leaf users can convert Rwandan francs into Rwandan franc tokens on the blockchain, which they can trade digitally and redeem for fiat currency whenever they want to cash out.

Leaf was recently acquired in March 2022 by IDT (NYSE:IDT), a licensed money services business in the US and a global provider of fintech, cloud, and traditional communications services. The Leaf team is excited to leverage the resources of IDT to deploy Leaf to more markets around the world.

Generating income with NFTs

Near the height of the NFT boom in late 2021, Leaf decided to do an experiment to see if it was possible for artists among their customers to generate income through NFT sales. Beginning with two artists and growing to more than 15, Leaf worked to facilitate sales on a Stellar-based marketplace called Litemint. Artists created digital art pieces (or digital versions of physical art) and Leaf worked with them to mint NFTs, list the pieces for sale, and connect the pieces with buyers.

“What I love about the Leaf model that makes it so different from more philanthropic or charity-based initiatives is that our version is impact art that generates direct income for creators,” said Samples. “It’s about connecting buyers and sellers around the world from very different walks of life.”

Over the course of the experiment-turned-standing initiative, Leaf has facilitated more than 90 NFT sales worth over $2,300 for artists. The money is paid directly to the artist’s Leaf Wallet in local currency. In countries where some refugees are forced to live on the equivalent of little more than a few dollars per month, an NFT that sells for an average of $33 per piece is significant income.

“Now we’ve got all these artists making substantial money on trading this wonderful art that we’ve been able to sell and access through a global marketplace,” said Robinson. Despite the global downturn in NFT sales in 2022, Leaf plans to continue the experiment and has a growing number of artists who would like to participate.

Building a digital identity

While central to its product offerings, cross-border value transfer and facilitating NFT sales aren’t the entirety of Leaf’s mission. At its core, Leaf is committed to helping individuals enter the formal financial system and build for themselves a digital economic identity.

“For me, an economic identity is about equipping someone with a paper trail and a past,” said Samples, “to give them tools to prove who they are so that they can be taken seriously within the formal economic world and be given the same opportunities as others. I believe very strongly that equipping someone with financial resources and financial help ripples out into every other area of life”

Through Leaf, customers have a permanent and public record of their transaction history that they can use to establish themselves with a bank or use as a proxy for a credit score to procure loans, added Robinson.

At the end of the day, fleeing a homeland because of war, famine, or political instability is traumatic; starting somewhere new is hard for anyone. Having finances in order — and a historical record — can ensure that refugees seeking a new life don’t have to start from square one when it comes to their money.

Learn more about Inclusive Fintech 50.