Security technology

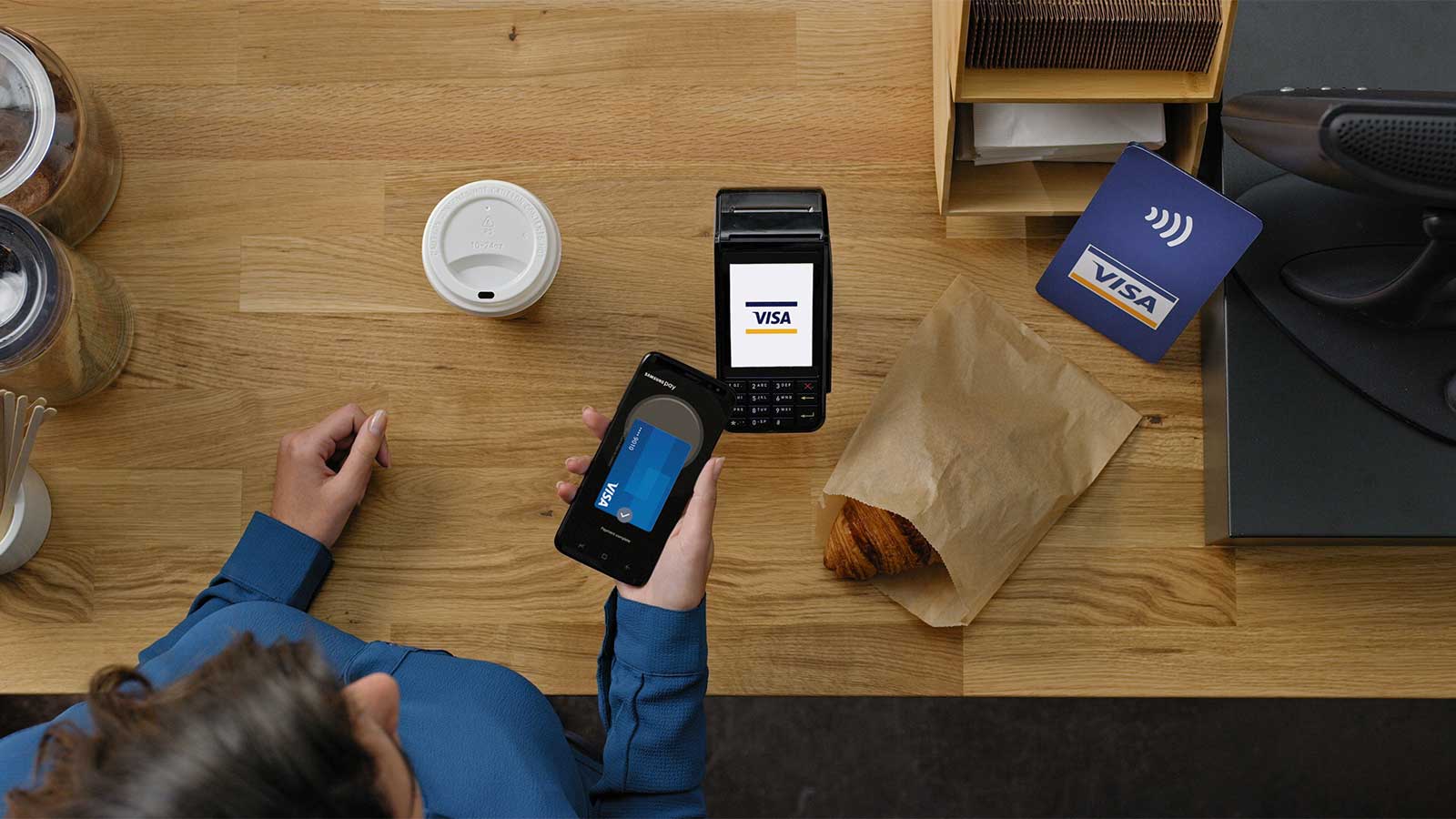

To meet the fast and continued growth of mobile transactions, Visa is introducing technologies that will significantly reduce payment fraud in the U.S. and around the world, helping to protect Visa partners from cyber security threat.