GenAI revolution: Understanding ChatGPT’s early adopters

February 2024 – In the latter part of 2022, generative artificial intelligence (genAI) captivated global audiences with its ability to interact seamlessly with users. A recent Visa Business and Economic Insights (VBEI) consumer survey found that almost 17 percent of Americans report having already used the first open-access chatbot to go viral, ChatGPT.

Examining ChatGPT user preferences and behaviors yields insights into areas such as user demographics and common traits, the types of tasks consumers perform with AI, and how consumers might expect the businesses they shop with to leverage AI tools, among others.

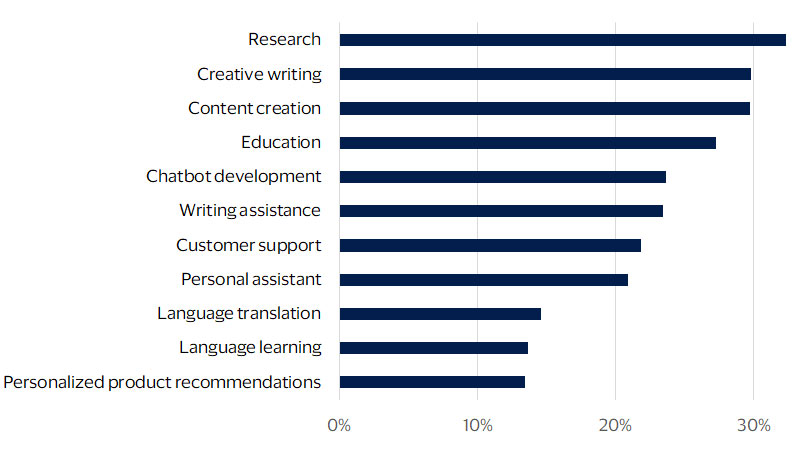

ChatGPT use cases

What do you use genAI for? (Check all that apply)

Decoding ChatGPT’s multifaceted utility

A substantial portion of users seek information from ChatGPT, with 32 percent using it to gain knowledge and another 30 percent employing it for creative writing. This inclination towards personalized, 'intelligent' interactions suggests that users value it highly despite a more complex engagement process relative to internet search engines.

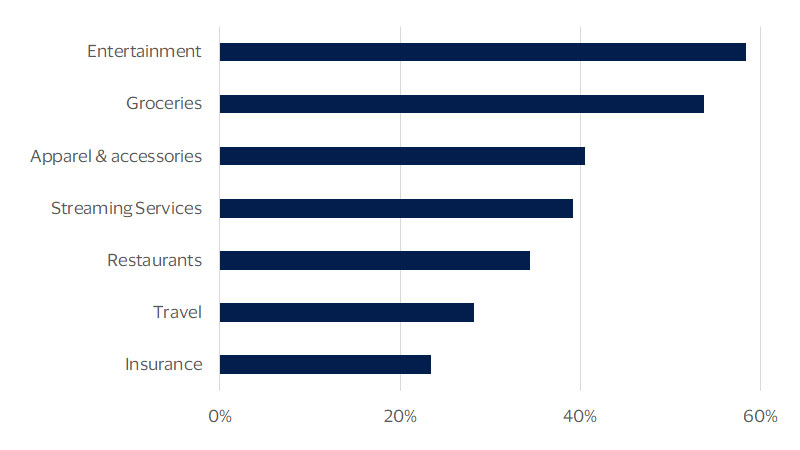

Entertainment emerges as a formidable contender in the AI-driven ecosystem, capturing the interest of 58 percent of users, followed closely by consumables such as groceries (54 percent) and apparel (41 percent).

ChatGPT personalized product recommendations

In which categories have you used AI for personalized product recommendations? (Check all that apply)

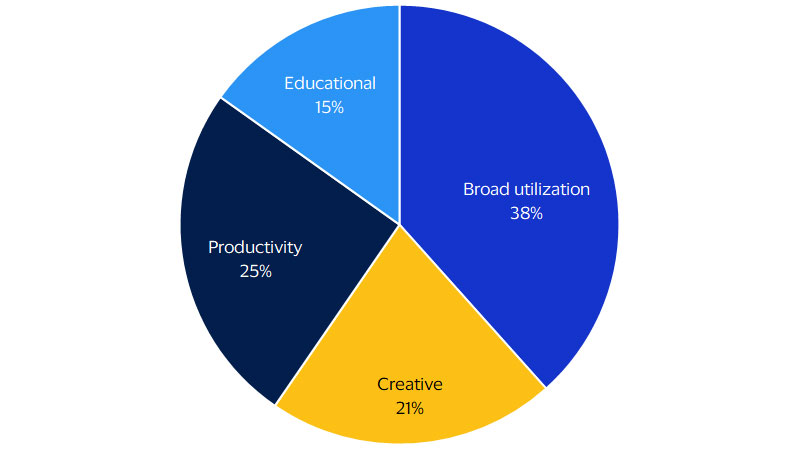

Delineating user segments: The tapestry of engagement

Through our proprietary research and third-party data, we uncovered a complex landscape of early adopters all looking to AI to satisfy their diverse use cases. Grouping users according to their needs can help frame the conversation. We segmented users into four distinctive categories1, 2 based on their engagement patterns:

- Broad utilization users: These are the most engaged generative AI users. They employ ChatGPT for a variety of tasks and see a place for AI in their daily lives

- Creative aficionados: Often younger in demographics, these users may be at the forefront of using ChatGPT to harness generative AI’s capabilities of creative expression.

- Productivity enthusiasts: This segment is drawn to AI’s promise of efficiency, seeking tools to help them be more productive when doing tedious tasks.

- Educational and linguistic scholars: This group comprises users from diverse demographic backgrounds and academic pursuits, united by their quest for knowledge and education.

Four key ChatGPT user segments

User vs. non-user consumer preferences

While all ChatGPT user segments indicate similar preference rates across industries when it comes to communicating with an AI chatbot vs. a live person, entertainment and travel stand out, with over half of all creative and education users preferring an AI tool to a live person.*

Across segments, users are more inclined to practice confrontational consumerism and/or engage in consumer activism by changing their purchase behaviors or championing ethical, environmental and social causes, for example.

Compared to non-users, AI users tend to be much more digitally savvy and adept at using in-store contactless/mobile/digital wallet payment options, biometric payment methods, and are more likely to own an electric vehicle.*

Implications for your business

These user segments are not demographically monolithic²—the needs that define them apply across gender and age groups. Understanding these segments can help businesses and marketers tailor their AI products and services to meet the needs and expectations of their target customers and increase their adoption and satisfaction rates.

Financial institutions:

- Increasing emphasis on personalized engagement: Growing consumer affinity for AI is recalibrating the way financial services companies interact with their customers. Organizations may use AI to provide valuable, data-driven insights on a consumer’s financial history, spending habits, and future goals. Such tools could help guide smarter investment strategies and savings plans that are customized by the individual based on their risk tolerance and financial objectives

- Enhancing security with digital payments: AI underscores the need for a diversified digital payment environment that encompasses contactless and mobile modalities. For everyday banking, customers use contactless cards issued by banks. AI algorithms monitor these transactions to detect any unusual patterns or potentially fraudulent activity, ensuring the security of customer funds.

- Elevating financial acumen: AI’s educational features present an opportunity for institutions to bolster financial literacy. AI can help customers improve their financial habits by providing insights into their spending patterns and offering tailored advice to help them reach their financial goals

- Championing responsible investing: The tilt towards responsible investing calls for robust ESG-centric investment avenues. AI can provide personalized investment advice to customers based on their individual ESG preferences. For example, it could recommend a green energy fund to a customer who is particularly concerned about climate change, or a fund focused on companies with strong gender diversity for a customer who prioritizes social equality.

Merchants:

- Infusing AI into customer experiences: AI promises to redefine customer service paradigms, accentuating personalized recommendations. For example, if a customer frequently purchases mystery novels, the AI might recommend newly released books in that genre. Or if a customer has been browsing winter coats but hasn't made a purchase, the AI could suggest popular or highly-rated coats.

- Keeping up with digital payment trends: A dynamic digital payment infrastructure that includes contactless and mobile options remains paramount. Based on a customer's purchase history and payment preferences, AI can suggest relevant products and offer discounts or loyalty rewards at the point of sale.

- Upholding transparency: Merchants are increasingly responding to heightened consumer scrutiny by finding ways to offer insights into product origins and ethical considerations. AI can provide customers with detailed product information. For example, when a customer scans a product's QR code with their smartphone, the AI system can display information about where the raw materials for that product were sourced, how the product was manufactured, and the carbon footprint associated with its production and transportation.

- Fostering global conversations: Merchants can use AI’s translation capabilities to transcend language barriers and open a global dialogue with their customer base. As an example, AI can analyze customer feedback and reviews from different regions and translate feedback written in various languages, allowing global retailers to gain valuable insights into the needs and preferences from customers around the world.

Footnotes

1 Visa Business and Economic Insights analysis of Prosper Data

² Berndt, K., Spire, K. and Batalla, D. Ipsos (2023). Want to understand early adopters of generative AI?

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.