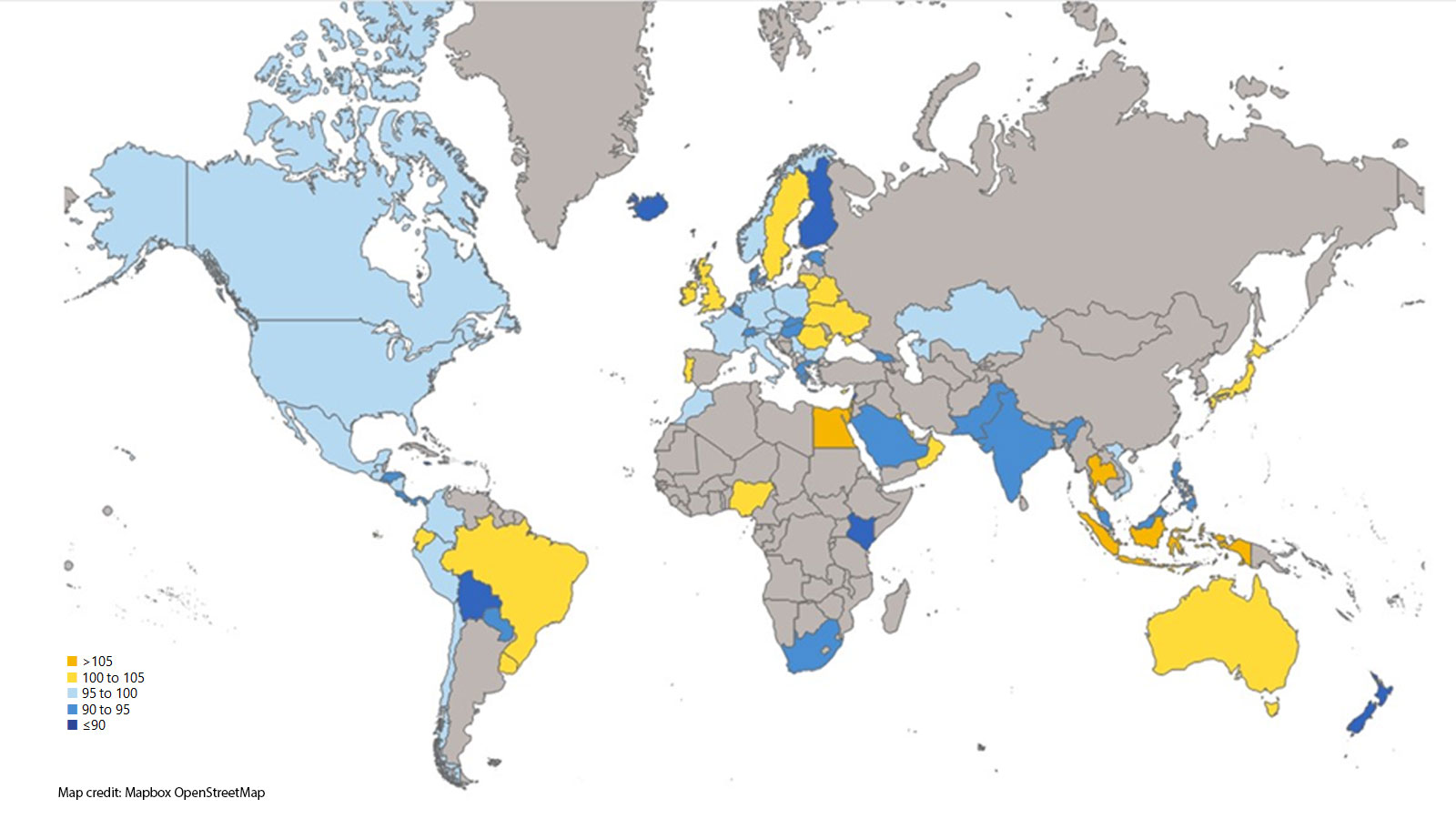

The Visa Spending Momentum Index (SMI)* is a leading economic indicator that provides a timely read on the health of consumer spending. The Index is based on a sample of current, depersonalized spending data from Visa-branded credit and debit credentials. The SMI is calibrated to be representative of all consumer spending regardless of form factor used for payment. When the SMI rises above 100, spending momentum is strengthening and when it falls below 100, spending momentum is weakening as fewer consumers are spending more, relative to the previous year. At 100, the SMI signifies that spending momentum is neutral and spending is growing at a pace consistent with its long-term trend.

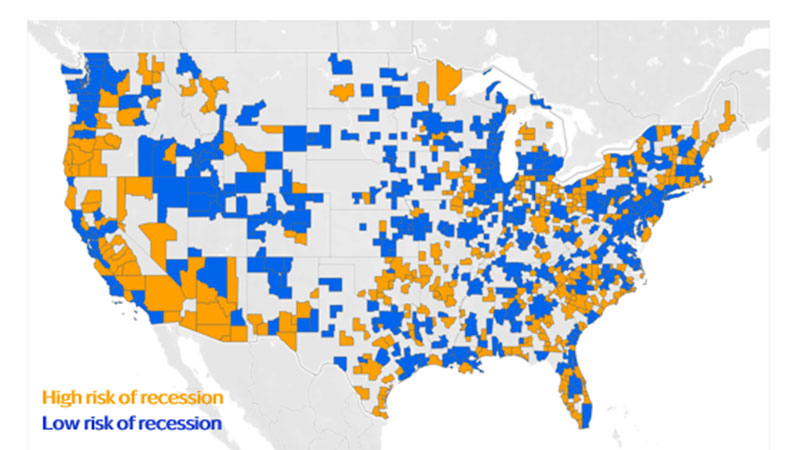

Existing metrics often track consumer spending only based on sales at physical retail outlets. Growth in both consumers' purchases of services and their use of digital commerce channels often gets lost. Visa's SMI leverages the power of the Visa network to fill this important gap. The index is based on current, depersonalized transaction data from a sample of Visa-branded credit and debit credentials, representing actual spending behavior by millions of consumers. For this reason, the SMI provides subscribing, eligible clients a timely, customizable view into consumer spending trends at the national, regional, and local spending level, and encompasses both online and offline purchases.