Five factors to watch in 2024

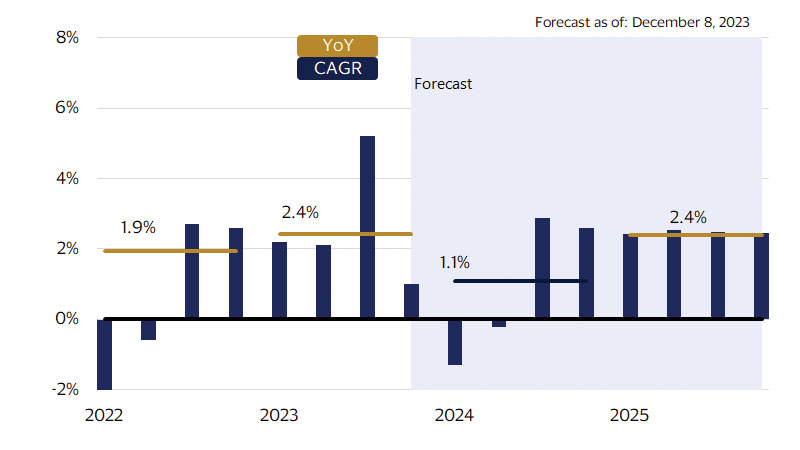

December 2023 – As we prepare to look ahead at what is in store for the economy in 2024, we begin by recognizing that this year has been one of positive surprises. Consumer spending has held up despite high inflation at the start of the year and softer consumer confidence in more recent months. Fueled by positive real (inflation-adjusted) after-tax income growth, consumer spending helped to lift gross domestic product (GDP) growth this year to an estimated 2.4 percent on a year-over-year (YoY) basis (see chart below). Fiscal factors were also a lift to economic growth over the last year, with the after-effects of both the Inflation Reduction Act and the CHIPS Act providing support for both state and local government investment and leading to strong commercial real estate investment in the first half of the year (see fig. 2 in full report).

In 2024, however, instead of positive surprises, we think it will be a year that simply meets expectations. For starters, most of the investment spurred by fiscal policy has likely run its course and is expected to provide less lift to GDP growth in the year ahead. The trend of positive real after-tax income growth reversed course back in June and has been flat or negative in four of the last five months through October, which will likely keep consumer spending growth more subdued at the start of 2024. Both businesses and consumers will continue to deal with the after-effects of higher interest rates, which are expected to weigh on both segments of the economy.

We see five key factors that will likely influence the contours of GDP growth in 2024:

- Inflation finally returns to 2 percent

- The normalization of interest rates is set to begin

- Business investment is likely to be among the weakest links

- Affluent consumers will increasingly gain influence

- Politics are set to become more political

The year will likely be bifurcated into two distinct growth regimes, in our view, with GDP growth contracting in the first half but bouncing back quickly in the second half of the year. The first two quarters of the year are likely to be the weakest, with a sizable chance that GDP growth will be slow enough and the contraction broad-based enough to meet the definition of a recession (although this is a very close call given the mild nature of the downturn).

Real GDP growth forecast (SA,* CAGR and YoY percent change)

* Seasonally adjusted

The second half of the year will be brighter in our view as inflation continues to slow, allowing the Federal Reserve to begin normalizing interest rates. These dynamics should free up credit and allow for more lending activity, in turn, helping to boost demand. Even after accounting for some interest rate cuts from the Fed, the elevated rate environment will likely still weigh on business investment next year, making it among the weakest links in GDP growth. The pullback in consumer spending on the heels of the reduced hours worked and a continued contraction in real disposable income growth will likely result in most of the consumer spending coming from the affluent segment next year.

Finally, next year is an election year. While we see little evidence that the run-up to the election will have a material influence on GDP growth, the continued fiscal fights in Congress over funding government agencies provide some downside risk to growth from government spending. Our forecast represents our best take on how current economic trends are shaping growth heading into 2024, but we fully admit that we could once again be surprised by the resilience of the economy.

As we sit on the cusp of a new year, we want to thank our valued clients, partners, and regular readers for allowing us into your inbox. We wish all of you the best in the year ahead.

Inflation finally returns to 2 percent

One of the defining features of the economy over the past three years has been stubbornly high inflation. YoY growth in the personal consumption expenditure (PCE) deflator—the Fed’s preferred measure of inflation—has remained above the Fed’s target of 2 percent since March of 2021.¹ In response, the Federal Reserve aggressively hiked interest rates to the highest level in over two decades in an attempt to bring inflation back down.² While the inflation rate has come down significantly from its peak of 7.1 percent in June 2022, it remains stubbornly above 3 percent. Despite persistently high inflation, current trends along with forward-looking indicators of inflation signal that the Fed’s 2 percent target will likely be reached by fall of next year.

An important early indicator of softening inflation is the outright deflationary trend for durable goods. Over the past four months, prices for durable goods have declined on both a month-over-month (MoM) and YoY basis.³ The sustained decline in durable goods prices is likely to continue into 2024, which should help bring down both the core (inflation excluding food and energy) and headline PCE deflators. Another important indication that inflation will soften in the near future is the trend of slower growth in retail profit margins. Changes in retail profit margins tend to foretell changes in core inflation two months later (see fig. 3 in full report). Part of the reason inflation remains so high is that prices for many categories, including childcare, rent and household care services, are more determined by consumer demand than industry specific factors.⁴ According to analysis from the Federal Reserve Bank of San Francisco, 65 percent of the rise in core inflation is attributable to consumer demand.⁵ With demand set to soften with the onset of a mild downturn next year, we suspect that there will be far less price pressure in these categories.

While disrupted supply chains played a significant role in driving inflation higher in 2021 and part of 2022, stronger than anticipated demand has been the culprit for persistently high inflation through most of 2022 and all of 2023. Thus far, high interest rates have done little to curtail consumer spending growth, but we expect that this will change in early 2024. We expect that the softening of consumer demand will bring core PCE down quicker than headline PCE after Q1-2024. Our forecasts indicate that by Q4-2024 (see fig. 4 in full report), both headline and core inflation should fall to an average of 1.8 percent YoY growth.

The normalization of interest rates is set to begin in 2024

The story of interest rates over the course of 2023 has been one of greater interest rate volatility, an inverted yield curve (where short-term rates rise above long-term rates) and higher absolute levels of interest rates. This year’s higher rate environment has been a function of continued uncertainty about the economic growth and thus the inflation outlook. Yet another layer of complexity driving interest rate volatility has been the uncertainty around how much higher the Fed would need to hike rates to bring inflation back down towards its target range. The result of the cumulative rate hikes from the Fed and higher long-term rates has been a rapid increase in interest costs (see fig. 5 in full report). We think the greater interest expenses on the part of businesses and consumers will be enough of a headwind to tip the economy into a mild downturn beginning in the first quarter of next year.

That said, we think the storyline behind interest rates changes later in 2024. For starters, the mild downturn we are forecasting to start the year will likely help to further put downward pressure on inflation as demand slows. The Fed, for its part, will begin to shift the focus to when they should begin to “normalize” interest rates. In our view, the first federal funds rate cut from the Fed is likely to take place at the June meeting. Given the persistence of inflation, we think the Fed moves cautiously to normalize rates and thus we expect only 25 basis point cuts at each subsequent meeting. Such a trajectory would put the federal funds rate at 4.25 percent by the end of 2024.

Business investment is likely to be among the weakest links next year

Despite high interest rates, several important factors have driven business investment growth since 2022, including robust investment in aircraft thanks to the swift travel rebound, in manufacturing infrastructure as a result of the CHIPS act, and other investments due to incentives in the Inflation Reduction Act. However, equipment investment contracted in the third quarter of this year for the first time in two years. We expect this trend to continue through the first half of 2024 due to the expected persistence of downward pressure on corporate profits, the inability of many small businesses to obtain financing, and the expected absence of extra fiscal support from the federal government.

Strong growth in after-tax corporate profits following the end of COVID lockdowns led to larger than usual cash balances at corporations. Additionally, many were able to lock in lower interest rates prior to 2022, which along with the strong influx of cash kept business investment growing despite rising interest rates. However, after-tax corporate profits have declined on a YoY basis in Q2 and Q3 of 2023, and our forecasts indicate that declining corporate profits will likely continue through the first quarter of 2024, putting pressure on firms to cut back on investments (see fig. 7 in full report).

The contraction of corporate profits won’t be the only trend to add pressure on business investment, as high borrowing costs have already hampered large companies’ ability to invest and will likely continue to do so. Borrowing costs have already had a significant impact on corporate spending as 41.7 percent of CFOs surveyed indicated that they have already pulled back on capital spending because of high interest rates.⁶ With rates expected to remain elevated through the first half of 2024, many corporations will cut back on investment until borrowing costs become more favorable. We expect that these factors will lead to cost cutting measures that will ultimately lead large companies to put off or cancel equipment purchases, R&D investments, and construction of new facilities.

Large companies will not be the only ones pulling back on investments in 2024. High borrowing costs will continue to be a major hurdle for small businesses to overcome, and likely cause them to pull back on investment. Additionally, even small businesses that are not dissuaded by higher borrowing costs are contending with tighter lending standards from banks (see fig. 8 in full report). This is likely to continue, with the tough borrowing environment already beginning to take a toll on small businesses. For example, the non-sentiment related measures within the Small Business Optimism Index have declined recently, including plans for capital expenditures, increased inventory, and job creation. We expect these measures to further deteriorate in the first half of 2024, and thus cause a further pullback on business fixed investment.

Affluent consumers will increasingly gain influence

Following three rounds of stimulus, near-zero interest rates through mid-2022, excess savings built up during the pandemic, surging wages (especially among those on the lower end of the income spectrum⁷), a stock market boom, and home values that rose rapidly, consumers have been in a strong position to spend for the past two years.

However, now that much of the excess savings have been spent or used to pay down debt and wealth effects from housing and stock market booms have greatly subsided, consumer spending growth has been driven mainly by strong growth in real (inflation-adjusted) disposable income. YoY real disposable income growth has eroded recently, and our forecasts indicate that real disposable income will contract on a YoY basis through the first three quarters of 2024. This contraction will likely lead to a more pronounced decline in spending among lower- and middle-income consumers, as they do not have large sums of excess savings to fall back on. Of the excess savings left, 96 percent of it belongs to the top 20 percent of income earners (see fig. 9 in full report).

Additionally, we expect interest rates to remain above 4 percent through 2024, which will be a major disincentive for borrowing among lower- and middle-income consumers. Given the uneven distribution of excess savings, the expected decline in real disposable income, and elevated interest rates, the affluent consumer will likely play an outsized role in spending next year. Through the first three quarters of 2023, the contribution to spending growth was already dominated by the affluent (see fig. 10 in full report). We expect that this trend will continue into 2024. The affluent consumer’s outsized impact on YoY spending growth is due in large part to significant increases in travel-related categories such as airlines (up 28 percent), passenger railways (up 54 percent), cruise lines (up 70 percent), and taxi/limo and rideshare services (up 38 percent), according to Visa credit volumes.⁸ Additionally, the increase in YoY credit spending in many leisure categories such as movie theaters (up 44 percent), orchestral performances (up 42 percent), professional sports (up 38 percent), private membership clubs (up 27 percent) and amusement parks (up 24 percent) has been strong among the affluent.⁹ Travel and leisure spending categories are likely to avoid large drop-offs in spending, as affluent consumers appear to value travel and leisure and have the excess savings to continue to take vacations and spend more on leisure activities.

While we expect the affluent to account for a significant portion of spending next year, there are potential downside risks to that outlook. A wider conflict in the Middle East could result in an equity market sell-off, which would likely result in a decline in consumer spending among the affluent, as a significant reduction in their wealth could lead them to spend more cautiously. In this case, we could see a more pronounced decline in overall consumer spending, which could lead to a deeper economic downturn.

Politics are set to become more political in 2024

In addition to all the economic factors influencing economic growth in the year ahead, there is an added layer of the 2024 presidential election. While there is little evidence to suggest that election years have any real economic impact, there could certainly be a psychological impact.¹⁰

We will be watching consumer confidence closely over the next year, as we suspect that the election cycle will be heating up going into next fall right when we expect economic growth to reaccelerate (see fig. 11 in full report). Besides the presidency, there are 34 seats up for re-election in the Senate and all 435 members of the House running for election in 2024. While it is very early, initial consensus ratings show that there are three toss-up seats in the Senate, with Republicans needing to net one or two seats depending on the outcome of the presidential race (the VP serves as the President of the Senate and can cast a tie-breaking vote) to take back control of the Senate.¹¹ While there are technically more Democrats up for re-election in the 2024 cycle than Republicans (23 Democrat seats vs. 11 Republican seats), there is still a path for Democrats to maintain control of the Senate. Out of 100 senators, there are now just 5 who hail from a different party than the party that won their state in the 2020 presidential cycle.¹² Thus, the Senate is likely to go the way of the presidential race. In the House, the current consensus is that there are 25 toss-up seats. With a fairly evenly-split 203 safe or leaning Democrat seats and 207 safe or leaning Republican seats, the House is truly a toss-up.¹³ Putting the pieces together, the presidency and both chambers of Congress appear to be pure toss-ups this cycle, which will likely translate into greater economic policy uncertainty as the year progresses.

Election uncertainty aside, fiscal policy will likely be on autopilot through most of next year. Currently, there are two impending funding deadlines: January 19th (for four appropriations bills) and February 2nd (for the remaining eight appropriations bills). Both deadlines were established through a continuing resolution (CR) that extended last fiscal year’s funding levels, which relied heavily on Democrats crossing the aisle to support the Republican leadership’s bill.

With some Republican members calling for cuts to spending and the need for the House to put forth funding bills that can garner enough support to pass the Democratically controlled Senate, the funding deadlines early next year pose a real threat of at least a partial federal government shutdown. If a longer-term funding bill cannot clear the Congress before early next year, a little talked about provision from last May’s deal to lift the debt ceiling would likely be triggered. Under the provision, there would be an automatic 1 percent across the board spending cut if the FY24 appropriation bills have not been passed by January 1st. The actual cuts would not begin taking place until April, but such a threat may motivate a bipartisan agreement. The risk, however, is that funding reductions, depending on the agencies impacted, would likely dampen the effects of federal spending and investment on GDP growth next year. We see only modest 0.2 percentage point contributions to YoY GDP growth next year, as we expect federal spending will be more or less unchanged from the levels of the last few quarters (see fig. 12 in full report). We suspect that the bulk of the expected fiscal policy changes will likely be a 2025, rather than 2024, story.

Footnotes

- U.S. Department of Commerce

- The Federal Reserve Board

- U.S. Department of Commerce

- Mahedy, Tim, and Adam Shapiro. 2017. “What’s Down with Inflation?” FRBSF Economic Letter 2017-35 (November 27).

- Federal Reserve Bank of San Francisco

- Duke University, Federal Reserve Bank of Richmond, and Federal Reserve Bank of Atlanta

- Federal Reserve Bank of Atlanta Wage Tracker

- VisaNet and TransUnion

- VisaNet and TransUnion

- Brown, M.A. and Pugliese, M. (Oct. 2016). Does economic activity slow in election years? Business Economics, Vol. 51, Issue 4.

- 270 to Win, 2024 Senate Election Interactive Map

- UVA Center for Politics. January 23, 2023. “Initial Senate Ratings: Democrats Have a Lot of Defending to Do.”

- 270 to Win, 2024 House Election Interactive Map

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.