Don't miss out on FSA or HSA savings

Enrolling in your company’s pre-tax healthcare account can save you a significant amount of money

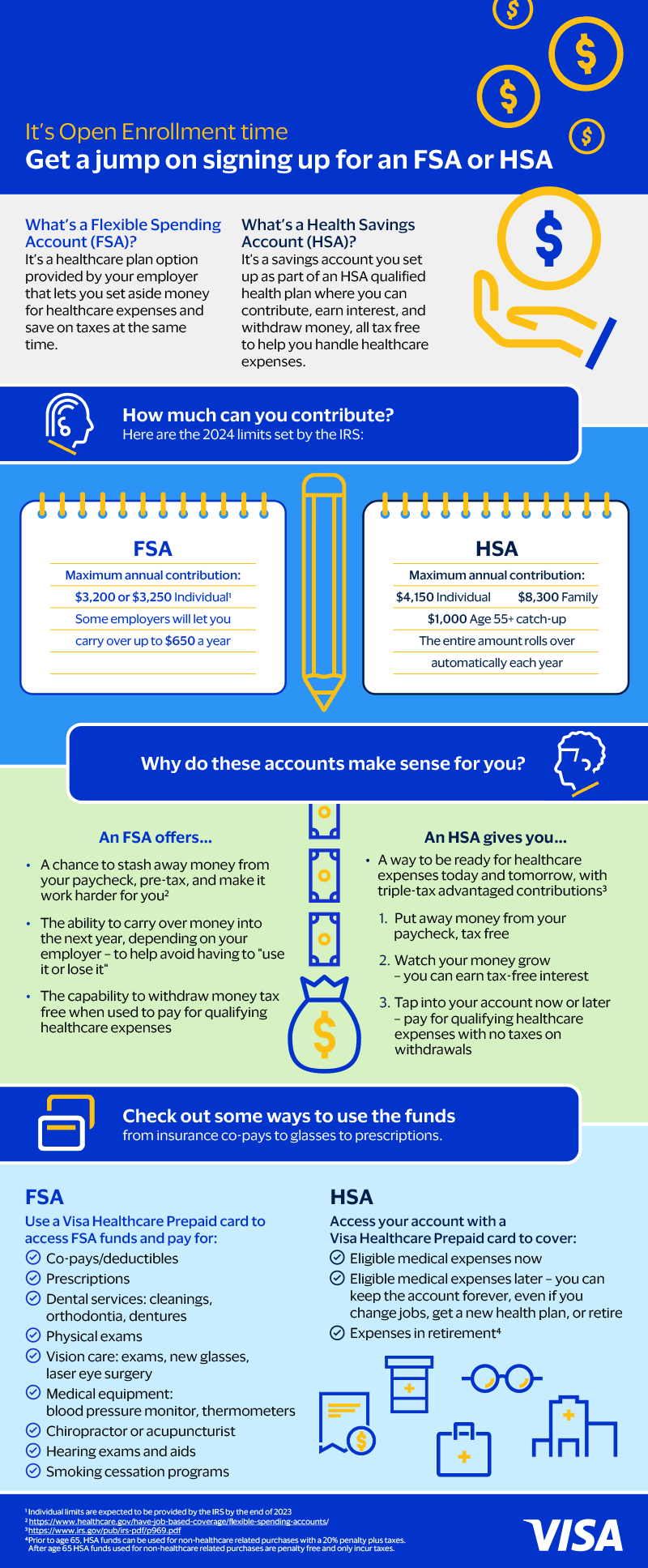

It’s the season to enroll in Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). But if you fail to sign up during your employer’s open enrollment period, you could miss out on thousands of dollars in savings.

So, let’s clear up a few things.

Tax savings make the plans worthwhile.

Both FSAs and HSAs are tax-advantaged accounts. What exactly does that mean? When you contribute to an FSA or employer-linked HSA, pre-tax dollars are automatically deducted from your paycheck — you don’t pay taxes on the money going into the account. You can also contribute to an HSA outside of work, and in that case, you’ll deduct contributions from your taxes at the end of the year.

You can withdraw money from the accounts at any time to pay for eligible healthcare expenses, and your withdrawals aren’t taxed either.

These accounts help you get a handle on healthcare expenses not covered by insurance.

You can use the accounts to cover qualified expenses including occasional medical costs like co-pays, lab fees and x-rays or everyday items like first aid supplies and contact lenses. Things like chiropractor and acupuncture visits are also covered, and so are home improvement costs to accommodate a disability. (Check out all the qualified expenses on the IRS website.)

HSAs are set up as part of a qualifying high-deductible healthcare plan.

That’s one of the key differences between HSAs and FSAs.

You enroll in these pre-tax accounts at the same time you select your health insurance — during your company’s open enrollment period.

When you choose a new health plan at work or confirm an existing plan during open enrollment, you can also enroll in one of these pre-tax healthcare accounts and decide how much to contribute.

Another option: you can set up an HSA independently of your employer through a bank, as long as you have a qualifying high deductible plan.

Deposits are usually automatic, and your employer might kick in even more.

With FSAs and employer-linked HSAs, pre-tax deductions are made automatically, right from your paycheck. What’s more, if you have an HSA, many employers will contribute additional funds to your account.

Use it or lose it? Not necessarily.

FSAs were introduced before HSAs. At the time there was some criticism, because if you didn’t spend all the money in your FSA account by year’s end, you’d lose it. That FSA spending deadline was a detractor for many people.

These days, FSAs have reduced the pressure to spend. Employers can now offer a grace period, giving you an extra 2.5 months at the end of the year to spend your FSA money or a "carry over" that lets you roll up to $610 of unused FSA money into the next plan year*. Of FSA users with a carry-over, 74 percent took advantage of that option in 2022, rolling over an average of $307 — well below the maximum allowable amount*.

With an HSA, you don’t have to worry about a spending deadline. If there’s any money left in an HSA at the end of the year, you’re allowed to roll over your HSA funds every 12 months.

FSA and HSA cards: the convenient, cash-free way to pay.

A Visa Healthcare Prepaid card makes it easy to access your FSA or HSA funds to pay for eligible expenses. Last year, 86 percent of FSA users surveyed and 66 percent of HSA users surveyed chose to use a healthcare card*. For even easier access, 36 percent of FSA cardholders and 20 percent of HSA cardholders linked their card to a digital wallet*.

Make the most of healthcare spending accounts.

Now that open enrollment season is here, make sure you sign up with your employer to tap into all the tax savings — and be sure you don’t leave any money on the table this year.

*Research cited in this post is from the 2023 Flexible Spending Account and Health Savings Account Consumer Research study commissioned by Visa and conducted by Material. Nationwide online research conducted in April 2023; FSA survey among 1,200 consumers and HSA survey among 1,032 consumers.