October 25, 2017- The U.S. economy is continuing its second-longest post-WWII expansion, and talk of a slowdown is intensifying. The length of the expansion is prompting the speculation, rather than any clear signs of a recession. In fact, consumers remain confident and their spending behavior is a clear indication: Retail sales (except autos) have been in a consistent growth pattern—averaging 5.1 percent for the year to date, according to the Visa Retail Spending Monitor, which reports spending on all forms of payment. Robust merchant categories such as restaurants and building, hardware and garden stores have helped to fuel the growth, as well as strong global travel spending, which is outpacing U.S. gross domestic product (GDP). The already-sluggish economy would likely be nearly anemic absent these and other strong sectors to help spur it along.

Slow economic growth expected for next several years

Growth of 2-2.5 percent in real GDP is expected for the next few years,* which could accelerate if proposed tax cuts and infrastructure investments pass. Job growth and housing will help to drive economic growth. The robust job market and job creation numbers of recent years have boosted consumer confidence and credit expansion. Job openings are near record highs, largely due to a skills mismatch in the existing workforce.

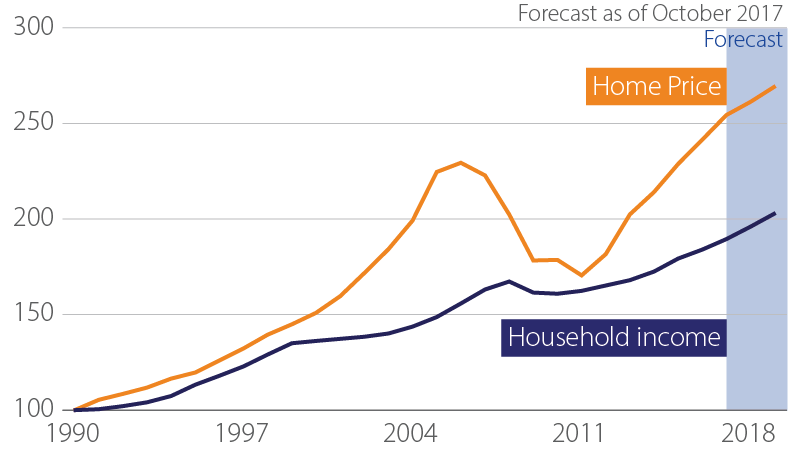

Household formation continues to push housing demand and elevate prices. The U.S. Census Bureau estimates that demand is outstripping housing supply by roughly 350,000 units (including both single-family and multi-family dwellings, such as homes, apartments and condos).

Economic expansions do not die of old age

Based on lessons learned from past recessions in the post-war period, certain telltale factors typically signal a coming recession. These include:

- Higher short-term interest rates than long-term rates (inversion of the yield curve). This is unlikely over the next 18-24 months, despite the increased probability of another Fed rate hike in 2017.

- Sharp rise in oil prices. U.S. production increases should offset recent OPEC cutback announcements. Gas prices went up due to the hurricanes, but oil prices declined and are now holding steady.

- Higher unemployment. Job growth is continuing, but job creation was lower than expected in August. The unemployment rate appears to have hit its low point of 4.3 percent. If it were to reach 4.8 percent, that could signal a looming recession—not likely in the coming year.

- Imbalances in financial or other markets. While equity prices relative to earnings are somewhat high, the market is surprisingly balanced. The housing market, conversely, is not. Home prices are increasing more quickly than household income, which could create an imbalance and lead to a correction in prices. This would impact consumer wealth, but is unlikely to cause a recession.

Household income and existing home prices (1990 = 100)

- Shortage of capital and liquidity hindering capital spending. Businesses are demonstrating a willingness to spend and heightened optimism should keep that momentum going.

- Looser lending standards since the end of the Great Recession. While more relaxed now, lending standards are nowhere near those that led to bad loans and the previous recession.

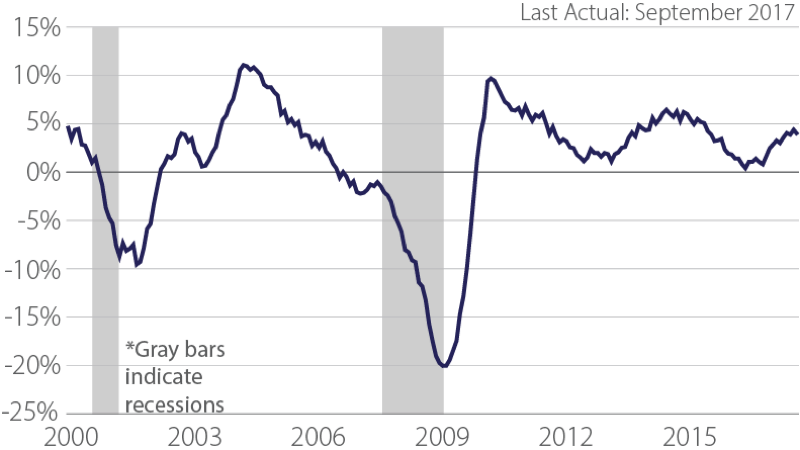

- Negative growth of leading economic indicators. The Conference Board index, which tracks key measures of economic activity, has been mostly on an upswing over the past year, despite a recent dip. This was likely due to the devastating hurricanes.

Composite Leading Economic Index (YoY percent change)

An economy on life support?

None of the conditions cited above is expected soon. The expansion should continue at the same slow, plodding pace for the next two years or longer. Certain events could alter this path, such as war, terrorism, policy missteps or failure to pass fiscal stimulus or tax cuts.

Under the right conditions, any one of these could either put the slow economy on life support, or pull the plug altogether on the current expansion.

Wayne Best, Senior Vice President/Chief Economist

Wayne Best leads Visa’s Business and Economic Insight team. As chief economist, he keeps close watch on emerging opportunities in the trillion-dollar payments industry. An active participant in the World Economic Forum’s Future of Consumption community, he identifies economic trends shaping the future. Best’s presentations and reports explain the impact of these trends to company and client executives, as well as government leaders around the globe. Before joining Visa in 1990, Best worked as a consultant performing cost benefit analyses for the power industry. In addition to an MBA, Best holds a degree in nuclear engineering and has participated in the Stanford University and Kellogg School of Management executive programs.