Next generation post-purchase solutions that help prevent and resolve pre-disputes

A proactive approach to reducing disputes

Disputes are on the rise. And merchants are feeling the impact. Visa Post-Purchase Solutions can help, with a data-driven approach that helps stop unnecessary disputes before they start.

¹Merchant Risk Council, 2023 Global Fraud and Payments Report. Survey of more than 1,000 merchants in North America, Europe, Asia-Pacific, and Latin America

Greater transparency, better efficiency

Pre-dispute solutions help provide protection from fraud, disputes, and chargebacks, enabling merchants to provide a better customer experience and retain profits.

Prevent disputes with data transparency

Learn how Order Insight connects merchants to issuers to provide customers with purchase details in real-time, at point of inquiry to clarify confusion and prevent disputes.

Resolve pre-disputes and reduce risk*

Learn how to address fraud and non-fraud disputes at the pre-dispute stage to improve the customer experience, control your dispute ratio* and help reduce overall risk.

Compelling Evidence 3.0

Visa has created a webinar to educate merchants about the updated dispute rules to help address friendly fraud and protect revenue.

*Acquirers may have their own risk assessment parameters, and may levy fees based on such parameters regardless of a Merchant meeting Visa's dispute ratio target.

Putting the power of data and Visa experts to work for you

Visa Post-Purchase Solutions offer multiple ways to address fraud and resolve disputes at the pre-dispute stage—from automated data sharing to partnering with experts at Visa.

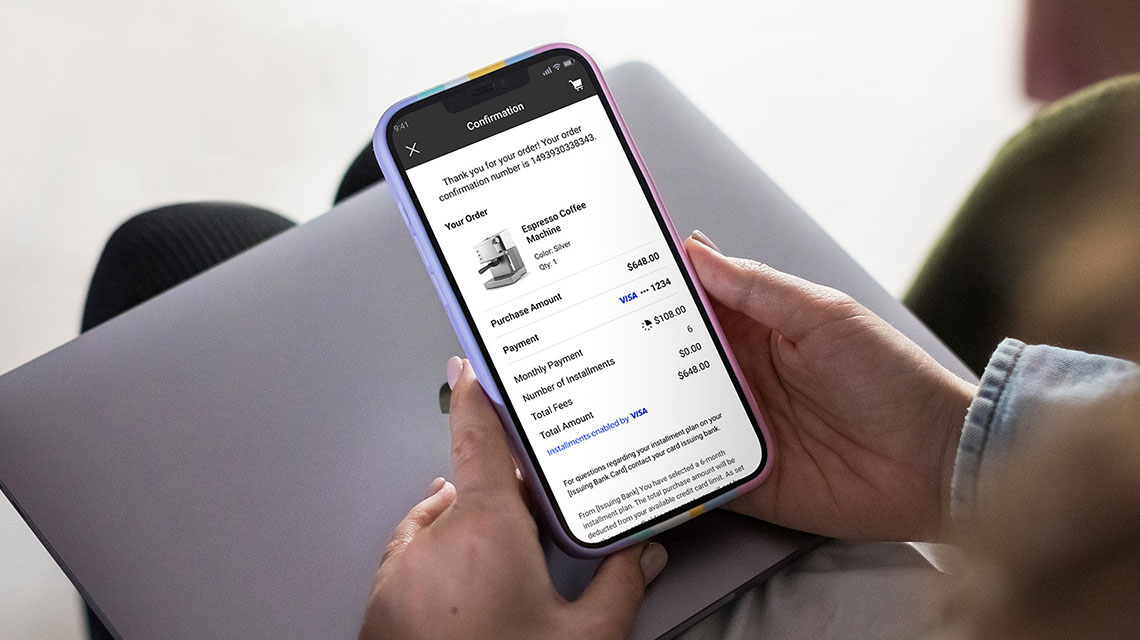

Verifi Order Insight®

Address disputes by sharing order details with issuers, so customers can be reassured that unfamiliar transactions are legitimate.

Verifi Rapid Dispute Resolution

Reduce operational expenses and dispute ratios by auto-refunding pre-disputes based on customizable rules.

Verifi Inform

Stay ahead of emerging fraud and enhance your risk decisioning with access to real-time fraud data from issuers.

Visa Compelling Evidence 3.0

Streamlines the submission of merchant transaction data for a qualified Compelling Evidence 3.0 response to address friendly fraud.

Visa Dispute Optimization Service

Visa dispute experts will evaluate and help optimize pre- and post-dispute processes to minimize chargeback ratios and combat friendly fraud.

News and resources

Stay up-to-date on dispute management trends to boost digital commerce for merchants.