When it comes to economic growth, age is much more than a number

November 2024 – As the year draws to a close, our projections for the just-concluded third quarter suggest stronger economic growth than anticipated for all U.S. regions except the Midwest. Solid economic growth and job creation, along with slowing inflation, continue to bolster consumer spending. The Federal Reserve’s 50 basis point (bps) cut will also help buoy economic growth; however, our new rate path forecast indicates that future rate cuts will be more gradual. As such, interest rate-sensitive sectors will remain sluggish through the first half of 2025. Additionally, decelerating job growth has led us to downwardly revise our employment growth forecasts for all regions except the South, which will likely add jobs more rapidly than previously expected.

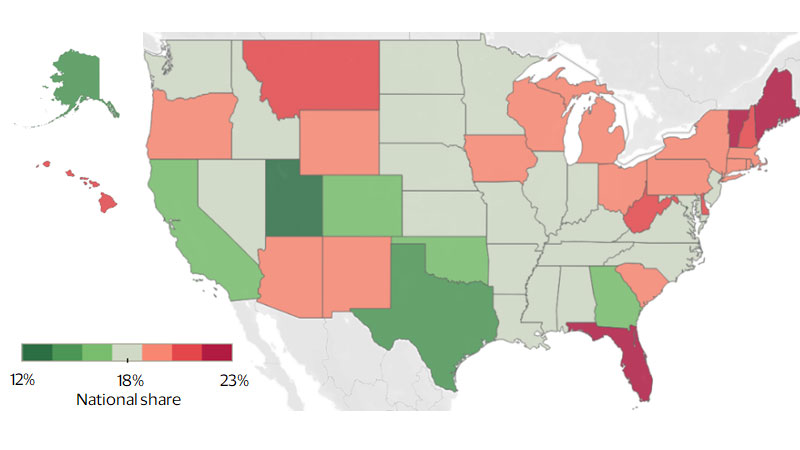

An aging population has made healthcare a vital source of job growth. From 2010 to 2023, the share of Americans 65 and older rose from 13 percent to 18 percent and is expected to continue to increase. This has placed unique labor demands on healthcare compared with other areas of the economy. Not surprisingly, healthcare has been a cornerstone of employment growth in all regions—first recovering from pandemic lows and then maintaining robust growth even as overall job gains have softened. Regions like the South are seeing healthcare jobs grow at a faster pace than the nation. Florida, with a high share of residents 65 and older, has seen a 12 percent rise in healthcare and social assistance employment since the pandemic, compared to 9 percent nationally. In the West, California, despite having fewer older residents, has seen a 15 percent increase in healthcare jobs since its recovery due to foreign migration, a strong university system, and its large population. As America ages, healthcare will continue to be a vital and competitive source of regional economic growth.

Healthcare jobs are likely to grow most in states with aging populations

Population of 65+ residents by state (share of total population

Highlights:

- When it comes to stronger growth in the Northeast, patients are key

- The economic engine of the South is set to weather the hurricanes

- Continual interest rate cuts and strategic sector investments are reshaping the Midwest

- Migration flows and lower interest rates will shape growth in the West

When it comes to stronger growth, patients are key in the Northeast

Through the first half of 2024, the Northeast’s economic growth underperformed the U.S. overall, and our forecast suggests that trend will likely continue for the region’s real gross domestic product (GDP) growth in Q3-2024. High interest rates are weighing heavily on growth in interest rate-sensitive sectors such as finance, professional and business services, and tech. However, economic growth and job creation in the healthcare sector has been a major boon to the region and has somewhat made up for slower growth in sectors constrained by high borrowing costs. While we expect the upper bound of the federal funds rate to end the year 100 bps lower than the start of the year, the Northeast’s economic and employment growth are likely to lag the U.S. overall in Q4-2024 as well. As a result of this relatively slower economic and job growth, we expect consumer spending growth to lag the nation in the final two quarters of 2024.

The slower pace of rate cuts compared to our outlook last quarter has impacted our forecasts for economic growth in the Northeast for 2025. Our new rate path outlook indicates that the upper bound of the federal funds rate will not reach its final resting place of 3 percent until Q4-2025. Thus, we expect economic, job and consumer spending growth to remain slower than the nation overall until 2026, when lower rates can fully unlock higher investment in the finance and tech sectors in Massachusetts and New York and in the manufacturing sector in Pennsylvania. Despite struggles in interest rate-sensitive sectors, economic growth and job creation in the Northeast should remain stable. With an aging population in both the region and the nation, the healthcare sector in New York, New Jersey, Maine and Massachusetts are set to continue to add jobs at a high rate. World-renowned medical institutions in the region will be a major magnet for medical tourism and continue to drive economic growth and job creation in the sector. Our forecasts indicate that the healthcare sector will be a major source of both wage and job gains next year and support stable consumer spending growth in the Northeast.

The economic engine of the South is set to weather the hurricanes

Through the first half of the year, the South led the nation in the pace of job creation and economic growth, and our forecast indicates that this streak extended to Q3-2024. While hiring in the manufacturing sector slowed in the second half of 2024, other sectors such as healthcare, retail, construction and professional and business services picked up the slack. Strong hiring in those sectors has helped support robust consumer spending growth, which has been a major driver of growth in the second half of this year.

In Q4-2024, we expect economic growth to decelerate due in part to the damage and disruption in states affected by hurricanes Helene and Milton. While the human cost was high and the recovery effort will be challenging, our forecasts indicate that—from an economic perspective—much of the disruption will be somewhat offset by gains in the construction sector during the recovery effort and strong growth throughout the areas unaffected by the storms.

Looking ahead to 2025, our forecasts indicate that the South will return to consistently outpacing all other regions in terms of real GDP, employment and consumer spending growth. Lower interest rates will likely boost manufacturing investments, particularly in the auto sector, which would induce more job creation in the sector and translate into strong economic and spending growth. This is particularly true for Tennessee, North Carolina, South Carolina, and Georgia, as all are set to benefit greatly from increased electric vehicle (EV) production. The EV revolution in the auto sector will not only benefit the South’s manufacturing sector but may also be a major boon to the mining sector. The recently discovered lithium deposit in southwestern Arkansas—one of the world’s largest—could contain enough lithium to meet projected 2030 world demand for EV car batteries nine times over, according to estimates from the U.S. Geological Survey and the Arkansas Department of Energy and Environment. If experts can find a way to extract the lithium, it would greatly benefit Arkansas and major EV manufacturers in the South by bringing down production costs and thus increasing demand for EVs.

Continual interest rate cuts and strategic sector investments are reshaping the Midwest

We expect the Midwest to trail other regions and the nation in economic growth, job creation and consumer spending through the forecast period. Slow employment growth and population declines, particularly in major states like Illinois and Ohio, have been a drag on regional growth. For example, Illinois continues to face rising unemployment in key sectors like professional services and manufacturing, which have yet to recover to pre-pandemic levels. Service sector cuts have hurt Ohio’s job market, while manufacturing layoffs continue to negatively impact Michigan. Indiana has held up better than its regional neighbors due to immigration; however, low wages ultimately limit the economic impact.

A variety of factors are driving regional outmigration and population declines, including an aging population, limited job opportunities (particularly in tech and other high-paying fields) and high taxes in states like Illinois. However, states like Minnesota are continuously addressing these challenges through increased collaboration with local business chambers and development organizations. In fact, we expect Minnesota to outperform the region through 2025. Additionally, the region’s overall affordability compared to other parts of the U.S. helps attract international migration, which in turn has offset some of the domestic outmigration. Healthcare employment is also a key source of job growth stimulated by the region’s aging population, particularly in Ohio. In addition to having a large share of residents aged 65 and older, Ohio is home to renowned medical institutions such as the Cleveland Clinic.

With more Fed rate cuts on the horizon and continued resilience in the labor market, Midwestern manufacturers will benefit from a better financing environment in 2025. Additionally, rising demand for American-made products also presents continued opportunities for regional producers, and healthcare payrolls will continue to be a bright spot. Nonetheless, regional outmigration, an aging population and other demographic challenges will weigh on growth. As such, we expect economic growth in the Midwest to continue trailing all other regions in 2025 and beyond.

Migration flows and lower interest rates will shape growth in the West

For the fourth consecutive quarter, economic growth in the West continued to outpace the nation, with GDP increasing 3.5 percent YoY in Q2-2024 compared with 3 percent YoY growth nationally. Nonetheless, we expect the region’s economic growth to decelerate through the second half of the year and into 2025, converging closer to national growth.

The West is grappling with the effects of population outflows from expensive coastal states into the region’s interior and to other regions. Nowhere has this been more pronounced than in California, where soaring housing costs and the rise of remote work led to a net loss of more than 900,000 residents who moved to other states between 2020 and 2023. While many exiting Californians stayed within the region, many others moved to southern states like Florida and Texas. Migration flows have also impacted the tech sector. California's share of U.S. tech jobs fell from 21 percent at the end of 2019 to around 18 percent in Q2-2024. Tech firms are still shedding jobs in California, Washington, Colorado and Oregon, but payroll declines are easing as the Fed cuts interest rates. As rates drop over the next two years, investments in AI, data processing and cloud storage will drive renewed hiring and expansion. Silicon Valley and other traditional tech hubs will remain; however, lower-cost states are expected to increasingly attract new hiring and investments. For example, a new semiconductor plant in Boise, Idaho, expected to be completed next year, stands to generate thousands of high-tech jobs.

Healthcare payroll growth continues to be a bright spot for the region, aided by an overall aging population and access to renowned medical schools and hospitals, particularly in California. Additionally, the combination of a large population base in coastal states and an older population demographic in many of the region’s interior states will fuel demand for healthcare workers in the years to come.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.