Featured content Digital currencies unlock a new era for payments and global finance

August 2024 – Money and finance are changing fast, thanks to new technologies, evolving customer needs, and the digitization of commerce. Central to these changes are digital currencies (see diagram below), which are breaking the old rules of finance and transforming how money moves around the world. Although they are still at an early stage of adoption, these new payment innovations could one day reshape the global financial system, bringing us a future that could be more inclusive, instantaneous and less bound by borders.

That day could come sooner than many expect. While the technologies underpinning digital currencies have been around for the better part of a decade, new paths have opened for their broader application as people increasingly sell and shop online. At the same time, governments' interest in promoting digital currencies has grown as geopolitical fragmentation brings new challenges to the existing global financial architecture.

The increasing adoption of digital currencies raises big-picture questions: Will blockchain technology democratize and decentralize finance, supplanting banks and governments alike? Or will these new technologies increase transaction speed and reduce costs within existing payment systems? Ultimately, the viability of digital currencies does not hinge solely on the sophistication of technology. Instead, the underlying economics and incentives are key, which this report examines alongside five possible non-mutually exclusive paths that digital currencies could take.

New ways to pay lead to calls for new forms of money

Commerce’s steady move online is changing the financial industry. More people are using online platforms and apps to shop and pay instead of cash or traditional banks. As a result, new kinds of payment providers are emerging, offering more choices and convenience and providing an opening for greater use of digital currencies. People buy and sell goods and services online much more frequently today than before the pandemic.

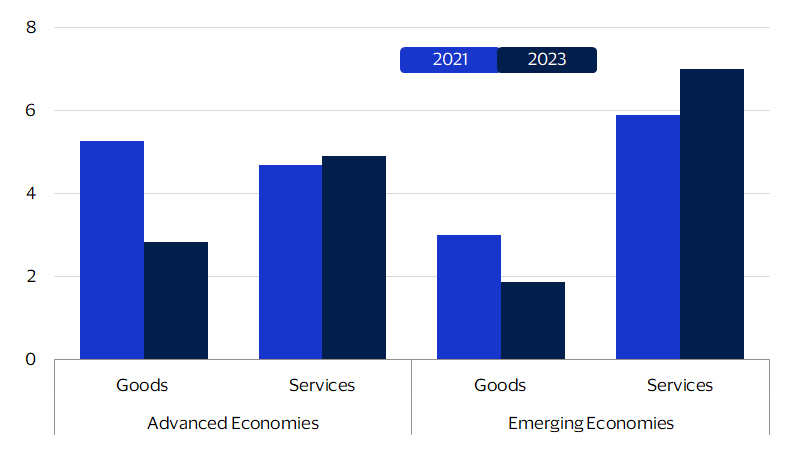

The adoption of digital channels to deliver services such as prepared meals, education and healthcare has not only been faster than goods but has also proven more enduring. Analysis of anonymized Visa transaction data across millions of merchants indicates that the share of e-commerce in total sales at service providers has increased by 4.9 percent in advanced economies and 7.0 percent in developing economies since 2019. Services’ shift to greater online sales matters because consumers tend to spend more on services than goods.

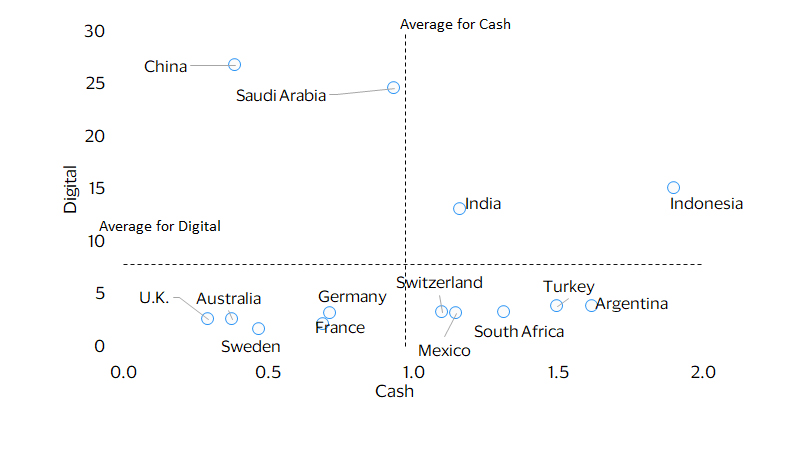

Similarly, money itself has become less physical. The average number of digital payments has risen sharply in recent years, from 70 per capita in 2012 to 198 per capita in 2022, according to data from the Bank for International Settlements. Over the same decade, the use of cash declined by an average of 2.8 percent. China and Saudi Arabia’s cash use fell below the average of their peers over this period, as emerging digital payments continued to gain traction among the Gen Z and millennial population.

Shift to e-commerce sustained, more so for service providers than retailers

Cash has declined as a means to pay

Five ways digital money could transform the payment architecture

Over a decade has passed since the first bitcoin was mined, unleashing distributed ledger technology such as blockchain. In 2024, the Bitcoin market cap is in the trillions. Although there have been fits and starts, digital currency use has now gained sufficient traction that we can identify five potential trajectories for the monetary and payment system.

Scenario 1: Cryptocurrencies could enable new modes of financial interaction

Cryptocurrencies, such as Bitcoin and Ethereum, are fundamentally assets that are recorded and represented digitally. If widely adopted, they could directly connect buyers with sellers, reducing the need for financial intermediaries such as commercial banks, clearing houses and centralized institutions. However, because they have no intrinsic value or issuer backing, cryptocurrency values are highly volatile, making them less reliable for everyday payments and savings.

Nonetheless, cryptocurrencies’ supporters believe that trust can be regained through strategic incentives to enable new modes of financial interaction, which would form the foundation of a parallel, decentralized financial system. This community governance model is enforced by consensus mechanisms, such as proof-of-work or proof-of-stake, to verify transactions and maintain the security of the underlying blockchain. Blockchain-based cryptocurrencies have two main types of participants: miners and users. Miners keep track of transactions, while users send and receive payments. Users need miners to update the ledger, and miners need users to pay for their service. In Bitcoin, under a proof-of-work mechanism, self-interested miners compete to solve math puzzles in order be picked to process users’ transactions. There is no legal entity or legal contract involved. Instead, there are only incentives that are linked to network tokens, and fully transparent, pre-programmed rules that are enforced by consensus mechanisms.

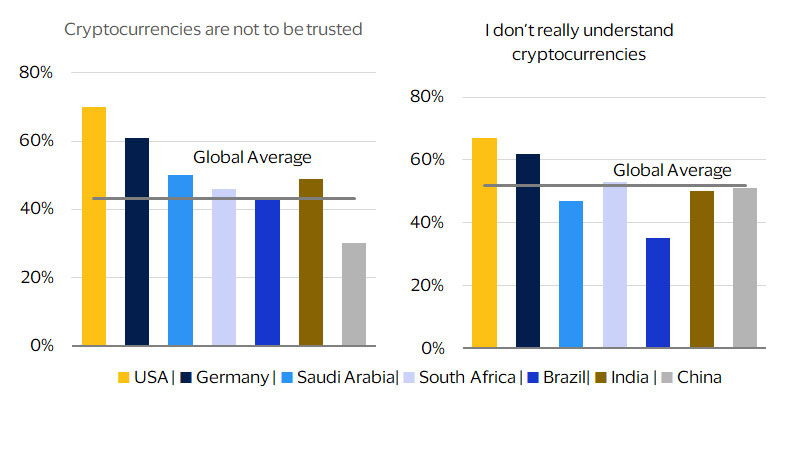

Trust in cryptocurrencies varies around the world, meaning that their wide adoption could splinter global finance. Advanced economies would likely retain the status quo, as their consumers have lower levels of trust in and understanding of cryptocurrencies (see chart below). In contrast, consumers in Asia Pacific, Latin America, the Middle East and Africa have a higher degree of trust in cryptocurrencies. Emerging markets in particular tend to have younger populations that are more attuned to digital technologies, as well as diminished institutional credibility and weak macroeconomic fundamentals in some cases. Trust in cryptocurrencies is also seemingly higher in economies with inefficient legacy payment infrastructure for facilitating remittances.

Consumers in advanced economies are less trusting of cryptocurrencies

Adult respondents who agree with the statement as a share of total

Scenario 2: Stablecoins could play a significant role in the payment value chain

Stablecoins are designed to hold a set value relative to a fiat currency or a basket of assets. They enjoy the benefits of blockchain technology, such as decentralization, security and transparency. At the same time, they avoid the drawbacks of cryptocurrencies, including wide swings in their valuation, lack of scalability and uncertain regulatory treatment. Stablecoins are now becoming popular outside of crypto circles for use in cross-border trade, wholesale settlement and consumer banking. The true extent of their popularity is clouded somewhat as, a Visa study revealed, most transactions are still initiated by bots rather than real users.¹

Unlike in the first scenario, central banks would retain their role of setting the value of money. However, the role of commercial banks under a stablecoin-based system is less clear. Fully backed stablecoins permit non-banks a greater role in financial intermediation. That said, banks are actively researching ways to leverage digital asset technology to remain relevant in retail payments and avoid being displaced from the payment value chain.

Scenario 3: Tokenized deposits maintain the relevance of commercial banks

Tokenized deposits would make commercial bank money programmable and usable in smart contracts and other blockchain applications, thus preserving banks’ function as financial intermediaries. Tokenized deposits and asset-backed stablecoins both represent liabilities of the issuer, which will be commercial banks for the former and private companies for the latter. However, tokenized deposits and asset-backed stablecoins differ in their role in and implications for the financial system.

Critically, by maintaining the current two-tiered monetary system with central bank and commercial bank money ensuring that a dollar deposited in one bank equals the exact amount of the same currency in another bank—or in the form of digital cash—tokenized deposits maintain the interchangeability of money, given that they are settled in central bank money. This sets tokenized deposits apart from options such as stablecoins, which could see departures in their relative exchange values away from par.

Further, tokenized deposits, which have the same economic and legal status as off-chain deposits, are likely to be subject to and enjoy the protection of existing deposit insurance schemes. Banks would likely also be able to borrow from the central banks as lenders of last resort when necessary.

Scenario 4: CBDCs preserve the public payment system’s relevance

Central banks are exploring CBDCs to ensure money and payments remain fit for our increasingly digital economies. Wholesale CBDCs are very promising, particularly in cross-border payments, which suffer from high costs and frictions. By utilizing decentralized ledgers or blockchain, wholesale CBDCs can bypass the need for a global central counterparty, enhancing the interbank system’s ability to facilitate cross-border transactions.

In comparison, there does not seem to be a compelling case for retail CBDCs yet, given well-functioning electronic payment systems, particularly in advanced economies. Nonetheless, these economies are exploring design requirements and consulting stakeholders in case they need to launch a retail CBDC in the future. The global experimentation with retail CBDCs, led by China, likely pressures other central banks to consider issuing their own to avoid economic disadvantages and currency substitution risks.

CBDC work among central banks has accelerated. As of May 2024, 134 economies representing 98 percent of global gross domestic product (GDP) are exploring a CBDC, up from only 35 in May 2020, according to the Atlantic Council. Currently, around half are in the advanced phase of exploration (i.e., development, pilot, or launch). Based on the number of central banks indicating that they would be very likely to issue a CBDC over the next few years, as many as an additional six retail and nine wholesale CBDCs could be in circulation toward the end of this decade.³ Even as developed countries tread cautiously on retail CBDCs, China and India’s central banks expanded the use of CBDCs as part of their respective ongoing pilot.

Retail CBDCs could pose risks to credit creation.⁴ Retail CBDCs that do not pay interest like cash should not affect most deposits that earn positive interest rates. However, if CBDCs pay interest, it could elicit a flow of funds from deposits to CBDCs. In this scenario, when people switch from bank deposits to CBDCs, banks’ funding positions worsen.

In most economies, retail deposits are a main source of cheap and stable funding for local banks. When customers swap their deposits for CBDCs, banks lose their retail deposits as well as central bank reserves. This makes banks’ funding less stable and liquid, which increases their funding risks.

To restore their funding stability after losing retail deposits to CBDC, a bank could either lend less to the economy or pay more for funding. For example, a bank could offer higher interest rates to keep its retail deposits or seek other sources of stable funding, which are usually more expensive than retail deposits, resulting in higher funding costs for the bank. Consequently, banks might increase lending rates to stay profitable, which could result in fewer loans overall.

However, these risks are manageable. Even if bank lending declined slightly, overall credit creation in the economy would remain intact. The ratio of customer deposits to total non-interbank loans has increased since 2019 (see figure below), suggesting depositor and investor confidence in the banking system as well as limited potential liquidity stress—even during the peak of the pandemic. Meanwhile, growth of non-bank financing, whether by capital markets or new tech players, can help mitigate any decrease in bank lending and keep the broader credit creation intact during non-crisis periods.

Banks’ funding positions have remained resilient

Change in ratio of customer deposits to total non-interbank loans since 2019, percentage points*

Scenario 5: An evolving status quo

Another potential path forward could entail fiat currencies and policy-led modifications to the payment infrastructure. Many countries have recently launched fast payments as a means to a cashless economy, such as Pix in Brazil and Unified Payment Interface (UPI) in India.

Fast payments are retail payments, usually in small transaction amounts, that the payee gets right away or almost right away on any day and at any time. Most fast payments happen within a country, but interlinking arrangements involving faster payment systems in different countries can support cross-border payments.

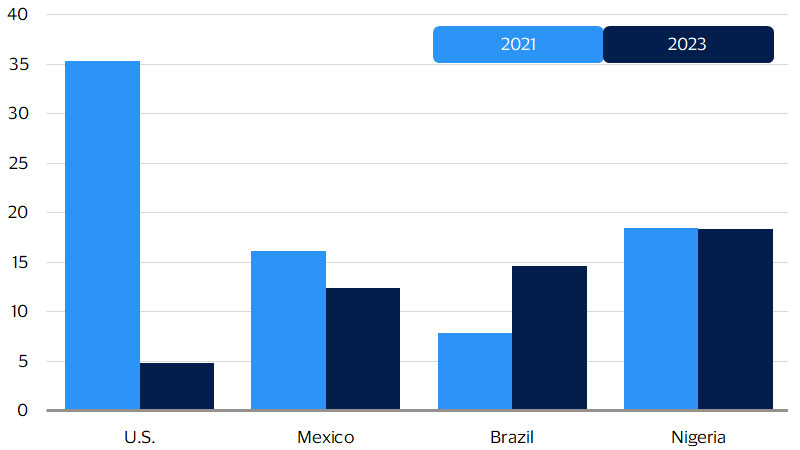

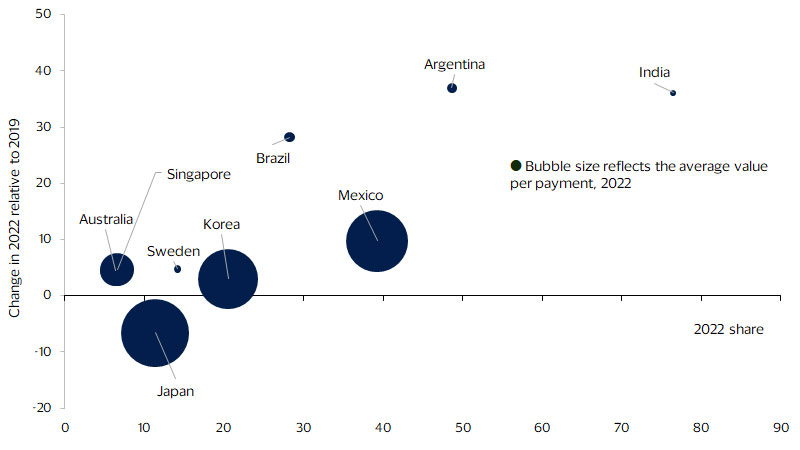

India (76 percent), Argentina (49 percent), Mexico (39 percent) and Brazil (28 percent) have among the highest shares of fast payments by number of transactions (see chart below). Transaction value is higher in countries where fast payments are used for government payments and transactions between businesses, as compared to primarily person-to-person/business payments in other countries that might also have transaction limits.

For instance, the average transaction value of fast payments in Sweden is around 0.1 percent of GDP per capita, indicating they are used mainly for person-to-person payments. At the other end of the scale, the average transaction value of fast payments in South Korea and Japan is around 10 percent of their respective GDP per capita, suggesting that they are used mainly for payments involving businesses, which are often higher in value.

Countries are increasingly turning to fast payments as an alternative to cash and card payments

Fast payments volume as a percentage of total cashless payments

Digital currencies can coexist constructively

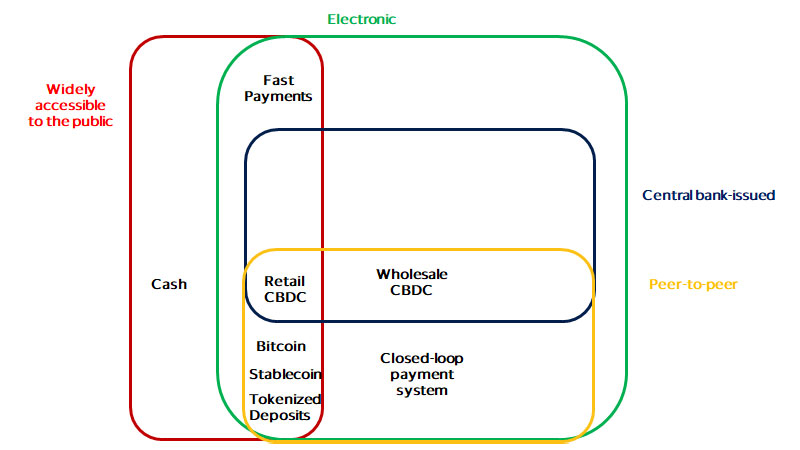

The potential scenarios for the future of money are illustrated in the diagram below, which highlights four key properties of money: the issuer (e.g., central bank), the form (electronic or physical), the extent of accessibility and the transfer mechanism (e.g., peer-to-peer transaction), based on the framework by Bech and Garratt (2017).⁶

In the diagram, the probability of each digital currency scenario is depicted by the area of intersection. In this regard, wholesale CBDC, tokenized deposits, stablecoin, Bitcoin and fast payments can coexist constructively in the short term and have higher odds of materializing compared to retail CBDC.

Already, the BIS and major Southeast Asian central banks have recently finished the detailed plan of seamlessly connecting their domestic fast payment systems to enhance cross-border payments. They will eventually be joined by the Reserve Bank of India, expanding the potential user base to India’s UPI, the world’s largest fast payment system.

Meanwhile, in one of the more likely scenarios, wholesale CBDCs could serve as the foundation of the financial system alongside tokenized deposits, which would allow banks to continue their financial intermediation function. Wholesale CBDCs do not face the same challenges as Bitcoin, for example. Despite being in existence since 2009, Bitcoin has struggled to build trust amid cyberattacks, loss of customers’ money and inherent governance weakness.

Potential paths for the future of money

Over the long term, digital currencies could form an interoperable network of financial ecosystems

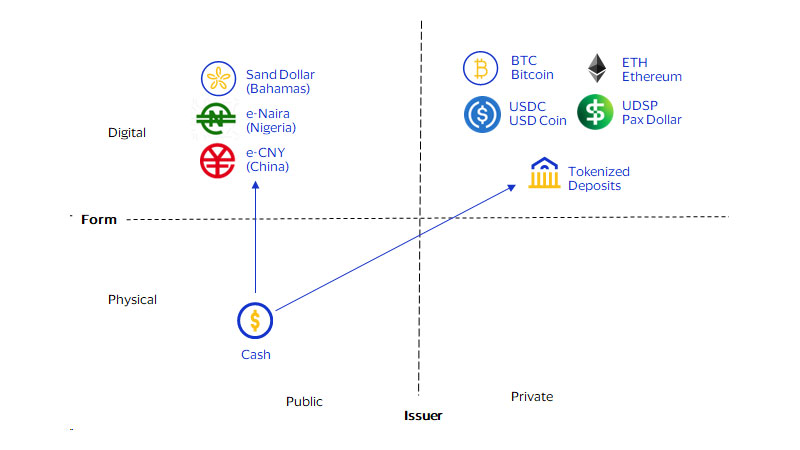

As the forms of money evolve (see figure below), a unified ledger that allows for interoperability between wholesale CBDCs, tokenized deposits and tokenized assets is the most likely path forward. Already, governments and large institutions are progressing from assessing the benefits of tokenization to trials and proofs of concept. For instance, in March 2024, the Hong Kong Monetary Authority (HKMA) launched Project Ensemble for a new wholesale CBDC initiative, which enables interbank settlement for tokenized commercial bank money (tokenized deposits). Further, HKMA has planned a sandbox to facilitate interoperability between the wholesale CBDC, tokenized deposits and tokenized assets.

Notably, these transformations are happening at the same time the fragmentation of the global economic order fosters demand for new alternatives to serve a more multi-polar world. Already, alternatives to SWIFT, the primary clearing house for cross-border payments since the latter half of the 20th century, have emerged. The coexistence of public and private sector digital currencies gives the finance industry an opportunity to build a brand-new monetary architecture—one that both supports the next wave of payment innovation as well as increases the diversity of firms innovating on retail payments and related services.

Regardless of which of the five potential trajectories money may take, digital currency has the potential to transform our financial infrastructure into one that is virtually seamless—allowing businesses and consumers to send any financial asset of any size from any device to anyone else in the world at any time. Further, increased interoperability will enable businesses to significantly expand the range of innovative financial services that are accessible and affordable to consumers.

Taxonomy of money

Footnotes

- Visa: Making sense of stablecoins, April 26, 2024

- Circle Announces USDC Smart Contract for Transfers by BlackRock’s BUIDL Fund Investors, April 11, 2024

- Bank for International Settlements (BIS) (2024), “Embracing diversity, advancing together – results of the 2023 BIS survey on central bank digital currencies and crypto,” June.

- Bank for International Settlements (BIS) (2018), “Central Banks Digital Currency,” Committee on Payments and Market Infrastructures, March.

- Bank for International Settlements (BIS) (2024), “Embracing diversity, advancing together – results of the 2023 BIS survey on central bank digital currencies and crypto,” June.

- Bech, M. and Garratt, R. (2017), “Central bank cryptocurrencies,” BIS Quarterly Review, September.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.