Olympic and Paralympic Games Paris 2024: And the first gold medal goes to…

On top of the podium for ticket sales

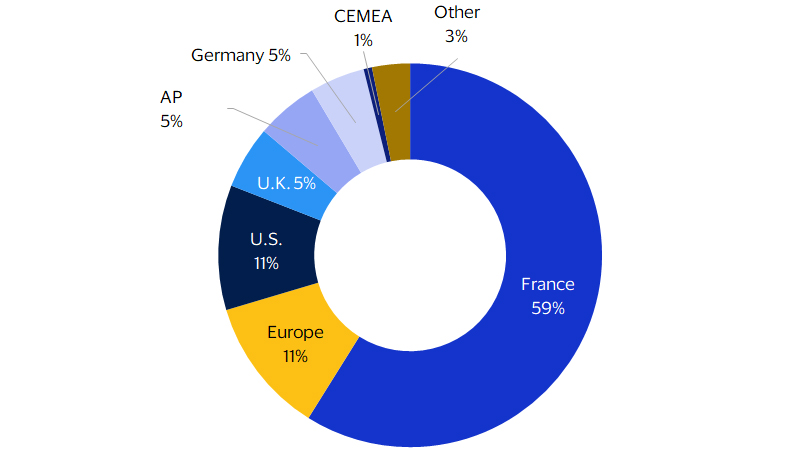

Not surprisingly, it is the host country, France, that accounts for the lion’s share of ticket purchases—at least 59 percent of the total Visa transactions. The silver medal in this race goes to the United States, where Olympic and Paralympic travelers, undeterred by the prospect of an intercontinental flight, were responsible for about 11 percent of total Visa ticket transactions. And the United Kingdom comes in third, at 5 percent, stealing the bronze at the photo finish from Germany and the Asia Pacific region, with a similar share of sales with Visa.

Cumulatively, Paris 2024 ticket sales reached nearly 1 million Visa transactions, including robust sales well into the final weeks before the official opening of the Olympic Games.

Ticket purchases with Visa by country/region of card issuance

The Olympic and Paralympic effect: Paris and beyond

Consumers are ready to do their part

Maybe it is no surprise that most tickets are sold to French cardholders—let’s call it the home court advantage. Yet it's interesting to note that Americans are coming to Paris as the top spenders. This is a race the U.S. visitor dominates, with spend on tickets almost twice as large as their European counterparts. For each $100 spent on Visa cards by U.S. travellers, visitors from CEMEA spend $69 and French cardholders spend $42.

While it is too early to fully project the “halo effect” that arrivals in Paris will have on the rest of the country, visitors from over the Atlantic are not expected to limit themselves to the French capital, taking full advantage of what France offers beyond Paris.

Indexed spend by country/region of card issuance

We’ll always have Paris

In the months leading up to the Games, there were questions on what uplift the Games could provide to a city that is already among the most coveted global destinations. The answer leaves little room to doubt: a lot. Arrivals by air to the French capital’s airports were expected to rise by 40 percent in the first week of the Olympic Games, compared to the same week in 2023, according to Visa Business and Economic Insights’s analysis of VisaNet, third-party airline merchant transaction data and TU data (January 1, 2020 to July 10, 2024). Interestingly, the increase in arrivals during the actual Olympic Games (+28 percent over the same period one year ago) was on par with the increase expected in the weeks before the Games (+25 percent). And it is in the pre-Games period that the surge in U.S. visitors was most intense (+88 percent). European travellers, helped by the convenience of a shorter distance to the destination, likely waited for the actual Games to begin before initiating their journeys (a pattern apparent for Irish, German, and British event-goers). Of course, for Europeans, one facilitating factor was the ease of travel thanks to the Schengen freedom-of-movement area, with no border controls between the 29 participating countries.

A celebration for the young (and the young at heart)

A deep dive into the demographics of U.S. visitors, the largest non-European contingent of tourists, points to a strong interest in the Games by a younger cohort, visitors aged 18-35 (Figure 3). For this group, flight bookings to France increased by about 140 percent compared to 2023. But all demographic groups showed a desire not to miss the event: bookings were up by about 75 percent for those aged 36-45, 46-65 and by about 50 percent for those over 65.

In the immortal words of Pierre de Coubertin, the founder of the modern Olympic Games, "The most important thing in the Olympic Games is not winning but taking part.” Travel transaction data show that this holds true not just for the athletes but also for the world travellers heading to Paris as spectators. As the Games proceed, may the best team win.

U.S. visitor demographics

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.