Where is the slowdown?

August 2023 – All regions of the U.S. saw stronger than expected economic growth during the first quarter of 2023. Only Connecticut and Indiana’s gross state products (GSPs) declined on a year-over-year (YoY) basis, and no state’s GSP declined on a quarter-over-quarter (QoQ) basis. Additionally, all states saw employment growth in the first quarter. However, the labor market is showing signs of slowing. Job openings have declined 18.3 percent since the Federal Reserve began hiking rates in March 2022. This monetary policy tightening (the Fed increasing rates) and resultant higher borrowing costs have, at least in part, caused interest-rate-sensitive firms to cut back on hiring. Using the liabilities to assets ratio as a proxy for higher rate sensitivity, the Federal Reserve Bank of Cleveland found that more rate-sensitive industries experienced more significant declines in job openings. Retail trade, wholesale trade and information (tech) had the highest liabilities to assets ratios, and thus were more sensitive to higher rates.

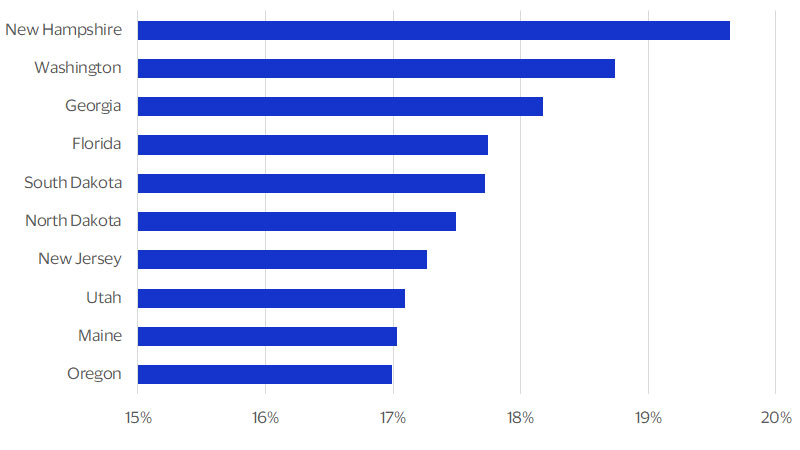

Given the West’s concentration of employment in those sectors, the region is still likely to suffer relatively heavier job losses in the downturn that we now expect to hit in the fourth quarter of 2023. However, we forecast fewer job losses in the Midwest and more job losses in the Northeast than our previous outlooks indicated. The Midwest’s GSP decline could be more pronounced than its job losses, as the less leveraged manufacturing sector will likely minimize future layoffs by using reserves to absorb losses from lower demand. Conversely, we expect lower demand in the retail and wholesale trade sectors to have a larger labor impact on the Northeast, as companies in these sectors are unlikely to have enough capital to avoid layoffs. We still expect the South to outperform the other regions, but given its high exposure to retail, wholesale and information sectors in larger states like Florida and Georgia, the difference will probably be less substantial than we previously predicted (see graph below).

The West and Northeast have high exposure to rate-sensitive industries

Share of employment in wholesale trade, retail trade and information sectors.

Northeast: Not so safe after all

After struggling to recover its pre-pandemic level of employment, the Northeast finally reached that milestone in Q1-2023. However, if the predicted downturn materializes later this year, recent data suggests that employment is likely to take a bigger hit than our previous forecasts indicated. On a YoY basis, June job openings in the Northeast declined more than any other region. States with greater exposure to the highly leveraged wholesale and retail trade sectors (New Hampshire, Maine and New Jersey) as well as those exposed to the highly leveraged tech sector (New York and Massachusetts) are likely to be sources of weakness in employment and GSP in the fourth quarter, when demand is expected to decline. Additionally, states such as New York, New Jersey and Connecticut had more available workers than job postings in July, according to analysis by the U.S. Chamber of Commerce. Firms in these states will likely be more inclined to cut costs by laying off workers when the economy slows. For these reasons, we have downgraded our Northeast outlook for Q4-2023 and Q1-2024.

Despite challenges ahead, the Northeast’s advantages should limit job and GSP declines. The region derives a high share of employment and output from the private education and health services sector, which has contributed greatly to employment growth in recent months. We expect that strength in this sector will continue into Q3-2023 and that its job losses in Q4-2023 and Q1-2024 will be relatively lower, which in turn should help mitigate job losses in the Northeast during the downturn. As a result, we still expect shallower job losses in the Northeast than the West. Additionally, we expect business investment to suffer less in the Northeast, leading to a milder contraction in GSP than in the West and Midwest. Federal Deposit Insurance Corporation (FDIC) data indicate that large states in the Northeast have higher than average excess savings per capita, which should support consumer spending during the recession.

South: Still strong, but more uncertain

The South has been a source of strength in the U.S. economy, thanks in large part to high domestic in-migration to Texas, Florida, Georgia, Tennessee and North Carolina. However, a recession that is likely to begin in the fourth quarter of this year could present some particularly significant challenges for Texas, Florida and Georgia. Our analysis of FDIC data revealed that consumers in Texas and Florida may have already used the excess savings accumulated during the pandemic on additional spending or to pay down debt. This indicates that their future spending could be at higher risk to downshift in the event of a recession, since those who lose their jobs will not be able to rely on excess savings to smooth out their consumption. Additionally, a significant portion of Florida and Georgia’s employment base is in highly leveraged sectors, which would mean that a slowdown in demand would likely result in more job losses and a steeper decline in business investment. Uncertainty about the future economic performance of these large states has led us to downwardly revise our forecasts for the South in Q4-2023 and Q1-2024.

Although the vulnerability in Florida, Georgia and Texas led us to downgrade our employment and GSP outlooks, our forecasts still indicate that the decline in jobs, GSP and consumer spending will have less impact on the South than other regions. We expect that relatively robust auto demand and very tight labor markets will limit manufacturing job losses and declines in business investment in the East South Central (Alabama, Kentucky, Mississippi and Tennessee). Additionally, sectors that depend heavily on the federal government in Virginia, D.C., and Maryland should still be a source of strength for the South Atlantic (Delaware, D.C., Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia and West Virginia). In anticipation of greater job losses and a steeper decline in spending and output in Texas than we expected, we have downgraded our outlook for the West South Central (Arkansas, Louisiana, Oklahoma and Texas); however, Oklahoma and Arkansas should remain more stable. Despite the potential for a deeper downturn than we previously expected, the South’s economy will likely still lead the nation through 2024.

Midwest: The Midwest moves closer to the middle of the pack

Based on incoming data, we have upwardly revised portions of our Midwest outlook. We now expect milder job losses and a more robust recovery, driven by the Midwest’s tight labor market and its unique industry dynamics. By some measures, states across the Midwest have the tightest job markets in the U.S. In the Dakotas, for example, only 35 workers were available for every 100 job postings in July, according to U.S. Chamber of Commerce estimates. Nebraska had only 40 available workers per opening, and several states had fewer than 60. These conditions indicate extreme recruitment and retention challenges, incentivizing companies to retain employees even if business conditions soften. This trend is prevalent in the manufacturing sector—arguably the Midwest’s preeminent industry—and is expected to limit job losses this year and next.

That said, while our new outlook expects fewer challenges for the Midwest, it certainly isn’t rosy. Job losses have already begun in several sates, including Minnesota, Kansas and Indiana. The unemployment rate is rising sharply in certain places, and average hourly earnings are declining in cities like Indianapolis, Chicago, Des Moines and Ann Arbor. Even though we expect fewer job losses, we still expect a meaningful labor market contraction that will cause a pullback in consumer spending. And this spending pullback appears to be imminent. According to Visa’s Spending Momentum Index (SMI), consumer activity is weaker in the Midwest than any other region, driven by emerging job market weakness and decelerating inflation. Midwest inflation has improved faster than the national average, taking pressure off consumer budgets and allowing some households to save more and spend less. We also expect a substantial decline in GSP. Even though companies will likely retain their employees, they are at substantial risk for revenue declines as business investment contracts and consumers become more cautious.

West: The bifurcated West sees tech growth, construction weakness

After a small but meaningful downturn in late 2022 and early 2023, the West’s tech sector is growing again. Tech companies are hiring, with California setting a new record for tech sector employment. This expansion phase comes on the heels of a stock market surge, with the NASDAQ up double digits since New Year’s Day. When stock prices are falling, tech executives face pressure to cut costs, a situation that typically incudes layoffs. This pressure can fade when stock prices are rising, allowing firms to focus on growth and expansion. At the same time, the fervor around generative artificial intelligence (gen AI) has induced a new wave of hiring. According to research from Stanford University, demand for AI skills is expanding quicky, with AI clusters forming in California, Washington and several other states. All told, recent tech hiring has supported the West’s job market in 2023, which is still expanding faster than the national average.

Looking forward, the West could encounter substantial economic weakness. Job losses are expected across most states, driven by layoffs in construction, retail, wholesale and government. State and local government budgets are already stretched in some parts of the West, suggesting that further softness in tax revenues will result in staffing reductions. At the same time, many of these states are exposed to the already overleveraged retail and wholesale industries. In construction-heavy states such as Arizona, Colorado, Idaho, Nevada and Utah, residential construction is unlikely to rebound until mortgages rates begin to improve around mid-2024. In sum, the labor market outlook for the West is tenuous, indicating upcoming weakness in consumer spending. Our outlook puts spending growth in the West behind all other regions for 2023 before rebounding at an above-average clip in 2024. GSP declines across the West could be more muted than in other regions, as some of its weakest industries—retail, wholesale and government—tend to have small impacts on statewide output estimates. We are currently preparing our 2025 regional forecasts, which will be available in the upcoming Q3-2023 U.S. Regional Economic Outlook.

Forward Looking Statements

This report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook,” “forecast,” “projected,” “could,” “expects,” “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.