Where people go, so too goes economic growth

August 2024 – With the first half of 2024 in the books, we have updated our regional economic forecasts through 2025, indicating that all U.S. regions likely experienced economic and job growth in Q2-2024. Despite clear softening, the overall labor market is still showing resilience, with more job openings than unemployed persons. These factors are keeping income growth elevated above the inflation rate, which will support solid, albeit decelerating, consumer spending growth. Furthermore, the expected arrival of Federal Reserve rate cuts in September will provide much-needed momentum to rate-sensitive sectors like financial activities as well as professional and business services, which have displayed weakness across most regions.

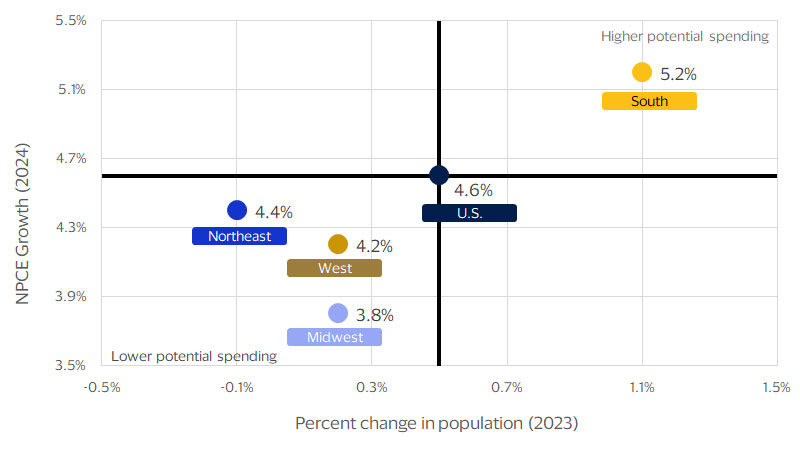

While consumer spending growth will gradually wind down in most regions through the next year, a clear divergence has emerged based on regional population changes (Fig. 1). For example, the South’s population has grown the fastest, fueled by incoming residents from other regions seeking job opportunities and a lower cost of living. Not surprisingly, spending growth in the South is expected to outpace the nation and other regions through 2025. Near the other end of the spectrum, population growth in the Midwest has underperformed the nation, partly due to out-migration in key states like Illinois and Michigan. Consequently, consumer spending is forecast to slow the most in this region. While the Northeast’s population declined last year, intraregional tourism has helped anchor the region’s consumer spending. Similarly, population growth in the West has trailed the nation, led by steep declines in California. However, Census data show a large share of exiting Californians stay in the West, and intraregional tourism has provided a spending boost to that region as well.

Regions with faster population growth in 2023 generally have more upside spending potential in 2024

Northeast: Focusing on the future

Economic growth in the Northeast has been steady, but slower than the U.S. overall. Our forecast suggests real gross domestic product (GDP) growth in Q2-2024 likely slightly underperformed the U.S. overall for the second straight quarter, with high interest rates leading to anemic growth in interest rate-sensitive sectors such as finance, professional and business services, and tech. Additionally, years of significant domestic out-migration in the region continue to dampen economic growth as slow population growth both limits labor supply and disincentivizes business investment. Layoffs at Tesla’s Gigafactory 2 in western New York set back manufacturing employment in the region and likely point to weaker manufacturing and overall employment growth in the second half of 2024. The likely declines in job creation and economic growth will also likely weigh on consumer spending growth in the region.

Despite the relatively weak outlook for 2024 in the Northeast, the region is in a strong position to see stronger growth in 2025. Rate cuts that we expect to begin in September will likely alleviate some of the stress that interest rate- sensitive firms are under. Our forecasts indicate that lower rates in 2025 should incentivize stronger investment and hiring in states that rely heavily on the tech, finance and insurance sectors, such as New York, Connecticut and Massachusetts. Additionally, planned semiconductor manufacturing investments in central New York, including the construction of a new major plant in Syracuse and the expansion of existing plants, should boost employment and economic growth next year and help support stronger consumer spending. Even long-term demographic headwinds are already beginning to slow. Slower domestic out-migration, along with the large influx of foreign workers into New York and Massachusetts recently, will likely help expand the labor supply and drive economic growth. While the Northeast’s growth prospects in 2024 may be disappointing, the future looks far brighter.

The South’s strong growth is set to soldier on through 2024

Our analysis indicates that the South will lead the nation in economic growth, consumer spending and job creation over the next year and a half. Manufacturing, tech and finance have all experienced strong growth in the region as the labor supply and capital investment have continued to expand. While domestic in-migration has slowed recently, the region has increasingly attracted foreign migrants, particularly into Florida and Texas. Strong growth in jobs and investment, along with consumer confidence that led the nation in Q2, signals that the South likely saw strong consumer spending growth in Q2-2024, propelling the region’s economic and job growth past all other regions, according to our estimates.

While significant investments in EV production, semiconductor plants and pharmaceuticals have supported the South’s manufacturing boom, large government investments in defense manufacturing have also been an important source of strength. Substantial increases in defense spending from the government spending packages passed in March have been an important source of investment and growth in the region, particularly for Virginia, Oklahoma and Texas. Tinker Air Force Base in Oklahoma City, the military’s main aircraft maintenance facility, is poised for major growth in the coming years thanks to larger investments in military aircraft. Additionally, military bases have been an important source of consumer spending in states like Georgia, North Carolina, South Carolina and Tennessee. The federal government’s more aggressive stance in facing geopolitical threats will thus likely have an outsized impact on the South. Outside of defense and manufacturing, the healthcare and tourism sectors in the South have also had surprisingly strong economic growth. The large movement of retirees to states like Alabama and Florida have driven increased demand to the healthcare sector. Strong travel demand has not only greatly benefitted southern tourist hotspots like Florida and Louisiana but has also resulted in more travel to lesser-known destinations like South Carolina and Alabama. With investment and job growth expected to remain robust in a number of diverse sectors, the South will lead the nation in economic, consumer spending and job growth in the second half of the year.

Strong healthcare growth in the Midwest not enough to offset softer demographics

We expect the Midwest to trail all other regions in economic growth, consumer spending and job creation in the second half of 2024 and through next year due to a lack of broad-based employment growth, including in key sectors. In Illinois, employment in the financial activities and professional and business services sectors continues to fall further below pre-pandemic levels. In Ohio, which is heavily dependent on producers, manufacturing payrolls have yet to recover to pre-pandemic numbers. Manufacturing jobs in Michigan, which is highly dependent on the Big Three automakers, are also well below pre-pandemic levels. Even above-average regional players like Minnesota and Indiana have struggled to recover payrolls lost in finance, professional and business services, and manufacturing.

Healthcare remains a consistent bright spot for the region, with strong gains in the sector reflecting a bounce back from jobs lost during the pandemic as well as an increasing demand for healthcare due to the region’s aging population. Most states in the region have exhibited strong healthcare payrolls, particularly Ohio and Minnesota, which are home to renowned medical institutions like Cleveland Clinic and Mayo Clinic, respectively. Unfortunately, the demographic trends fueling the region’s healthcare sector growth point to an insidious problem: population declines fueled not only by lower birth rates, but also out-migration, particularly from prime-age workers. Illinois has borne the brunt of this trend due to higher taxes and fiscal uncertainty, but it is not alone. Minnesota and Michigan have also struggled recently with out-migration due in part to harsher weather and colder climates.

In the long run, healthcare will be the backbone of the region’s job creation, but as those job gains moderate, growth and investment in other sectors will be necessary to propel the region forward. One example is a $25 billion project to build two semiconductor plants in Ohio, which is set to be completed by 2027. Nonetheless, in the absence of strong growth in other areas of the economy, soft demographics will keep the Midwest a step behind the nation.

The West goes from California dreamin’ to California leavin’

After three consecutive quarters of outperforming the nation, economic growth in the West likely slowed and tracked with the national GDP in Q2-2024. We expect the region’s economy to continue decelerating through the second half of the year, only slightly edging out national growth.

California will be a drag on growth, underperforming many of its neighboring Western states. The Golden State’s population has declined for three consecutive years going back to 2021, and while COVID-related deaths and lower fertility rates have played a role, California has hemorrhaged residents to Texas, Arizona, Florida and other states with a lower cost of living. Soaring housing costs are driving the exodus, particularly among less affluent residents. But the proliferation of remote work, combined with high housing costs, has also encouraged more affluent residents to leave the state. While the outflow has abated, the cumulative loss of consumers up and down the income spectrum is a headwind for growth in the region. What is more, strong public sector jobs growth in California is masking large and mounting job losses in the private sector. The state’s Legislative Analyst’s Office estimates that California has lost more than 150,000 private sector jobs since employment peaked two years ago.

Because of its sheer size, even minor percentage drops in California’s population equate to large numbers of residents leaving, and this can have an outsized impact on the region. Fortunately, among the top 10 destinations for former Californians, six (Arizona, Washington, Nevada, Oregon, Colorado and Idaho) are in the West. As such, California’s population decline is not entirely a loss for the region, but rather a partial disbursement of economic activity to the region’s growth states. As such, even as tech companies invest outside of California and workers head to lower-cost states, the West will retain some of those investments and labor, giving the region a slight edge over the nation.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.