Cardholders can pay with a contactless card by holding the card flat and tapping it at a contactless-enabled checkout terminal. The payment is processed using the same dynamic security technology as with card payments, and the transaction time takes seconds.

-

Tap to pay: Secure payments for your cardholders

You can deliver effortless payment experiences to your cardholders at the point of sale.

What are contactless payments?

Contactless payments are transactions made by tapping either a contactless card or payment-enabled mobile or wearable device over a contactless-enabled payment terminal. Cards, phones, watches and other devices use the same contactless technology.

Contactless payments can both improve the checkout experience and may also increase cardholder satisfaction. Because your institution engages directly with Visa cardholders across multiple in-branch and online touchpoints, you play a critical role in helping create a positive contactless payment experience.

Benefits of contactless payments for Issuers

Increase cash conversion

Contactless cards have proven effective in converting cash to card-based payments¹.

¹Transaction Lift Analysis of Tap to Pay Active Cardholders, VisaNet Data, January 2019 – January 2020

Offer a better customer experience

Cardholders can tap to pay in seconds with no contact, allowing for an easy and touch-free experience at checkout.

Enable cardholders’ access to a growing global trend

As contactless continues to gain global momentum, contactless cards offer consistency, providing your cardholders with the same experience at merchants around the world.

How contactless payments work

Look for the Contactless Symbol that signifies a contactless-enabled checkout terminal.

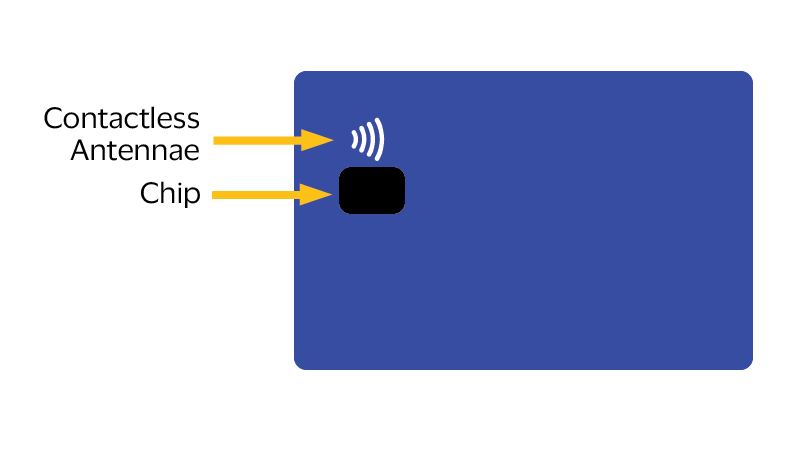

The chip plate on a contactless card is visible on the front of the card. A contactless card can also be referred to as a “dual interface” card – simply referring to the fact that it supports contactless payments in addition to contact payments (e.g. swipe or dip).

Inside the card, the chip and antennae communicate with the point-of-sale terminal to send transaction data.